County Tax Due by April 30, 2024

- Details

- Written by Joanne Wallenstein

- Hits: 168

As a reminder, please note that the Westchester County Tax is due by Tuesday, April 30, 2024; if not paid on-time a penalty accrues on May 01, 2024. Tax due dates and a penalty schedule can be found on the Village Treasurer’s web page here. Per New York State statutes, the property owner is responsible for paying their county taxes and failure to receive a tax bill does not alleviate that responsibility.

As a reminder, please note that the Westchester County Tax is due by Tuesday, April 30, 2024; if not paid on-time a penalty accrues on May 01, 2024. Tax due dates and a penalty schedule can be found on the Village Treasurer’s web page here. Per New York State statutes, the property owner is responsible for paying their county taxes and failure to receive a tax bill does not alleviate that responsibility.

County taxes may be paid online. If you will be away during the tax collection period, you may pay your taxes online until 11:30 PM on April 30, 2024.

Alternatively, one may remit payment by mail, in-person at Village Hall, or using the drop-box located at the Village Hall entrance. However, it is important to note:

• Postdated checks cannot be accepted by the Treasurer’s Office. Any postdated check will be returned to the issuer.

• If using U.S. Mail, the envelope must be hand stamped by the Post office no later than April 30, 2024 for the County Tax payment. All payment envelopes must be hand stamped by the post office by 12 AM on May 01, 2024.

• If planning to use the drop box or pay in-person, an on-time payment must be delivered no later than 4 PM on April 30, 2024. For in-person drop-offs please note that the Treasurer’s Office window on the first floor of Village Hall is open Monday through Friday from 9 AM to 4 PM.

Reminder that you can sign up to receive tax bills, receipts and reminders by email by creating an account directly on the Village’s website here.

Questions may be directed to the Treasurer’s Office by phone at 914-722-1170 or by email at treasurer@scarsdale.com.

New Playground Planned for Greenacres

- Details

- Written by Joanne Wallenstein

- Hits: 1243

After years of negotiations, Scarsdale Village has announced plans to install a new playground on the Village-owned portion of Greenacres field, across from the school.

After years of negotiations, Scarsdale Village has announced plans to install a new playground on the Village-owned portion of Greenacres field, across from the school.

The existing playground has dated and broken equipment and the baby swings have been missing for five years. A sorry sandbox and worn benches are long overdue for replacement. Funds that were earmarked for the park in previous years were inadequate and were spent on other projects.

Advocating on behalf of the Greenacres Neighborhood Association, President Kirsten Zakierski was successful in her campaign to get Village Trustees to allocate $200,000 in the proposed Village budget for 2024-25 to build the park.

Three proposed designs have been received by the Recreation Department and the neighborhood association sent out an email asking for residents to vote for their favored options. Take a look at them here.

All include two new baby swings!

Here are the three options. What do you think? Submit your feedback below.

Village Trustees and Village Justices Sworn In to Office

- Details

- Written by Joanne Wallenstein

- Hits: 453

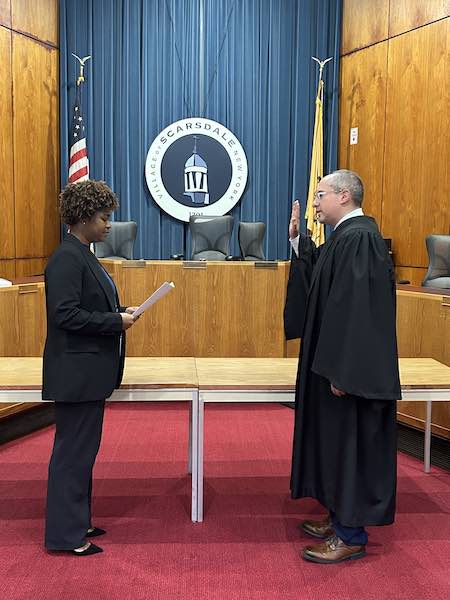

Village Clerk Taylor Emanuel and Trustee Jeremy WiseIt’s official – three Village Trustees and the Village Justice were sworn in to office at an official ceremony at Village Hall on Monday April 1, 2024. Trustee Jeremy Wise was sworn in for his first two year term, Trustees Jeremy Gans and Ken Mazer were sworn in for their second two year terms and Village Justice Michael Curti was sworn in as Village Justice.

Village Clerk Taylor Emanuel and Trustee Jeremy WiseIt’s official – three Village Trustees and the Village Justice were sworn in to office at an official ceremony at Village Hall on Monday April 1, 2024. Trustee Jeremy Wise was sworn in for his first two year term, Trustees Jeremy Gans and Ken Mazer were sworn in for their second two year terms and Village Justice Michael Curti was sworn in as Village Justice.

The four were elected on Tuesday March 19, 2024 in a Village-wide election and on Monday they were sworn into office by Village Clerk Taylor Emanuel.

Photos here:

Village Clerk Taylor Emanuel and Trustee Jeremy Gans

Village Clerk Taylor Emanuel and Trustee Jeremy Gans Village Clerk Taylor Emanuel swears in Trustee Ken Mazer

Village Clerk Taylor Emanuel swears in Trustee Ken Mazer Vllage Clerk Taylor Emanuel swears in Village Justice Michael Curti

Vllage Clerk Taylor Emanuel swears in Village Justice Michael Curti

Stormwater Projects, Road Paving and Pool Planning to be Funded in 2024-25 Village Budget

- Details

- Written by Joanne Wallenstein

- Hits: 1324

Though the community is keenly aware of the budget for the Scarsdale Schools, the proposed $70,529,300 2024-25 Village Budget receives less scrutiny.

Though the community is keenly aware of the budget for the Scarsdale Schools, the proposed $70,529,300 2024-25 Village Budget receives less scrutiny.

A public hearing on the proposed Village Budget was held at the Village Board meeting on April 9, 2024 and Acting Village Manager Alexandra Marshall presented a topline report of the budget which can be viewed on the Treasurer’s page of the Village website here.

Here are some highlights:

-The budget calls for an increase in the tax levy of 4.93%, or $2,293,000, which exceeds the New York State Tax Cap. This increase equates to a 4.27% increase on the tax rate or $348.39 for the average household.

-This is the 13th year that the New York State Tax Cap rule has been in effect, which allows for increase of the levy by the lesser of 2% or the rate of inflation.

-The increase from FY2023-24 in non- discretionary budget items such as insurance premiums and pension alone total $1,754,500. It is important to note that this dollar amount already exceeds the allowable levy increase under the tax cap formula of 3.56% or $1,658,000.

Included in the budget is funding for some important public works projects:

Planning for the upcoming pool renovation, the budget includes funds for pre-construction services from Hill International who will guide the Village in selecting a project architect and moving forward with design development and construction planning.

This year the Village repaved 11.2 miles of roadways, exclusive of the roads that were repaved by Con Edison due to the gas line replacement. This year’s budget includes funding to continue with repaving of our roads at current or even better levels.

Stormwater management is another big line item. $1,714,000 is scheduled for the coming year and another $3,000,000 for future projects. The Village Engineering Department is currently evaluating eight proposed stormwater management projects and will recommend how to move forward and the associated costs.

The Heathcote Road bridge will be repainted, rust proofed and secured.

Playgrounds at Greenacres School and Willow Park will be replaced at a cost of $200,000 per park and additional funds have been allocated for park upgrades.

There will be renovations to ballfields, improvements to the paddle tennis courts and renovation of the Supply Field storage facility.

The Scarsdale Business Alliance will receive $30,000 to fund the upcoming Scarsdale Music Festival.

At Village Hall there will be a security upgrade, a renovation of the HVAC system and work on the parking lot.

The Village will spend $40,000 to purchase LED holiday lights that can be used every year.

Commenting on the proposed budget, Trustee Sameer Ahuja commended the Village staff and board for their work on it and said, “I will be excited to vote yes on this budget later this month.”

Trustee Jeremy Gans seconded the kudos for the staff and the board, sasying that “four passes on the budget is more than usual. I am impressed by this board’s willingness to fund capital projects, park and recreation and our roads.We have spent a lot of time aligning this year’s budget with the constituency we serve. We manage our funds to safely invest and to be flexible to be able to fund short term needs.

Trustee Karen Brew pointed out, “We started above the tax cap due to non-discretionary expenses … we don’t want to mortgage the future by deferring expenses. This budget strikes the right balance between investing and being fiscally prudent and moving the Village ahead.”

The budget will be voted on by May 1, 2024. Unlike the school budget, the Village budget is not voted on in a community referendum but approved by a majority vote of the Village Board. Due to the fact that the Wi-fi failed during the hearing and those online may not have been able to speak, the budget hearing was adjourned to the next meeting, when residents will be permitted to offer additional comments on the budget.

At Village Hall: Mayor Says Village is Advocating for a Solution for Tax Issue, Plus the Farmers Market is Back

- Details

- Written by Joanne Wallenstein

- Hits: 2002

Ready to address the tax penalty issue, Mayor Justin Arest came to the March 12, 2024 meeting of the Village Board with an update and a course of action for possible means of returning penalties and fines to those who failed to pay their taxes on time due to non-receipt of their tax bills.

Ready to address the tax penalty issue, Mayor Justin Arest came to the March 12, 2024 meeting of the Village Board with an update and a course of action for possible means of returning penalties and fines to those who failed to pay their taxes on time due to non-receipt of their tax bills.

He assured resident that the “Village is doing everything in its power to advocate for our residents and to work toward a solution,” and working with the Village attorney and State Assembly member Amy Paulin to advocate on behalf of residents.

However he said that enacting a legislative measure in Albany, similar to one passed to allow Mt. Pleasant to offer tax penalty refunds, could take up to nine months to resolve.

He reviewed a new communications policy, (see below) to ensure that residents are alerted when taxes are due and encouraged everyone to sign up to receive emails from the Village by enrolling on NotifyMe (https://www.scarsdale.com/list.aspx) and Everbridge Emergency Notification System (https://member.everbridge.net/311440963535088/new).

Read his full statement below:

During public comments, several residents spoke about the issue:

Several residents came to speak at the podium about the tax issue during public comments.

Howard Burke of 9 Reimer Road told the Mayor, “I do appreciate your comments. I wish it had happened earlier. Advocating for the state is good – what was lacking before was communication and transparency.”

Veronika Roberts of 3 Obry Drive posed questions about what happened. She said, “Do you have evidence of who failed to deliver the two bills?”

Lynn of 12 Cooper Road thanked the Mayor for the clarification. She said, “A lot of people are being affected and are waiting for updates on the investigation.” She reported that she received another bill yesterday dated March 6 for taxes she had already paid. She said, “There is definitely something going on. What goes wrong? What caused the problem? We want to hear the details so that we know that no such error will happen again.” The Mayor later apologized and said that was a mistake.

Anne Moretti of 10 Pinecrest Road said there are 42 homes in Sherbrooke Park and many did not receive their bills. She asked, “Of the total number of bills that normally go out in September, how many were penalized for non-payment compared to previous years? As far as I can tell 500 people were affected. Clearly there was a glitch in the system. I would love to know the total number that received penalties. Is it possible that there was corruption of the data from the Village? How did the tax department transmit the data to the printer? Who prints these bills? As a realtor I promote the fact that our Mayor and Trustees present the best of us.”

Craig Zwerling of 4 Fairview Road said, “I greatly appreciate the towns efforts towards resolving the issue. What were the amount of people missing the first and second installments? In 2022 98% of people paid as of 1/31. This year there was a downward trend. Please provide data about payments made on time in 2023 vs. previous years. It would be helpful moving forward.”

Term Limits

The Board held a hearing on a proposed code change that would eliminate term limits for service on the Board of Architectural Review and the Committee for Historic Preservation. The same resolution would require the Planning Board to “complete its report and recommendation on items referred to it by the Board of Trustees from 60 days to 30 days.”

The rationale for the elimination of term limits for the CHP and BAR was that trained, willing and competent volunteers could continue to serve and their institutional memory would be valuable. Trustees report that it is often difficult to find qualified and willing residents to serve on these boards. Defending the proposed change, Trustee Mazer said, “Abolishing term limits gives the Board of Trustees flexibility to choose the most competent volunteers possible to serve on these boards. Every year we examine the composition of these committees – and some of the people who are serving are best.”

However, during public comments several residents spoke against elimination of term limits.

Mayra Kirkendall Rodriguez called in via Zoom and said, “I am concerned about term limits – the elimination of term limits make me nervous. We want to take advantage of all the educated people who live in the Village. We don’t want someone on a board forever. I don’t agree with the non-partisan system but I do thank you for stepping up. But why eliminate term limits? I urge you to explain that. I am strongly opposed to that. Get out there – and find people to serve.”

Bob Berg said, “I think the this is a stupid proposal. These are two controversial committees: the BAR and CHP frequently make decisions that are unpopular with neighbors. Some people call the CHP the committee for historic destruction. These are controversial committees and you want to get turn over on those committees.”

Paul Diamond said he is a former member of the CHP. He said, “I am in favor of term limits. If you have a problem with gaps in timing you can extend certain people’s term limits on a case by case basis. To set the stage on having the same people for 8-10 years, that is heading in the wrong direction.”

Publication of Meeting Notices

A hearing was held on a proposed law to standardize the requirements for the publication of meeting notifications. Under the new law, when notices of a public hearing

are required to be published in the newspaper, it will be published in the official

newspaper at least once and at least five (5) days before the public hearing.

There were no comments on this code change.

Sandwich Boards on Sidewalks

A proposed code change would allow owners of retail businesses and food purveyors to place sandwich boards advertising their offerings on the sidewalk in front of their stores. The signs can be no larger than 36” high by 15” wide. The business owner will need to get a permit from the Village Engineer to post the sign.

Public Comments

Bob Harrison urged the board not to propose a budget that exceeded the tax cap. He pointed out interest rate projections from the Federal Reserve which are not projected to drop. He was disappointed that the Treasurer’s Report did not include a report on investments.

Mayra Kirkendall Rodriguez called in for a second time. She said, “I did not say it was an illegitimate election. But there is very little democracy here. You were selected by a closed door committee. I do appreciate the hours you put in.” She continued, “If you can’t fill a board, call me! We can get people in.” Referring to the discussion about term limits she said, “There’s an expression, politicians and diapers need to be changed often.”

She then reported that longtime Scarsdale resident Lucas Meyer passed away that morning. She said, “He loved the non-partisan system. He was a big fan of neighborhood character and preservation.”

Trustee Reports

There is a ban on gas leaf blowers until October 31, 2024. Residents are advised to avoid fines by not using gas leaf blowers.

Trustee Brew said that the League of Women Voters of Scarsdale had budget analysis session and consensus meeting on Monday March 11 about the Village budget and they will deliver a point of view on the budget at an upcoming meeting.

Trustee Ahuja used his time to defend the non-partisan system and volunteers. He said, “Being compared to a diaper is a first. I want to comment on those who question the legitimacy of our government and the efforts of our volunteers. I want to say the statements that were made earlier do nothing for the people of Scarsdale.”

Farmers Market

Trustee Gruenberg reported that the Village has signed a professional agreement with an organization that will bring a Farmers Market to Scarsdale. The market will be held on Sundays, beginning at 9 am on Chase Road between Spencer and Christie Place from May 12 to November 24, 2024. She said that the new organization will bring in many new vendors and has good ideas on producing a good market for Scarsdale.

Grant

Trustee Whitestone reported that State Senator Shelley Mayer had helped the Village to procure a $100,000 grant to procure two new motorcycles for use by the police. These will replace some aging motorcycles.

Treasurer’s Report

Village Treasurer Ann Scaglione reported that as oof February 29, 2024, 98% of the school tax levy had been collected. As of 5 pm on March 12, that numbers was 98.6%

She said, “We are working with residents who have questions, gathering email addresses, and working with the post office. We changed envelopes to ensure that non-deliverables will get returned. The tax software company came in to discuss system issues and possible improvements.”

She said, “County tax bills will be mailed on April 1.” Residents can also go online and pay their county tax bill after April 1, 2024.

Election

The Mayor reminded everyone that the Village election will be held on Tuesday March 3/19 from 6 am to 9 pm at Scarsdale Library. Those wishing to vote early can go to the Village Clerk’s office and vote before 3/19.

Here is the Mayor’s Statement on the School Tax Issue from the March 12, 2024 meeting of the Village Board:

I would like to address the School Tax issue and penalties incurred by residents. We understand there are many residents who are frustrated with and upset by what has transpired. They, like the Village Board, are eager to seek a resolution on this matter. Our hope is to offer some relief in response to what we believe was a failure by the United States Post Office to deliver tax bills in late August/early September 2023. However, determining exactly what that relief will look like and when residents can hope to receive any relief will take some time.

I want to reassure you that the Village is doing everything in its power to advocate for our residents and to work toward a solution. Our goal is always to do what is fair to individual taxpayers, while keeping the best interests of the overall community in mind. Our job as trustees is also to be aware of the consequences of the choices we make today and how those choices may impact residents and our community in the future.

We have been working with counsel and studying the NYS Real Property Tax Law and continue to believe that extremely limited options are available to local municipalities to waive or reduce penalties in circumstances that are similar to what Scarsdale residents are currently facing. Despite these significant obstacles, we have been working closely with our state assembly member, Amy Paulin, and her office to explore possible solutions, including special legislative remedies, and to advocate for our residents at the State level as appropriate.

We are aware of what occurred in Mount Pleasant in 2019 in response to the USPS’s failure to deliver bills. The Board has asked Assemblymember Paulin for assistance to understand the process for how to move forward with a formal request from this board to her office for help in achieving relief and what the timeline would be.

To level-set expectations, the Mount Pleasant case took nearly 9 months to resolve and involved special legislation passed by the Assembly and Senate at the State level and an endorsement by the Governor, as well as additional months for the comptroller’s office to ensure that the right taxpayers received the right refunds. Like Mount Pleasant, this would not be an easy or quick fix.

While receipt of the tax bill itself does not in any way affect the validity of the taxes or interest prescribed by law, we always want to support our residents and keep them up to date on important matters. We also want to ensure that any action we take this year in regard to the penalties is not precedent setting and does not set unrealistic expectations for what might happen in future years. So just to be clear, we are working with Amy Paulin’s office to request relief for our residents as appropriate with the State.

Moving forward, the Village is actively working to revamp and refine our communication strategy when it comes to tax billing. We plan to use all of the tools at our disposal to alert residents of tax bill and due dates, but for our efforts to be truly effective, we need residents to sign up for both NotifyMe (https://www.scarsdale.com/list.aspx) and Everbridge Emergency Notification System (https://member.everbridge.net/311440963535088/new).

Some of the ways in which we will communicate are as follows:

• Paper bills will continue to be sent out by the Treasurer on a set schedule throughout the year.

• In addition to paper bills, we will send e-blasts via NotifyMe to alert all residents when bills are mailed. These notifications will not be parcel specific but will include a link that any resident can use to pay property taxes online. We will also be sending out texts with the same information but again this is an opt in option and not one we can do without your registration. We do not have the ability to collect everyone’s contact information without your help.

• The current resident and parcel specific e-mail reminder system or a new one will also be used as well.

• We have already added the tax bill due dates to the PTC calendar. We thank them for their partnership.

• We will be working with the neighborhood associations to also send email reminders about tax collection.

• We will include reminders in Scarsdale Official, our weekly newsletter.

• We will also be sending out press releases and partnering with Scarsdale10583.com to post these reminders. We also thank Ms. Wallenstein for her partnership.

• We also would encourage everyone to put the tax dates on your own calendars to avoid missing payment deadlines in the future. Again, not receiving any of the attempts at outreach that I have outlined, including not receiving a paper or electronic bill from the Treasurer, does not relieve a resident of their responsibility to pay taxes on time. This is not a Village of Scarsdale policy, but something clearly stated in the New York State Real Property Tax law.

• As always, we are open to feedback and input from our residents and invite you to reach out to mayor@scarsdale.com if you have any additional insights or questions.