2020-21 Scarsdale Village Approved After Considerable Debate

- Wednesday, 29 April 2020 14:16

- Last Updated: Thursday, 30 April 2020 12:13

- Published: Wednesday, 29 April 2020 14:16

- Joanne Wallenstein

- Hits: 2526

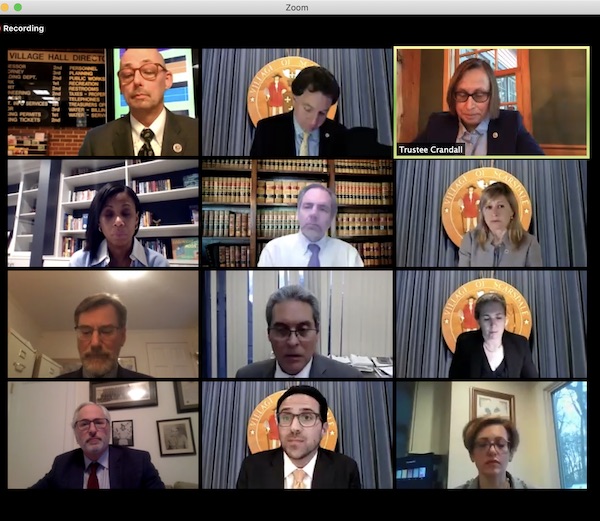

Photo Credit: Emily GilmanUnder pressure from a rival political party that is seeking to unseat candidates for the Village Board selected by Citizens Nominating Committee, members of the Scarsdale Village Board provided a lengthy defense of the proposed 2020-21 Village Budget. At a virtual meeting held on April 28 attended by 68 viewers, the Board of Trustees ultimately voted to pass the budget by a vote of 6-1. The $59 million budget is a 1.46% increase over 2019-20 which would result in an annual increase of $95 for the average homeowner in Scarsdale. In order to minimize the increase, 49 non-union Village employees will forgo their raises in 2020-21 and $210,000 was taken from the library budget which will open two months later than anticipated.

Photo Credit: Emily GilmanUnder pressure from a rival political party that is seeking to unseat candidates for the Village Board selected by Citizens Nominating Committee, members of the Scarsdale Village Board provided a lengthy defense of the proposed 2020-21 Village Budget. At a virtual meeting held on April 28 attended by 68 viewers, the Board of Trustees ultimately voted to pass the budget by a vote of 6-1. The $59 million budget is a 1.46% increase over 2019-20 which would result in an annual increase of $95 for the average homeowner in Scarsdale. In order to minimize the increase, 49 non-union Village employees will forgo their raises in 2020-21 and $210,000 was taken from the library budget which will open two months later than anticipated.

The Village budget became a political issue in the upcoming election where a slate of three candidates for Village Trustee from the Voters Choice Party are challenging non-partisan slate. The Voters Choice Party circulated and submitted a petition with 455 signatures calling for $2 million in cuts to the budget. They claim that “These cuts can be undertaken without cutting back on services, furloughing staff, or negatively impacting our Village.”

However, in an April 23 letter to the Village from Mayor Marc Samwick on April 23 Samwick writes, “Unfortunately, some view the current situation as an opportunity to create a political divide. They advocate that the solution to reducing Village property taxes is to penalize our first responders and to ask our Village Justice to forgo his salary. This is unacceptable, especially at the time when we need our first responders more than ever. We cannot penalize first responders working hard in extraordinary circumstances, or public servants who continue to perform the job they were elected to do. Degrading our professional police, fire department, or criminal justice services is not only unconscionable but also unwise.”

The Mayor and two trustees made extensive comments defending the budget. Here are excerpts from their comments:

Mayor Marc Samwick:

The Village Board has repeatedly affirmed our commitment to review Village finances regularly and make as many budget revisions as needed as the pandemic and its aftermath continue to unfold. Our actions to date and into the future will be from an informed position, with the latest data and best visibility possible. We have taken quick, decisive action. We do not believe it to be prudent to take actions out of panic or fear. And, we will certainly not make decisions based on any political interest. That is not who we are as a community. On the contrary, we have a very long history of responsible, long-term financial stewardship that we will not abandon. This long-term focus on financial stability and strength is widely recognized, including the recognition received by our long-standing AAA credit rating, and has provided the Village with the financial flexibility to manage the economic impact of the pandemic.

The Village also benefits structurally from the ability to revise its budget continually throughout the year. As we work through the pandemic and gain better visibility, services and projects will be reevaluated. If we need to cut services in the future, we will do so carefully, thoughtfully, and with community input. Budget decisions may have unintended consequences and it is our job to consider those to the extent possible, and not to act in haste.

…The Village Board will continue to be proactive and work to make, in its judgment, the best fiscal decisions for all of Scarsdale. And, we will do it together with the community to balance, as optimally as possible, the tradeoff between costs and services delivered

Trustee Justin Arest:

Oversight of a community’s finances is one of the most important roles of a trustee. And in this capacity, and everything we do, we are governed by New York State Law and of course the constitutions of both NY State and the United States of America. ….

Understanding that we are living through a health crisis that has created an economic crisis and therefore the restraints that we have on resources- our staff is working around the clock and many are putting their own health at risk- I believe we have acted sensibly and with great care.

… I believe that should the economic crisis not recede, certain, possibly many line items included in the budget will not be feasible. But not because there was never a will to complete them or that they were frivolous in nature. It is because we will be in a position where we must choose not to proceed in order to protect our community’s finances and that is why the budget for FY 20-21 must be flexible and adapt to our needs. Do I know how bad things will get and exactly which items will need to be sacrificed to solve the deficit we face? No. At this point no one can.

There are two changes included in this resolution: one to reduce the Library’s operating budget and use those savings to directly reduce the tax levy, and therefore the taxes our residents pay. The second is a reallocation of a planned salary increase for non-union employees to the COVID Contingent Account. Both changes are necessary now because without action, the monies would be allocated and at least partially distributed and unavailable for tax relief and additional protection from the crisis later.

…I want to conclude speaking directly to the tax increase. On a resident’s tax bill, our Village tax portion will increase by 1.46%. Village taxes cover all of our municipal services such as public safety, sanitation, water department, building department and all of other everyday services and account for roughly 18% of our total property taxes. The balance, of course, is separate from our Village government and is comprised of County taxes at roughly 17% and the remaining 65% is School taxes.

None of us are immune to the impacts of COVID-19 and I am in favor of doing everything I can in my role as your trustee to help. And that is why my message to anyone in the community who genuinely does not understand how we can increase taxes in the current environment is that all of us take this role extremely seriously, we are deftly aware that our decisions have implications and that we would not, in fact could not, advocate for any increase if we did not believe it is necessary at this point. I understand that many in our community are out of work, have seen their businesses severely impacted, and their savings diminished; there are residents who are rightfully worried, and those worries have nothing to do with political opportunism. I pray for better times for all of us financially, but my main concern currently is for all of our health and safety as well as the financial health of our village….

Our village has de facto term limits on its elected leaders. If we had chosen the politically expedient path, you would see seven trustees insisting on a tax reduction or at least a freeze. We might become more popular today and might not even be in these seats or facing reelection when the detriment of unwise choices comes back to haunt us. However, we, as individuals and as a collective board, look at our job as doing what is best for our community, not what might be in our own political interests.

Trustee Jane Veron:

“In pre-COVID days, what feels like another lifetime, we finalized the tentative Village budget. After months of rigorous analysis, discussion and debate, we struck just the right balance - providing services our residents valued, investing in our future, and being responsible fiduciaries to our taxpayers.

Then COVID hit, and my knee jerk reaction was to cut taxes to the bone - no matter what. I knew that people would be hurting, and I wanted to do whatever I could to help. But when I moved past my emotional response, I realized that what felt good now would likely have perilous results later.

While I want to give taxpayer relief, how much is responsible to cut? Is it worth risking not having the wherewithal to pay our emergency workers overtime if COVID thinned their ranks? Could I justify not being able to regularly pick-up virus-infected trash? And what about the unanticipated costs that will likely arise? Just tonight, we have a resolution to buy more police uniforms with a note that we disposed of some because of COVID contamination. Could I have foreseen that?

The Village Board has discretion over 18% of your total tax bill. School and County taxes account for approximately 65% and 17%, respectively. Of the approximately $59MM Village budget, over 75% is non-negotiable - contractually obligated personnel-related or state-mandated expenses. The Village budget pays for services you rely upon - police, fire, sanitation, sewers, water, roads, recreation.

While none of us knows how the future will unfold, from this vantage point at this moment in time, non-property tax revenue will likely be in a precipitous decline, and we anticipate a revenue shortfall. In the ensuing months, Scarsdale will likely need to do more with less….

Tonight, we will vote on the revised budget that includes a property tax decrease and a proposed cut to salary increases for nonunion Village employees. It seems incongruous to defer hard earned increases to those who are working without break during this unprecedented time, but in preparing for the worst, we are choosing to allocate those funds to the COVID emergency account….Respected civic groups including the League of Women Voters and the Scarsdale Forum endorse our budget….

…This budget journey is just beginning. It is impossible to know right now how deep and far reaching the wrath of COVID19. There will be tough decisions that we will need to make together with data, analysis, and public conversation. Together, we will arrive at what is fundamental to Scarsdale and at what cost.

How much of the way we do things in Scarsdale will need to change? How much change will our residents desire or tolerate? What did we learn through past crises that can help us now? What have we learned in our quick pivot now that will inform how we work in the future?”

Trustee Jonathan Lewis voted against the budget. Here are his comments:

"In 1940, former Scarsdale Mayor Warren Cunningham explained that the purpose of Scarsdale’s non-partisan office holders was to “give Scarsdale the best possible business administration.”

Mayor Cunningham does not say our duty is to agree with each other at all times, though our tradition is collaborative. His statement, which appears on the website of the Scarsdale Citizen’s non-Partisan Party, is that our objective is the best result.

With regard to tonight’s budget resolution and my vote on it, I believe there is the world before COVID19 and the world after COVID 19. I am proud of this board and the process that led to our original budget.

With regard to the current budget, I believe that in recent board meetings and in our one working group session on the budget back in March, we never asked or addressed the key strategic question: what is the right level of taxation for this time? What is the proper level of taxation for this new period we so abruptly entered? What is the right level of taxes consistent with the best possible business administration now?

Our core business is essential services and public safety. I want to acknowledge a recent letter by 4 former mayors: Kroenlein, Hochvert, Mark, and Steves. I know these individuals and respect them greatly. I agree with their conclusion that it is critically important we maintain full budget support for our first responders, our police department and our fire department. In this emergency nothing is more important as trustees than maintaining the critical services, including sanitation and water, that keep our neighbors safe and healthy.

My view is that the best possible way to ensure we will always maintain critical services at appropriate levels is by ensuring our village balance sheet is strong, flexible, and stress tested by a variety of scenarios - including a worst case one. Reserves are our last line of defense - if we want to maintain public safety at optimal levels, we need to maintain reserves to have financial flexibility, and plan in advance how we will respond should reserve levels fall. We've not done that exercise yet. To that end:

1 - Work sessions should occur in an up-tempo manner perhaps every 2 weeks -- perhaps alternating weeks with traditional BOT meetings. In these sessions we should be debating a priority list of items that we will consider cutting in the future to maintain our strong financial position, should this become necessary. I think it will.

Some might argue more meetings may tax staff resources during a period of crisis, I believe we do not need additional staff support to discuss our strategic goals. This board is capable of discussing important strategic goals without significantly, or unreasonably drawing on staff.

This type of planning is essential, in my view, to secure our ability to pay for a fully funded level of essential services even in the darkest scenarios.

2 - In these sessions we would revisit our Scenarios 1 and 2 and define a Scenario 3. There has yet to be any conversation at board meetings about possible adverse shocks to our cost structure that would negatively impact our financial position. These cost structure shocks could include an unexpected surge in overtime, an increased required contribution to state pension plans due to the stock market sell-off, among other factors. These should be discussed and modeled.

3. Of particularly great concern is the need to create contingency plans regarding reserve levels. If revenues fall more and costs rise more our reserves will drop. There is likely a level of reserves this board will view as an absolute minimum requirement to maintain a flexible and effective financial profile. We’ve not discussed this. We could consider framing this conversation in terms of the fiscal stress indicators monitored by the state comptroller.

The analysis noted above would be, for me, important inputs to evaluating a budget’s fit for these times.

Finally, my own view is at a time of great pain and suffering there should be no tax increase. We show solidarity with our neighbors through actions and I believe no increase would have been the strongest possible initial statement of solidarity. Being in solidarity with our customers, our taxpayers, is good business. While many Westchester communities may still be raising taxes, I believe we should hold ourselves to our own standard.

I have great admiration for my fellow board members and our village manager Steve Pappalardo and his entire staff who have shown great strength and resiliency in this crisis. I want to thank them for their public service.”

Supporters and detractors for the 2020-21 proposed budget called in during the public comments period:

Former Mayor Dan Hochvert read a letter in support of the budget signed by four prior Village Mayors.

Non-Partisan Party candidate Randy Whitestone said, “We have not emerged from this crisis… George Latimer said, “The rainy day has come.” We are facing a fiscal monsoon. The Scarsdale Village budget needs to be a living, dynamic budget. Revenues may go down, expenses may go up. What about pension costs? Garbage collection is up 19% due to people being home…. I do think all the work done on the budget will come in handy. It will help the board set priorities in the future. … This has been an awful time but we will get through this with a sense of common purpose and mutual respect.”

Steve Pass called to discuss the petition circulated by the VCP – calling it “an emotional pitch to a financial desire.” He said, “I cannot find a single Village in Westchester that has proposed lowering taxes this year.” He continued, “We deserve more than political grandstanding in this time of crisis. I support the budget and thank you for all the work that you do.”

Jeremy Gans thanked everyone for their hard work and sensitivity during the crisis. He said, “This weekend Bob Berg said to me, “You and your rich friends do not think it is worth looking for savings in this year’s budget.” Ganz continued. “Nothing could be further from the truth. Our trustees have looked at every line and done everything they can to lower our taxes. People move here because Scarsdale is an incredible place to live. The community is safe, we have good schools. Taxes are used to pay our first responders and to fund our schools. I am not in favor of higher taxes. Especially now it is vital to look at all expenditures. The budget provides for expenses that the next year is likely to bring.”

VCP candidates and their supporters called in to object to the budget:

Bob Berg spoke about cutting costs without cutting services. He criticized the board for spending $200,000 on lawyers and consultants for the Freightway Garage. He complained that he did not hear back from the Village Board on his party’s working paper. He said, “You can cut our taxes for a change – this is the time to do that.” Berg said that a verbatim transcript for each Board meeting was required by law and asked when they would be provided. He objected to the Mayor’s April 23 letter that included “a political diatribe against me and my fellow candidates for Village Trustee … is it necessary for the Mayor to use Village resources to send out these messages?

Berg’s daughter Zoe said, “I am the daughter of Bob Berg who is running for trustee. I am a proud graduate of Scarsdale High School and Barnard College. I am here to express my independent views of the budget process. This administration has been unresponsive to questions about where our tax dollars are going. What we are seeing in Scarsdale is not democracy. The local level is where hope starts. Actions speak louder than words. I hope we can work together for a better Scarsdale in the future.”

VCP candidate Sean Cohen said, “I think there are a lot of passions running around. If ever there was a time to put aside petty partisanship the time is now.”

VCP candidate for Village Trustee Robert Selvaggio said, “13% of New Yorkers are currently unemployed. My friends have been furloughed, laid off and I have taken a pay cut. My wife is unable to see patients. This is not the time to be raising taxes.”

Yingyong Chen demanded the elimination of all non-essential spending. He said, “We do not authorize the Village to stash money away for spending... Overloading this year’s budget with unnecessary expenses is irresponsible. Overburdening residents with unnecessary expenses at this time is unwise.”

Jerome Wong from 94 Brown Road, said these are “unprecedented times.” He said, “it can’t be business as usual. Financial control sends a good sign. Why should (the budget) go up? Given the suffering at least keep it flat given this environment.”

Mayra Kirkendall Rodriguez from Fox Meadow Road spoke at length quoting comments from a petition launched by the Voters Choice Party on April 19, 2020 that now has 455 signatures. She said, “I urge you to lower taxes in the worst economic crisis since the great depression.”

Update from the Village:

In comments from Village Manager Steve Pappalardo, he noted that two cars were stolen from resident’s driveways this week and reminded people to lock their cars and refrain from leaving the keys inside.

He reported that four village trees had been illegally cut down from the village right of way on a property in Greenacres this week and said the matter will be brought to Village Court on June 17 if it is in session.

Pappalardo said that Governor Cuomo has issued a new order allowing annual tax grievance day to be held virtually at the designated date(s) in June.

He reported that residents were for the most part complying with social distancing rules, with the exception of a wedding that was held outside last week at a resident’s home. He said summons’ were given to the homeowner.

Last Mayor Marc Samwick said that Bicycle Sundays on the Bronx River Parkway would begin, this Sunday, May 3.

In other business, the Village Board approved the following:

A change to Village code to move the deadline for senior citizens to file a renewal of their STAR exemption from May 1 to June 16 to file. Village Assessor Victoria Sirota explained that their office has reached out to those who previously filed for a STAR exemption to let them know the process for renewing this year. Those filing for the first time will still need to apply by May 1.

A software agreement with Software Consulting Associates for an upgrade to the PAS property record management system for three years for a fee of $34,000 and an annual maintenance fee of $10,000.

The purchase of new uniforms for police to replace those that were contaminated during the COVID crisis at a cost of $24,690.

An expenditure of $138,596 for engineering services including a sanitary sewer evaluation study and cleaning and inspection of sewer lines in Drake-Edgewood to alleviate wastewater back ups in homes along Barry and Madison Roads.

Funds not to exceed $30,000 for the cleaning of 1,600 catch basins in the Village for flood and pollution mitigation.

An extension of the construction management agreement for the library renovation of $140,100 to provide construction oversight through August 2020.

At a meeting of the Town of Scarsdale, following the Village Board meeting the Board approved the temporary reduction of penalties for the late payment of county taxes up to July 15 provided that the town apply the Westchester County Executives’ criteria for the determination of hardship due to COVID -19.