Board Wrestles with 2023-24 School Budget

Just minutes after celebrating his appointment as Superintendent of the Scarsdale Schools on February 13, 2023, Dr. Patrick and the board got started on the difficult job of producing a 2023-24 school budget. The challenge this year is that the Board has committed to a $5 million renovation of the high school auditorium that makes it difficult to propose a budget that comes in under the tax cap.

Just minutes after celebrating his appointment as Superintendent of the Scarsdale Schools on February 13, 2023, Dr. Patrick and the board got started on the difficult job of producing a 2023-24 school budget. The challenge this year is that the Board has committed to a $5 million renovation of the high school auditorium that makes it difficult to propose a budget that comes in under the tax cap.

Staffing

The administration is proposing staffing changes including a half time position for student support, a full time custodian for the high school and $200,000 in fees for consultants. The budget allows for three faculty contingency positions depending on school enrollment including one middle school special education teacher, one special education teacher for the high school and another floating assignment as needed.

Benefits

Employee benefits account for an increase of 6.78%. The self-funded medical insurance budget is expected to increase 11.25% based on the current year claim experience and adjustments for large non-recurring claims. The NYS Teachers Retirement System contribution rate is decreasing, while other Insurances are increasing primarily due to an increase in Medicare Part B expenses associated with an increased number of retirees.

Transportation

There is a proposed 7.74% increase in the transportation budget. In 2022-23 the budget funded the purchase of 1 large bus, 3 mini-buses and 1 automobile/van for $297,500.

The 2023-24 transportation budget includes:

The planned purchase of 1 large bus and 3 mini-buses

A contractual salary increases of $188,000 thousand for the drivers

$24,000 thousand for a transportation efficiency study

$70,000 increase in capital equipment purchases related to the lease maintenance facility a $40,000 increase for busing related to athletics.

Lease with the Village of Scarsdale for $4126,305.

A state law passed in Spring 2022 requires that all new school bus purchases be zero-emission by 2027 and that all school buses in service be zero emission by 2035. Transportation costs are 3% of the draft budget.

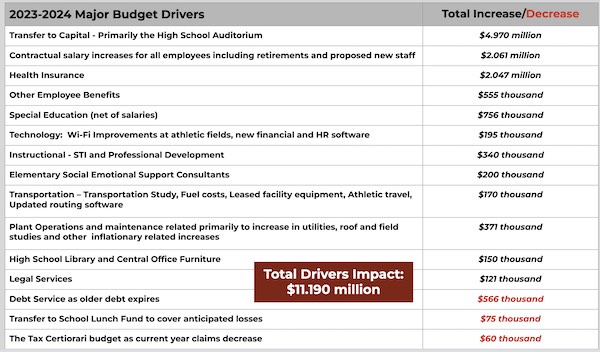

Budget Increases

The main drivers of the budget increases are the $5mm auditorium renovation, contractual salary increases ($2mm), health insurance ($2 mm), employee benefits ($555k) and special education salary increases (($756k) plus other increases for a total of $11.190 million.

Budget Proposals

At this first budget study session of 2023, the administration gave the school board four possible budget proposals for the 2023-24 school year. The first proposal, (Draft 1) which includes the renovation of the Scarsdale High School auditorium, would increase the budget by over 6%, with a projected increase in the tax levy of 4.55%.

Anticipating that the Board would ask for alternatives, new Superintendent of Schools Dr. Drew Patrick led off by noting that the administration was holding off on creating the full budget book until they had examined several scenarios.

Budget draft 1a does not include the high school auditorium. In this version of the budget, the increase is 3.48% from last year, with a projected increase in tax levy of 3.80%.

Budgets 2 and 2a both include considerations for reductions to the first drafts, with #2 including the high school auditorium renovation and #2a excluding it.

The proposed savings, totaling $866,710 would come from omitting the following from the budget and using $1,281,233 from the ERS, TRS and Health Insurance Reserves.

Hiring an additional custodian: $65,000

Special Education: $150,000

Food costs for Board meetings: $25,000

Financial software for business office: $16,000

Student activities fund at SHS : $10,000

Fund Balance

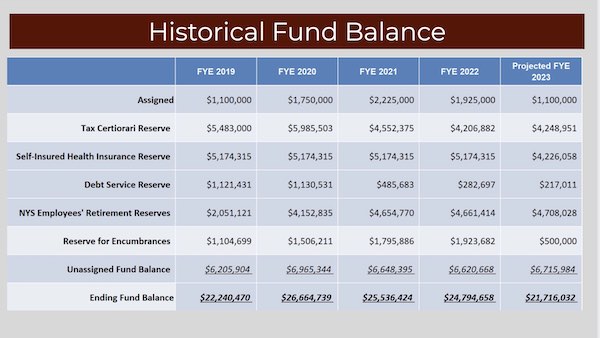

If the Board does opt to assign $1,281,233 of the fund balance for the 2023-24 budget, the fund balance would fall from $24.7mm as of June 2022 to $21,7 mm as of June 23 and would stand at only 3.65% of the total budget. State law says that the maximum that can be held in reserves is 4% of the budget. The fund balance would be at the lowest level it has been in the past five years.

After the slide presentation, board members had many questions for the administration.

Board Member Bob Klein, who is an architect, suggested reducing the budget of the auditorium by asking the architects “If we reduced our budget by $500,000 can we keep the scope of the project?” He said the renovation budget was generous and asked if any value engineering had been done. Dr. Patrick said that since the renovation is excluded from the tax cap it wouldn’t necessarily close the budget gap. The simplest answer, both Dr. Patrick and Stuart Mattey noted, would be through value engineering and materials.

Board member Jim Dugan, shouting into his microphone due to difficulties being heard, said “I feel strongly that the auditorium project should be included in the budget. The upgrades have been needed for so long and people have been very patient waiting so long. “I feel strongly we owe it to the students and the community that have been promised for a number of years. …I do think we owe it to the community to narrow the gap above the tax cap, making the cuts that we can. As long as we have been judicious, I would support those cost saving mechanisms.”

Board member Suzie Hahn Pascutti asked about funding the auditorium if it is excluded from the budget. Assistant Superintendent Mattey gave a number of options, including as a stand-alone bond or making it a part of a future bond project.

Colleen Brown supported moving ahead with the auditorium project and utilizing the proposed cuts.

Susie Hahn Pascutti supported the auditorium. However, she said she was “leery about cutting too much into our reserves. She said there are proposals to raise the limit on reserves to even 10%.” Healthy reserves are important.

Jessica Resnick-Ault said she was “torn between the obligation to include the auditorium but also to do it in the smartest way possible….Perhaps that does mean changing parts of the project scope.”

Patrick asked the Board to give the administration a read on where they want to go.

Bob Klein also asked about the implications of proposing a budget that exceeds the tax levy limit. Dr. Patrick answered, “A proposed budget that exceeds the allowable tax levy requires a supermajority vote of the public, 60% yes, to pass the budget. A levy that’s at or under the limit only requires a vote of 50% plus 1.”

Klein wondered about the potential effects of proposing a budget that exceeds the tax limit and putting the decision about potential cuts to the community?

Dugan said if the vote fails they can propose a second budget. Mattey clarified, “If the second vote fails, then your levy must stay the same as the current year.”

Board President Amber Yusuf wanted to understand tradeoffs and potential cuts before making the decision on whether or not to exceed the tax cap.

Vice President Ron Schulhof supported the auditorium project, saying that he was flexible about how it could be funded. He also said he thought the Board should be cognizant of the tax cap, saying “While it is this Board’s decision on what we propose to the community, ultimately it is the taxpayers’ decision whether to pass that budget or not. Mr. Schulhof also made the point,” If the district uses reserves this year, and next year is a tough year, what does that mean for next year? … I don’t want to box us into a place where we can’t be flexible and deliver new programs.”

Amber Yusuf supported including the auditorium in the budget or in a bond.

At the conclusion of the meeting, Dr. Patrick said they would come back with a list of proposed reductions to bring the budget in closer to the tax cap and will also give more consideration to the use of reserves.

See the full presentation here.