Analysis: How Do Home Sales Prices Measure Up to Scarsdale Assessments?

- Category: The Goods

- Published: Monday, 12 November 2018 13:28

- Lee Fischman

This analysis was submitted by Scarsdale resident Lee Fischman. Last year he co-chaired the Scarsdale Forum's Assessment Revaluation Committee and authored a draft report on the 2016 revaluation which was not published.

This analysis was submitted by Scarsdale resident Lee Fischman. Last year he co-chaired the Scarsdale Forum's Assessment Revaluation Committee and authored a draft report on the 2016 revaluation which was not published.

Property assessments are a cornerstone of Village finance and yet are based on an imprecisely valued asset: homes. They therefore tend to be notoriously inaccurate, unstable, and often controversial. When they get too far out of whack, a municipality-wide revaluation is called for.

What’s the state of Scarsdale’s assessment? The following analysis uses data provided to me by Village staff. I’ve had my work reviewed by at least one qualified, neutral person and will gladly provide it to anyone else who asks (contact the Editor and she will forward the request). A footnote describes what data was left out of my analysis , which runs from 2010 through June of this year. In the charts below, the term “Roll Year” is used, but since roll years are updated in the fall, the roll year 2017 actually includes the first six months of 2018. I could not provide an analysis past June 2018 because disqualifying “condition codes” were not yet applied by staff to certain records; I would urge that these be amended on a timelier basis, or a decision to conduct a future revaluation could be needlessly delayed for lack of information.

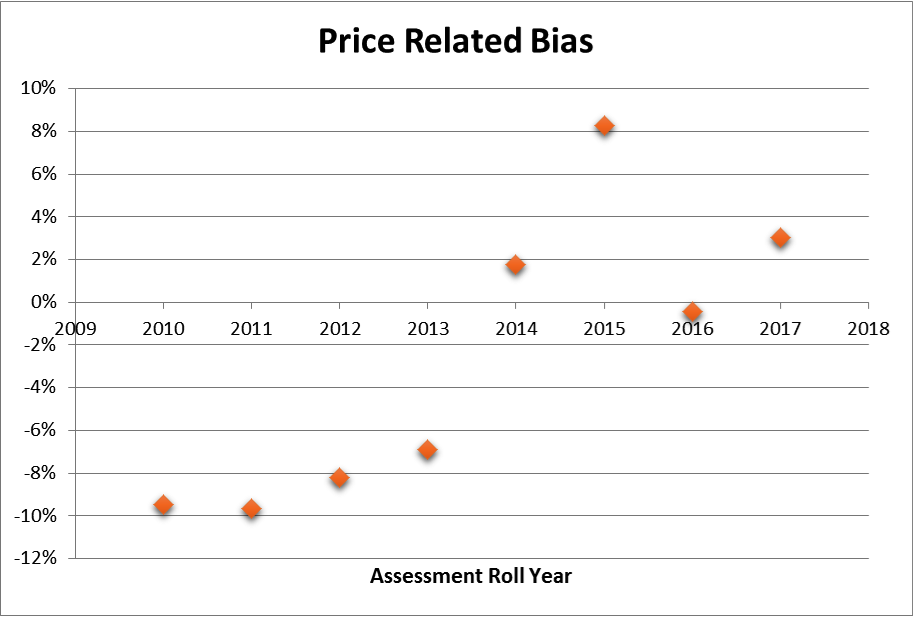

Equity is a critical aspect of assessments; residents want to know that owners of differently valued properties are each “paying their fair share”. The leading statistic for this purpose is currently the Price Related Bias (PRB). Below is a chart of Scarsdale’s PRB over time.

Pricing bias was decidedly negative in the years leading up to the 2014 revaluation, indicating that assessments undervalued more expensive properties. The 2014 revaluation appears to have flipped assessments to slightly favoring less expensive properties. While continuing to use the 2014 roll, in 2015 assessments become strongly progressive, at a level which probably was outside of reasonable bounds. The reader may recall that the Assessor cited market price movements as a major reason why a new revaluation was necessary, although she did not show them.

The 2016 revaluation resets the PRB to a nearly equitable level. This surprised me, as I distrusted the 2016 revaluation as much as anyone else! However, by the following year, using data from September 2017 through June of 2018, the PRB again trends towards greater progressivity. Preliminary indications (not published) are that this trend continues.

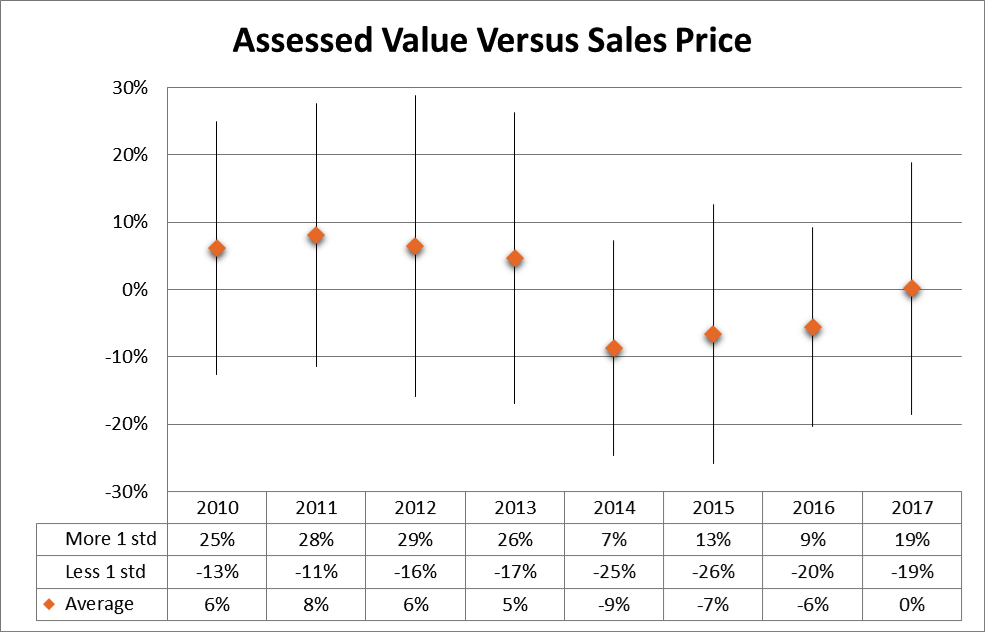

How accurate have initial assessments been over the years? The following chart tells the story. Prior to 2014, properties were on average over-assessed. In following years, they seem on average to have been under-assessed. Final, post-grievance assessments could have lessened the (positive) extremes seen below, provided a homeowner took the chance to grieve. Of course, an average is just that, and so the vertical lines show the spread of assessments. (For you nerds, they extend 1 standard deviation either way and assume a symmetric distribution.)

The 2014 revaluation also appears to have increased the average error in assessed values versus sales prices; this aligns with a major criticism of the estimating method used in the 2014 revaluation, that it introduced additional error into valuations. Interestingly and surprisingly given problems with the 2016 revaluation vendor, that latter effort appears to have modestly reduced overall error. Further results indicate that while the 2014 revaluation did nothing to improve valuation accuracy, the 2016 valuation brought assessment accuracy to its lowest point since 2010. That is even more amazing considering that this author believes the 2016 revaluation involved guesstimates.

These statistics matter a great deal because they deeply affect our pocketbooks, our sense of fairness, and they change over time. The public needs to be shown this information and probably more, on a regular basis and next time preferably not by a private citizen, but by Village staff. We need to publicly monitor the health of the current assessment, and together understand when new revaluations are required.

1) My analysis excluded:

• Christie Place sales

• All data with inadmissible condition codes

• New construction or renovations within two years, on the reasoning that assessments would be out of date for these.

• Land sales