Recent Sales Data Shows That Ryan Model is Closer to Market Value than Tyler

- Category: On Our Radar

- Published: Thursday, 09 March 2017 12:35

- Joanne Wallenstein

I t appears that critics who excoriated Scarsdale Village Trustees and Village Managers about the results of a 2016 real estate tax revaluation may have protested too much. A group led by Mayra Kirkendall-Rodriguez called the Scarsdale Committee for Fair Assessments claimed that the 2016 revaluation shifted the tax burden from the larger estate-like properties to Scarsdale's more modest homes. They spent months building their case and ultimately filed a lawsuit – called an Article 78 – against the Village, asking them to void the "flawed" revaluation or pay reparations to petitioners.

t appears that critics who excoriated Scarsdale Village Trustees and Village Managers about the results of a 2016 real estate tax revaluation may have protested too much. A group led by Mayra Kirkendall-Rodriguez called the Scarsdale Committee for Fair Assessments claimed that the 2016 revaluation shifted the tax burden from the larger estate-like properties to Scarsdale's more modest homes. They spent months building their case and ultimately filed a lawsuit – called an Article 78 – against the Village, asking them to void the "flawed" revaluation or pay reparations to petitioners.

However an analysis of recent sales data from the Village shows that this second revaluation – called the "Ryan" revaluation for the man who built the model, yielded assessments that are actually closer to market value than the previous model built by Tyler Technologies for the 2014 and 2015 tax rolls. This report confirms an analysis posted on Scarsdale10583 in October that showed that assessments were in line with 2016 sale prices.

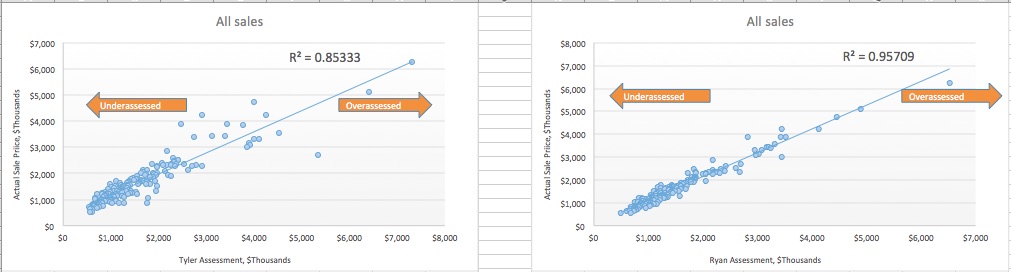

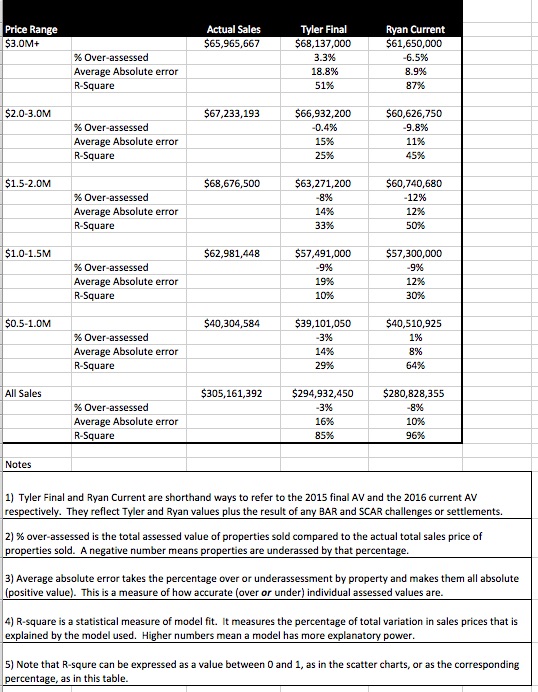

Brian Nottage, a Scarsdale resident who holds a PhD in economics and works in commercial real estate asset management analyzed 185 sales* from January 1, 2016 to February 21, 2017 and found that both models under-assessed the value of Scarsdale homes but overall, the Ryan numbers were closer to market value than the Tyler values.

Using data from the Assessor's office during the period, Nottage compared sales prices to 2015 and 2016 assessed values. After analyzing the data, Nottage said, "Bottom line, both the Tyler and Ryan rolls have underassessment for the Village overall and that rises by price tier. However whether looking at average error, average absolute error or R-square, Ryan is considerably more accurate at each price tier."

The data shows that overall Ryan's R-Square value or correlation co-efficient is 96% as compared to the Tyler model that yields an 85% value. The analysis also shows that homes valued at between $500,000 to $1,000,000 were assessed at closest to market value, disproving the notion that owners of more modestly priced homes were over-assessed to make up for decreases for the wealthiest homeowners.

It is true that Ryan's reval under-assessed homes priced at $2 million and above but homes in other price ranges were also equally under-assessed. See the summary chart here and view the entire analysis here.

The petitioners also claimed that the NYS equalization rate applied to the 2016 revaluation proved how far off it was from actual market value. However, if Scarsdale had instead stuck with the Tyler assessments, the state would have also had to apply an equalization rate to Scarsdale.

We asked Scarsdale Assessor Nanette Albanese to explain and she said, "Market conditions after the 2014 revaluation were showing that those assessments were not reflective of subsequent sales (that will always be the case and is another reason that assessments need to continually be updated using a new sales base.) As such, we expected that the 'overall' appreciating market conditions (not for the high-end, however) would cause a calculated 2016 equalization rate below 100%. This was one of the various factors that was considered when making the decision to perform revaluation in 2016."

*Note: 87 sales were excluded as they were properties with "condition codes" that might make them non-arms length, vacant land or commercial properties or ones that had been renovated post-Tyler.