Proposed 2020-21 Scarsdale School Budget to Go Up Just 1%

- Tuesday, 21 April 2020 14:12

- Last Updated: Tuesday, 21 April 2020 15:27

- Published: Tuesday, 21 April 2020 14:12

- Joanne Wallenstein

- Hits: 2511

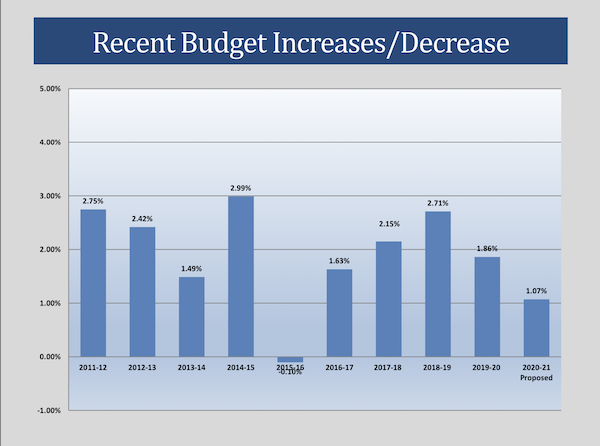

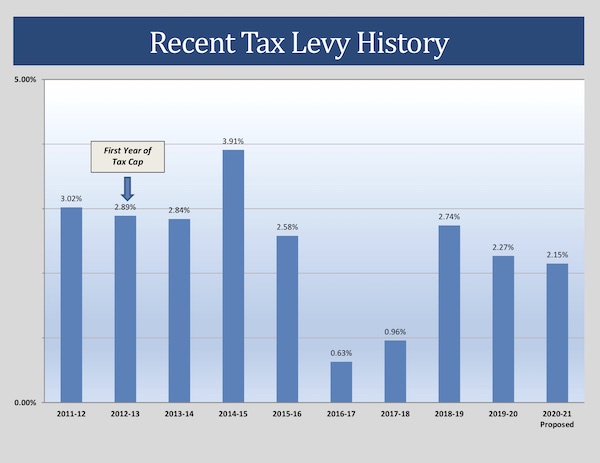

The school administration presented new numbers for the proposed 2020-21 school budget, reducing the proposed budget to budget increase to just 1.07% and the proposed tax levy increase to 2.15%. This is the second lowest increase in the past 10 years and on a par with peer districts in the Westchester-Putnam School Boards Association.

The school administration presented new numbers for the proposed 2020-21 school budget, reducing the proposed budget to budget increase to just 1.07% and the proposed tax levy increase to 2.15%. This is the second lowest increase in the past 10 years and on a par with peer districts in the Westchester-Putnam School Boards Association.

Assistant Superintendent Mattey presented new estimates of expenses and revenues since school has now been closed for many weeks and economic conditions have changed. The district has realized some savings since the schools are closed, but at the same time anticipates that revenues from state aid, sales tax and interest will decrease.

Here are the latest assumptions for the end of year balance for the 2019-20 School Budget:

State Aid: For this year, the state had committed $800,000 in aid to Scarsdale. Assuming no changes are made, Mattey projected a $156,000 surplus in state aid for 2019-20.

Interest earnings are expected to drop by $395,000 due to the economy.

Sales tax was expected to rise dramatically, but has now been decreased to a surplus of $412,000.

Assigned fund balance is currently anticipated to decline by $1.1 million

Use of reserves is expected to be a deficit of $221,000 which will no longer be used for cooling projects.

The total proposed revenue deficit for 19-20 is $1,148,000.

The picture for expenses for this year has also changed.

Mattey anticipates a $1.4 million surplus in the health insurance account because the district received a $400,000 rebate from the prescription benefit plan, claims have decreased and stop loss insurance collections are reduced by $500,000.

A spending freeze for non-essential expenses will yield a surplus of $920,000.

Salary savings resulting from the school closing will yield savings of $820,000.

Due to a decrease in price and use, the district will save $500,000 for oil and gas.

Special education costs will rise as a result of an increase in the number of students requiring special education services at a cost of $1,074,000.

Other savings from security, bus fuel, safety monitors will be $825,0000.

The total surplus from expenditures is anticipated to be $3,390,000.

Putting all this together, Mattey anticipates that the district will end the fiscal year on 6-30-20 with a fund balance of $24,483,216, which is $2.2 million higher than the fund balance at the end of the last school year.

Looking forward to 2020-21, Mattey examined what happened to state aid in times of large budget deficits from NYS and has recommended reducing anticipated state aid to Scarsdale by $920,488 for next year. He also believes sales tax revenue will continue to decline and reduced that by $181,000. He anticipates further savings in health insurance ($820,000) and an increase of $300,000 for special education, due to the rising number of students.

Adding all this up, Mattey presented the following proposed budget for 2020-21:

Total Draft Budget $162,508,332

Budget to Budget Increase 1.07%

Projected Increase in Tax Levy 2.15%

Projected Tax Increase:

Town of Scarsdale 1.99%

Town of Mamaroneck 2.81%

The state has ruled that the budget vote should be held no sooner than June 1. Therefore, the administration recommended that the board adopt the 20-21 budget at their meeting scheduled for May 11 with a possible budget hearing on May 19. Mattey questioned how the election could be run while respecting social distancing rules. Many of the people manning the polls are senior citizens so he wondered how this could be safely conducted.

Several of the school board members commented on the budget.

Chris Morin said, “I think our challenges are going to deepen for a while. The Governor is saying that our situation is only going to grow more dire. Next year’s TRS number will grow more difficult. As we look ahead, do we have any strategy for dealing with our budget constraints (such as mandates, civil service rules etc.)?

Scott Silberfein said, “I think the current proposed budget falls short for our taxpayers. I am not advocating for deeper cuts. But I would advocate for a greater use of our assigned fund balance. This is a year when it is probably necessary to give relief …. I don’t want to use too much as we could be in a worse position next year.”

Board President Pam Fuehrer said, “The 1.01% budget increase that is proposed now is among the lowest in our peer group. For these nine schools the average for the tax levy increase is 2.4%. Compared to our peers and West-Put school districts it is what we are seeing across the board.”

Stuart Mattey responded: “We considered further use of the fund balance – above the $1.1 million. The danger is, if we thought this would only go on for one year, we could use more assigned fund balance as a band aid. But if this downward turn continues, we would dig a hole that we would have to dig out of twice.”

Ron Schulhof said, “When you look at the budget to budget increase of just 1%, the administration has done a good job of finding places to cut expenses. If we try to reduce taxes with fund balance this year, we might be in a difficult place next year. We are already using $300,000 more. I think the community supports the core educational program and not making cuts to it. I would like to hear from the community.”

Carl Finger said, “A lot of work has been done and I would like to hear what other people have to say about it.”

The board invited public comments.

SHS PTA President Deb Morel read the following statement from the SHS PTA Executive Committee:

The Scarsdale High School PTA Executive Committee appreciates this opportunity to comment on the proposed 2020-2021 School Budget. We hope everyone here and in the Scarsdale community is well and coping with the new “normal” of social distancing. We also appreciate what a difficult time this is, and thank the members of the Board of Education and both the District and the High School Administrators, particularly Dr. Hagerman, Mr. Mattey, Mr. Martin and Mr. Bonamo, for their commitment to the education of our students and for their time, expertise, and responsiveness during the budget process.

The High School PTA Executive Committee stands by its previous statements of support for all of the High School administration’s requests, but we acknowledge and agree that some of those, including the staffing additions, the renovation of Art Room 215 and the Quiet Study Space in the library, while necessary, are more appropriate for future budget cycles.

We fully support the District’s recommendation at the March 30th Budget Session against personnel cuts in the 2020-21 school budget. We expressly do NOT support reductions to faculty or staff at the high school that would increase class sizes, decrease curriculum offerings or negatively affect the support our students get and need from resources like the Learning Resource Center, the Math and Writing Centers, the Counseling Department or the College & Career Center.

With respect to the high school auditorium project, we continue to support the full project as necessary for the safety and education of our students and all community members who use the space. Though we respect and accept the Board’s decision to trim next year’s budget in response to economic concerns related to COVID-19, we strongly urge the Board to transfer from Debt Service the approximately $730,000, originally part of the 2014 Bond and earmarked for the auditorium, to the project fund in the 2020-21 budget to accomplish--or at least start-- some of the most critical items on the auditorium project list in the coming year.

We remind the Board and the community that this budget is for the entire upcoming school year-- a year, I sincerely hope, that our children can enjoy with each other and their teachers using our school buildings and facilities to their full capacity and potential. We must develop and pass a budget that can support that learning and activity, and that upholds the excellence of Scarsdale schools.

Again, we appreciate your time and efforts on behalf of Scarsdale High School, our students, and the larger community, and your consideration of our comments this

evening.

Claudine Gecel of 10 Kent Road said, “This budget book is getting more appropriate to the environment we find ourselves in. As this might go on for more than one year, TRS depends on the rate of return that is assumed, if they lower their rate of return we will have to increase our contributions… At some point health expenses will catch up – people won’t postpone treatment indefinitely. Maybe we can put the $770,000 in a reserve fund for use later… Maybe we have to look at big ticket items and assess whether we really need them. We are spending a lot of money on security services, all over the place. It’s a large number. Do we want to look at that? $1 or $2 million per year. Even though there are state mandates, we don’t necessarily have to comply with all of them.”

Mayra Kirkendall Rodriguez from Fox Meadow Road provided extensive data about unemployment and the economic downturn and called for minimizing any increases, though she said, “I would love to see an expanding budget. I have long advocated for more foreign language and math in the elementary schools.”

Art Rublin from Donellan Road said, “You have done a great job at striking the right balance. We know how affluent this community is in a lot of respects. In the scheme of things $400 is something folks can bear. The more consensus you can have on this board the better. If there is some increase in the use of the fund balance that you can agree to - $100, 000 or $200,000 – I would be comfortable with that… If Bronxville is approving a budget with an increase of 2%, we should keep this in mind. There is a point of diminishing returns in terms of cutting the tax levy.”

Bob Harrison spoke at length. Here are excerpts from his comments: “I would like to see a 0% increase. There are some years in which the budget has not been passed. My favorite expression is “shared sacrifice.” In 2009 the superintendent and top five administrations agreed to freeze their salaries. I am asking the top people who are on this call to offer to freeze your salaries for the coming year. You have your jobs. Many people in our community are not going to have any paycheck.

This is the time to use the fund balance. Maybe we’ll have a vaccine in 18 months and this will turn around. Thomas “I love you” – what’s the projected increase in your salary for the coming year? You don’t have to worry about a paycheck coming in. So I ask you – shared sacrifice. I ask you to bring the increase down to no increase.”

Robert Berg said, “We are in a severe crisis of unmatched proportions. We have to have shared sacrifices. A lot of our residents have lost their jobs and lost their savings. We have to pass a budget with their votes and I think the budget you are proposing is too high. You have to come in with a 0% increase. It’s doable. You can do it thought attrition. Share their teaching responsibilities with existing staff – share their responsibilities with administrators who are not teachers. You should have a standstill arrangement and not have any increases. That will save money. It’s fair. That’s a shared sacrifice. Or pay the tax bill in two installments. That would be a great benefit to taxpayers. You can do it without interest if you get the approval from the county to do that. The point is your school taxes are enormous and a great hindrance to selling your house. The taxes are killing our property values.”

Mattey responded to some of the questions raised. About the high school auditorium he said, “We will not use the $730,000 for the auditorium next year because the phasing doesn’t work. The first phase would be over $1mm, so none of those dollars are included. It’s on hold right now though we may consider a bond in the future.” About the health reserve and TRS reserves, Mattey said, “between the two pension reserves, we are just about at $4 million.”

Responding to Bob Berg’s idea of splitting the school tax bill to allow two payments, Fuerher said that the Board had asked for more information about splitting tax payments.

Note from the Scarsdale Schools re: Kindergarten Registration

Parents Encouraged to Complete Online Kindergarten Registration As Soon As Possible

The Scarsdale School District continues to offer online Kindergarten registration. Current residents who expect to have a child attend Kindergarten during the 2020-2021 school year are encouraged to complete this process as soon as possible. Although prospective Kindergarteners may register at any time prior to the start of the school year, completing this process early ensures a smooth placement process. Children whose fifth birthday falls on or before December 31, 2020 may be registered for the 2020-2021 school year.

Please visit www.scarsdaleschools.org/registration for instructions on how to register online.

Enrollment in one of the five elementary schools (Edgewood, Fox Meadow, Greenacres, Heathcote, and Quaker Ridge) is determined by the neighborhood in which you reside. If you do not know which elementary school serves your neighborhood, please contact the District Registrar, Nunzia Mauro, via email at registrar@scarsdaleschools.org.