In Support of Curti for Village Justice and Mazer for Village Trustee

- Details

- Written by Joanne Wallenstein

- Hits: 783

(This letter was written by Tim Foley)

(This letter was written by Tim Foley)

Dear Editor,

I have been privileged to get to know Michael Curti, the candidate for Village Justice running on the non-partisan slate this year, in two very different contexts.

When I first met him, I merely knew him as my new across-the-street neighbor. Over the years, it's been a delight to get to know him, his wife Gina, and his kids and watch them become a fixture of the neighborhood, particularly around holidays and the "town square" that is the morning school bus stop. I've experienced again and again what a fundamentally decent and generous person he is, and how supportive and even keeled his temperament has been in all my interactions with him.

Gradually I became more and more aware of his stature within the Westchester County legal realm, as our professional circles began overlapping more and more. I soon learned that everyone who I know who has encountered Michael, be it when he was Corporation Counsel for the City of Yonkers, or when he was a Westchester County Assistant District Attorney, or from a particular matter that appeared before one of the local Industrial Development Agencies, shared that he was the same person professionally as he was personally -- thorough, detail-oriented, and a first class legal mind combined with the same even-keeled temperament and quiet decency.

For Scarsdale, the proof is in the pudding. He has served admirably as Acting Village Justice. His career has been clearly focused on public service and the public good. With Michael Curti, what you see is what you get, and what everyone has seen is exactly the qualities we'd wish to have in a Village Justice. I encourage all of my neighbors to vote for him on March 19!

Tim Foley

73 Brown

(This letter was submitted by Michael Suzman)

Dear Scarsdale 10583,

I read the recent interview with Village Trustee Ken Mazer and was inspired by the dedication to service Ken and all our Village Trustees bring to our exceptional community. The countless hours our Trustees volunteer on our behalf are a model for governance, especially in a time where many of our national leaders seem unable to work with their colleagues in an effective manner.

Ken Mazer is a long-time friend and Scarsdale neighbor, and I am proud to support him for another term as a Trustee. His thoughtful approach to many issues, from housing development to water management to recreation opportunities, balances the needs of our community in a fiscally prudent manner.

We are fortunate to have leaders in our town like Ken who keep our Village one of the most desirable places to live in the country. I will be proud to vote in our upcoming election.

Michael Suzman MD

Fox Meadow Resident

Scarsdale Treasurer Answers Questions About the Tax Billing Process

- Details

- Written by Joanne Wallenstein

- Hits: 1804

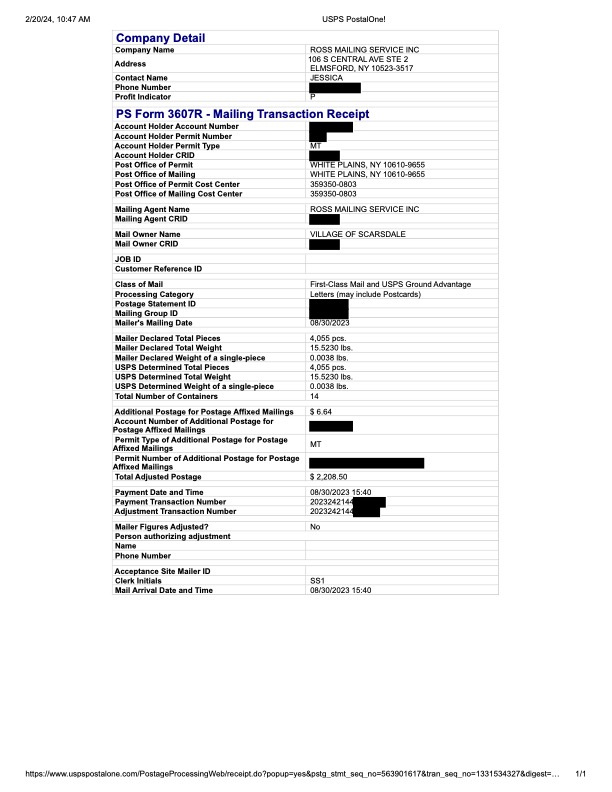

In the wake of the mystery of the missing school tax bills in September, 2023, we asked Scarsdale Village Treasurer Ann Scaglione some questions about the preparation and mailing of tax bills and here is what she shared:

In the wake of the mystery of the missing school tax bills in September, 2023, we asked Scarsdale Village Treasurer Ann Scaglione some questions about the preparation and mailing of tax bills and here is what she shared:

-Please forward me photo of the mailing receipt for the bills:

Attached please find the postal receipt of the 2023 School Tax Bills. Please note, the number of pieces indicated by the Post Office agrees with the bills produced by the Treasurer’s Department.

-Do you have any samples of the bills in the window envelopes? I know from my many years of experience in direct mail marketing that sometimes the address portion slips or is not folded correctly and the address does not show through the window of the envelope causing the mail to be undeliverable.

For each collection that we prepare bills, we work with our software provider to ensure that the format is correct, which includes the standard folding that will align with our window envelopes.

-What is the Village’s procedure when undeliverable bills are returned to the Village? Are residents called? Are the bills re-mailed?

My department reviews mail returned. If the address is incorrect or outdated, we will update our system and send out the mail in a new envelope.

-For those who escrow their taxes, are the same bills sent to the banks in the same format or is this done electronically? Did we have any incidence of banks failing to receiving the paper bills?

We receive data files from the tax service organizations before each tax billing and upload this information into our database before the bills are prepared. This is listing identifies the parcel and the bank code assigned. Electronic billing files of the escrowed accounts are submitted to the tax service organizations, so they know the amount of taxes due on each parcel. We then receive bulk payments, typically on the last day of the collection, for these payments that we apply in our system.

-Has the Village given any thought to marking the outside of the envelopes, “Tax Bill Inside” so that people don’t mistake the envelopes for other communications?

This is not something that we have done here – great idea to consider! Thank you.

Scarsdale Business Alliance Appeals to the Village of Scarsdale for Funding

- Details

- Written by Joanne Wallenstein

- Hits: 1292

What role should Village government play in ensuring the vitality of the retail community in Scarsdale Village? Who should fund the efforts of the Scarsdale Business Alliance (SBA) to bring foot traffic to the Village, beautify the Village Center and make it an appealing place for retailers to locate their businesses?

What role should Village government play in ensuring the vitality of the retail community in Scarsdale Village? Who should fund the efforts of the Scarsdale Business Alliance (SBA) to bring foot traffic to the Village, beautify the Village Center and make it an appealing place for retailers to locate their businesses?

That was the question on the minds of the Scarsdale Board of Trustees when the Scarsdale Business Alliance made an appeal to the Village Board to help them fund their efforts at a work session on February 6, 2024. Specifically, the group would like to replace volunteer efforts by retaining an Executive Director to run the SBA and serve as a development officer.

At a work session of the Village Board on February 6, 2024, former Mayor Jane Veron and SBA President Marcy Berman-Goldstein outlined their multi-year effort to bring back a defunct Chamber of Commerce. As a part of their work they grew the membership ranks from Village businesses, hosted events like Light the Dale, the Farmer's Market and the Scarsdale Music Festival and funded the large Dine the Dale tent on Spencer Place, giving the community an outdoor venue for gatherings.

They pointed out that these efforts strengthened community building, made Scarsdale more walkable and helped to fill empty storefronts. Though they will not continue to erect the Dining Tent, they do hope to continue their efforts by working with the county on a program called “Destination Scarsdale,” which would attract county wide traffic to the Village, especially on Bicycle Sundays when Scarsdale is a mid-point along the Bronx River Parkway bike route.

However, the revenue from membership dues at $30,000 falls short of what the group requires to hire the Executive Director at a salary of $80,000. They hope to hire a professional to build relationships with business owners, run events and sell sponsorships for SBA initiatives. Sponsorships of the Dine the Dale tent brought in almost $60,000 in revenue and without that the group will run a deficit. Also, the work has been fueled by Marcy Berman-Goldstein and other volunteers who are asking for help.

In a discussion about the request the Trustees asked questions about the SBA budget, and also wanted to know if this was a one-time request or if the expectation would be that the Village would fund the SBA year over year.

The trustees said they will continue to discuss this request in their upcoming budget sessions.

Residents Assessed Penalties for Late School Tax Payments

- Details

- Written by Joanne Wallenstein

- Hits: 3093

(Updated February 18, 2024) Scarsdale is known for its high real estate taxes, but a suspected glitch in the tax notification process has caused some residents' tax bills to climb even higher. We got distressed calls from residents who only recently found out that they missed their first school tax payment – due by September 30, 2023 -- and the second, due on January 31, 2024 and were assessed high penalties. Some said they have lived here for years and never missed a payment, but this year they claim they never received a bill.

(Updated February 18, 2024) Scarsdale is known for its high real estate taxes, but a suspected glitch in the tax notification process has caused some residents' tax bills to climb even higher. We got distressed calls from residents who only recently found out that they missed their first school tax payment – due by September 30, 2023 -- and the second, due on January 31, 2024 and were assessed high penalties. Some said they have lived here for years and never missed a payment, but this year they claim they never received a bill.

In fact, the Village Treasurer reported that the collection of the school portion of Village taxes is alarmingly slow this year. $13.6 million in school taxes that were due by January 31, 2024 remain uncollected. Since there are stiff penalties for late tax payments and the schools need this revenue to operate, this is a cause for concern among residents and the Village.

At the February 13, 2024 meeting of the Village Board, Village Treasurer Ann Scaglione said that only 91.24% of the school tax levy had been collected as of January 31, 2024, the lowest rate in the Village’s history. She said, “Our office has been focused on this for the last few weeks.”

In 2020 the Village moved to a two-part tax payment option. For school taxes, which are the largest portion of the tax bill, the Village mails one bill with two payment coupons the first due on September 30 and the second on January 31. For those who opt to pay in installments it is up to the resident to remember to pay the second installment by January 31. A second bill is not mailed. The same is done for Village taxes which are due on August 1 and December 31.

Scaglione said that in 2020, the first year the Village moved to the two-part installment option, 885 parcels were delinquent on their school taxes. Yet only 39 of those missed their first installment, with the balance, or 816 homeowners missing the second installment. This may indicate that everyone received their bill, but some forgot to pay the second installment.

However, this year Scaglione reported that 216 missed both the first and the second installments and 284 missed only the second installment.

Why did they fail to pay? People who are calling the Treasurer or coming to Village Hall say they forgot or they never received the original bill. Commenting online, residents blamed the Village, first for the failure of the mail and email notifications and second for not alerting them earlier that their first payments had not been received.

Residents who have been assessed thousands of dollars in penalties contend that something went wrong. In online comments they say that they never received their school tax bills in the mail in September (or to date) or email reminders and therefore they did not make a first payment. They only learned they were delinquent in January, some too late to avoid penalties on both payments. Penalties range from 2% to up to 12% for payments made after January 31, 2024.

Scaglione maintains that the office sent out paper bills and email notifications to all residents. She said her office has found that “it is not just one segment of people” who failed to be noticed. Her office is showing proof that the bills were mailed as well as providing the dates email notifications were sent to those who opted in for email reminders.

At the Village Board meeting Mayor Justin Arest made it clear that the Village does not want to collect penalties. He said, “We don’t want to collect this money – we don’t want our residents to pay penalties. That’s why we’re happy the Treasurer is sending out additional delinquent notices and hope that will bring in the revenues.” However, he said that the Village Treasurer’s office cannot waive the fees.

New York State law requires residents to pay their taxes, whether or not they are notified. It is the responsibility of the taxpayer to pay taxes on property they own. Even if the owner does not receive a tax bill, it is the owner’s obligation to secure a tax bill and make payment. The taxpayer, therefore, is liable for all penalties and interest on late payments.

Regardless of who is at fault, delinquent residents may still be liable for the penalties on their late school tax payments.

This is not the first time there was an issue with the tax installment payment plan. In 2020, there was an error in the printing process and though the coupons showed the correct amount to pay, the printed receipt showing assessed value and total tax information were not accurate. The Village did not send out new bills as the payment coupons were correct.

On Sunday night February 18, 2024, Mayor Justin Arest sent the following letter to those who had written to him about the tax issue:

Thank you for your email. I have heard from several residents with similar concerns. The Manager’s Office and I have started our own investigation (with the assistance of the Treasurer) into the matter. This will continue over the next week, and I hope to have more to share with the community soon. We are aware that many residents have stated that they never received their tax bills in the mail. We have been in communication with the USPS and have reached out to the regional post master. We have also spoken to our state elected representatives to see if there is any support they can provide. I am sensitive to the stress this is causing our residents, and we are doing everything we can to try to understand what took place and if there are any options moving forward. I am sorry I don’t have any more information at this time. It is my hope that more details will be forthcoming.

I expect to update the community at our next board meeting as well as via written communication.

Thank you for your email and for your patience as we examine what transpired.

Best,

Justin

Justin Arest

Mayor

Candidates Sought for Associate Village Justice

- Details

- Written by Joanne Wallenstein

- Hits: 1467

The Judicial Qualifications Advisory Committee is seeking individuals interested in serving as Scarsdale’s Associate Village Justice.

The Judicial Qualifications Advisory Committee is seeking individuals interested in serving as Scarsdale’s Associate Village Justice.

The Committee welcomes all qualified applicants who live in the Village of Scarsdale and are members in good standing of the New York State Bar with courtroom experience.

The Associate Village Justice serves in the absence or incapacity of the Village Justice. The Committee screens candidates for this position and reports their assessment of the candidate’s qualifications to the Mayor. The Mayor then makes the appointment with confirmation by the Village Board of Trustees. The position is open as Associate Village Justice Michael Curti was appointed to fill the term of the retired Village Justice. The term of the Associate Village Justice is one year, beginning April 01, 2024. The Associate Justice may be reappointed for additional one-year periods, each commencing on the first Monday in April of the year in question.

Interested persons should send a letter of interest and resume to Stephen Sage by email to personnel@scarsdale.com or by United States Postal Mail to 1001 Post Road, Scarsdale, New York 10583. The deadline for receipt of materials is February 16, 2024. If the Committee wishes to interview a candidate, they will contact the candidate directly after the deadline for submissions has passed.