School Board Gives Green Light to Initial Renovations at SHS Auditorium and Uses Fund Balance to Soften Impact on Taxpayers

(Updated 5-14) Though the Board of Education was expected to finalize the 2020-21 Scarsdale School Budget at their May 11 meeting, some last-minute changes brought the proposed tax increase down and necessitated an additional meeting for final budget approval on Wednesday May 13.

(Updated 5-14) Though the Board of Education was expected to finalize the 2020-21 Scarsdale School Budget at their May 11 meeting, some last-minute changes brought the proposed tax increase down and necessitated an additional meeting for final budget approval on Wednesday May 13.

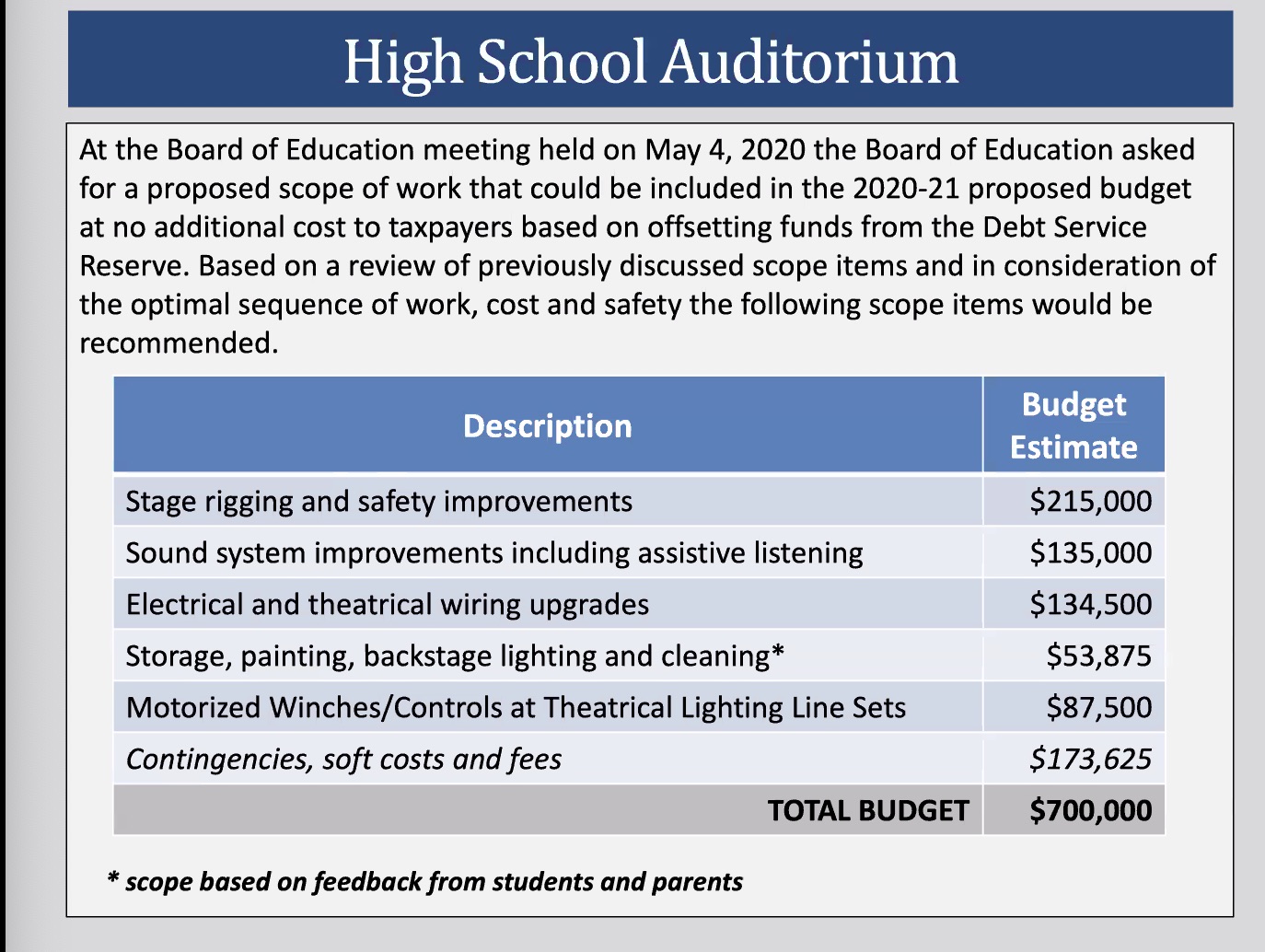

What happened? The long and short of the story is that first, the Board decided to transfer $700,000 from debt reserves into the proposed budget to begin renovations of the Scarsdale High School auditorium. The total estimated cost of the project is $1.9 mm, but architects determined that some of the necessary updates could begin with the $700,000 in funds approved by voters in the 2014 bond.

See below for a list of items that will be addressed, with work expected to be done during the summer of 2021.

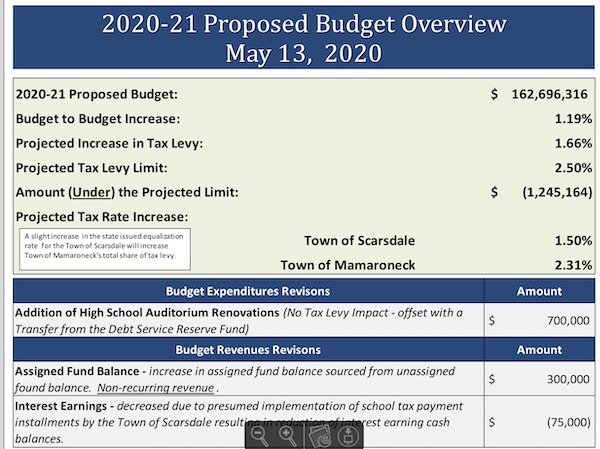

Second, due to the closure of school, the district realized savings and anticipates that the fund balance at the end of June would be $24,734,716, or 3.95% of the total budget. The maximum a district can hold is 4.00%, so the $24.7 million is higher than usual.

Several Board members advocated to take more funds out of reserves this year to soften the impact on taxpayers. Traditionally the board uses $1.1million of reserves in the following year’s budget. At previous meetings, the board had agreed to take $350,000 more out of reserves for a total contribution of $1.45 million. At Monday night’s meeting, Board member Scott Silberfein again raised the possibility of increasing the contribution from reserves. After considerable debate, the Board coalesced around adding another $300,000 to the 2020-21 budget, making the total contribution from the fund balance $650,000.

Third, the Board held a lengthy discussion about allowing taxpayers to pay their school taxes in two installments, rather than in one payment in September. This decision is ultimately up to the Scarsdale Board of Trustees as the village collects taxes, but the school board agreed that they support this change and asked the village board to explore installment billing and other avenues of tax relief for homeowners.

Accordingly, if payment were made in two installments in September and January, Assistant Superintendent Mattey estimated that the school would lose about $75,000 in interest on the uncollected funds.

Accordingly, if payment were made in two installments in September and January, Assistant Superintendent Mattey estimated that the school would lose about $75,000 in interest on the uncollected funds.

These three decisions changed the projections that Assistant Superintendent Mattey presented at the outset of the meeting. When he refigured the impact of all these adjustments, at the end of the meeting he projected a 1.19% budget to budget increase, a tax levy increase of 1.66% which translates to a 1.498% percent increase for Scarsdale residents and a 2.31% increase for those in the Mamaroneck strip.

Coming to consensus on these issues took considerable discussion.

On the decision to fund auditorium improvements, several members of the Board were strongly in favor as they were eager to comply with the wishes of parents and the PTA who supported the work. However, some were concerned about what changes the COVID crisis might require to open school in the fall and wanted to keep the funds in reserve for maximum flexibility. Ron Schulhof said, “I think it’s prudent to keep money in the reserves in case the school needs to be reconfigured to facilitate social distancing. It came up very late at the last meeting. I don’t think the community has enough time to opine at such a late point in the budget process.”

Scott Silberfein responded, “We have $23 million in reserves – how would it hurt to use this $700,000 for the auditorium? … (SHS President) Deb Morel has brought it up at every meeting. This isn’t impacting our taxpayers and that’s why I am comfortable doing this.”

Alison Singer also supported the transfer. She said, “I think it was clever and creative to look for a way to use the funds in the debt service account to fulfill our obligation to do something about the auditorium. Now the architects have found some projects that it is wise and prudent to use these funds for, so I support it.”

A similar discussion ensued about using additional funds from the fund balance to decrease taxes. Scott Silberfein said he would like to use as much as the Board was comfortable adding. Assistant Superintendent Stuart Mattey cautioned” the Board might be digging a hole that it might be difficult to get out of next year.”

Board President Pam Fuehrer said, “If we do adopt this, we have to change the property tax card which we are due to approve at this meeting. If we make that change, we will meet again to approve the edited card.” She later said, “I think it’s very clear that as a board we have a lot of positions on this and I think as a board we understand the value of respecting those differences and find something that is going to make a difference to our taxpayers but maintain our concerns about uncertainty next year and the impact on next year’s budgeting, all of which are reasonable and have been brought to us by leadership. Coming to a compromise number at $200,00 could go a long way. We have to come together on a number and move forward.”

Carl Finger proposed adding an additional $300,000 from the fund balance to the current budget, saying, “It’s not so big that we can’t come down from it or refund this amount next year. It’s a good compromise and a good number.”

At that point, there was general agreement on the$300,000. However Ron Schulhof objected to the process. He said, “I just want to point out, at our last meeting when we were scheduled to vote we made $1.4 million in changes. Now we’re making another major change. It does not give the Board or the community time to opine on this. From a process standpoint I am struggling to understand how we got here and it’s disappointing.”

Chris Morin defended the changes. He said, “We’re finally listening to the community. We’re hearing taxes are too damn high, we want to renovate the auditorium and we want to pay taxes in installments.” Scott Silberfein concurred saying, “I don’t want to leave the public with the headline that we made $1.4 million in changes and never spoke to them about it. We have been talking about the fund balance and the auditorium for weeks and months. We have been as responsive as possible in listening to our constituents.”

(Updated 5-14)

At the May 13 meeting, the budget below was reviewed, including the changes noted above. You can see the Property Tax Report Card that you will receive in the mail here:

Here are a few highlights from the public comments portion of the meeting:

Marshall Kitain of Fox Meadow Road asked how schools can open in September, saying “e-Learning is not workable in my home…. Parents are not trained educators. I recognize that now there is no other option, but I implore the board to develop a plan to open school in September especially for our youngest learners.

SHS PTA President Deb Morel said, “The Executive Committee is thrilled about the board’s consensus to use the $700,000 from debt reserve to begin work on the auditorium. It is the right and responsible thing to do. Thank you!”

Nicholas Thompson of Forest Lane asked the board for a flat or 0% tax increase saying that people aged 20-34 years-old would not be able to stay in town.”

Mayra Kirkendall-Rodriguez talked about the financial stress on parents. She discussed the districts triple AAA bond rating and said the district should use it. She suggested an analysis to figure out how much fund balance could be used without affecting the rating. She said, “Should a bond be issued for the auditorium renovations?” She favored installment payment for school taxes.

Eric Lichtenstein of Richbell Road echoed Marshall Kitain’s comments about e-Learning and the difficulty in educating young kids. He said, “It is difficult and challenging for the young kids to spend their time on Zooms. There is no replacement for in school classrooms. I would encourage the board to keep the synchronous learning consistent. For instance, they are not all in the morning…. It is difficult if things are happening at various times in the day. Have all the learning in the morning and teacher planning in the afternoon.” He added, “I want to bring up graduation for the middle schoolers and the elementary school students. Plan something special for fifth and eighth graders who are moving up.”

Art Rublin of Donellan Road voiced “support for the budget that you are putting together” He said, “I think the auditorium is a good development… I think there will a lot of support in the community.”

Diane Greenwald of Oak Lane thanked the SHS faculty and senior class student government for arranging a wonderful event. She said, “teams of masked teachers drove beeping across town to deliver nearly 400 signs to mark the homes of the class of 2020 and cheer for them as they approach their derailed milestone graduation. I felt like the entire community was rooting for our teens! I am so grateful for this joyful act of kindness for my kid and yours! This is Non sibi -- This is why I live here. This is why I support our schools.”

She continued, “School is the thing we sacrifice FOR. This is why we all work hard to live here. Quality education is the priority. I don’t always agree with every choice, but I have never seen a Village or a District professional or a Village or District volunteer be cavalier about the responsibility of spending funds. Ever. I hope you will feel good about your role as stewards in a balanced tradition, protecting valued investment into learning and development. You all work hard to propose a prudent budget that is responsive to the needs of the students, the values of the community, and the economic resources available at any given time. Furthermore, helping to keep our faculty and staff employed in such meaningful work is a privilege — for the children, for the economy, for society, for the future. Cutting taxes is an easy talking point but not always an economic positive. The Scarsdale School District is an important area employer, and cuts cannot be profound or deep without a ripple of negative consequences.”

You can watch the meeting online here.

The board will meet again on Wednesday May 13 at 5:30 pm to finalize the budget and approve the property tax report card.

Board members and Administrators will be participating virtually via Zoom. To view the Special Meeting live, click this link or access it via the District Calendar.