Proposed Redistricting Maps Could Pit Jamaal Bowman Against Mondaire Jones for the 16th Congressional District

- Details

- Written by Joanne Wallenstein

- Hits: 4197

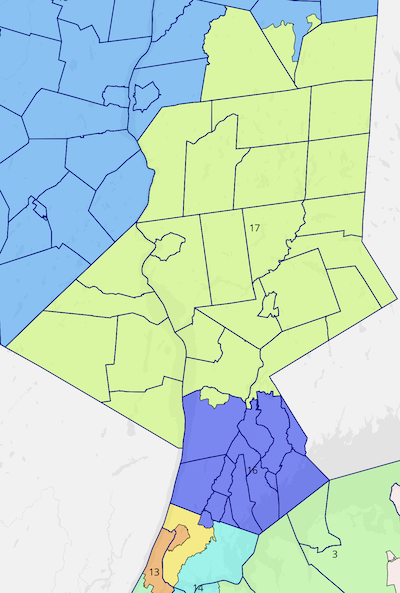

The proposed map of the 16th district keeps Scarsdale in one district with other southern Westchester towns, but includes portions of the districts now represented by Jamaal Bowman and Mondaire JonesThe redistricting battle in NYS goes on. After proposed maps approved by the state legislature were declared unconstitutional, newly redrawn maps of New York’s Congressional and State Senate districts were released on Monday May 16, 2022. The maps were drawn by Jonathan Cervas, the special master appointed by the court and are subject to the approval of New York State Supreme Court Judge Patrick F. McAllister, who has set a deadline of this Friday 5/20 to approve final lines. Between now and Wednesday, members of the public can submit comments on these maps to the Court via email to bwise@nycourts.gov.

The proposed map of the 16th district keeps Scarsdale in one district with other southern Westchester towns, but includes portions of the districts now represented by Jamaal Bowman and Mondaire JonesThe redistricting battle in NYS goes on. After proposed maps approved by the state legislature were declared unconstitutional, newly redrawn maps of New York’s Congressional and State Senate districts were released on Monday May 16, 2022. The maps were drawn by Jonathan Cervas, the special master appointed by the court and are subject to the approval of New York State Supreme Court Judge Patrick F. McAllister, who has set a deadline of this Friday 5/20 to approve final lines. Between now and Wednesday, members of the public can submit comments on these maps to the Court via email to bwise@nycourts.gov.

The new maps, if approved, would set the stage for Republicans to win seats in the upcoming mid-term elections at a critical time. According to Politico, “The newly redrawn New York congressional map didn’t just erase the political advantage the party hoped to gain through gerrymandering before state courts stepped in to stop them. It also set New York’s Democratic incumbents against each other in a zero-sum game of survival — which will soon see some of them brawling in primaries and left others pleading with the court-appointed map-drawer to change course.”

If approved, the new maps could pit Mondaire Jones against Jamaal Bowman for the 16th district, because Representative Sean Patrick Maloney has already announced he will run for the 17th, now held by Jones. In New York City, two longtime Congressman, Jerry Nadler and Carolyn Maloney, will run against each other in the primary for the 12th district after the new maps put them both there.

In this latest draft of the Congressional lines, Scarsdale would be entirely in District 16. The newly drawn district would contain the residences of two incumbents, Jamaal Bowman and Mondaire Jones. What this means is that they could opt to run in District 16 . Under the law congresspeople can run in any district in a state - they are not tied to run only in the district that has their residence, or alternatively they could choose to run in a different - most likely a neighboring - district.

On Tuesday May 17, Bowman vowed to continue to run for District 16 though it no longer includes much of the area of the Bronx formerly in his district, which would now be divided among three districts. He tweeted, “Now, I only have one message for NY-16: I will continue fighting for you, and I will fight to continue to represent you. Jamaal Bowman now represents Scarsdale in Congress

Jamaal Bowman now represents Scarsdale in Congress

He sent the following email to his constituents on May 17. “Yesterday a court filing unveiled the newly redrawn congressional districts in New York City. The new maps, which were drawn by court-appointed Special Master Jonathan Cervas but are not yet final, change the 16th Congressional District to remove much of the Bronx, decreasing the Black voter population by about 17%.

The whole point of redistricting is to create congressional districts that keep communities of interest together. Unfortunately, the map created by the special master splits NY-16’s historically low-income Bronx communities into three congressional districts and decreases the Black voter population by 17%. This occurred despite an outpouring of testimony urging redistricting officials to protect the Black vote by keeping the northeast Bronx with lower Westchester together. The proposal shows that Co-Op City is mapped into NY-14, Williamsbridge and Baychester into NY-15 and Edenwald kept in NY-16. The map data shows that this directly resulted in the Black voter population declining by 17%. Co-Op City, Williamsbrige, and Edenwald are strong communities of interest that must remain together as a unity and connected to lower Westchester. The Black voting power in NY-16 cannot be diluted in favor of more compact but less fair maps.”

For the State Senate lines, the draft map would place Scarsdale in Shelley Mayer's district.

The final word on the maps is due on Friday May 20, 2022.

Representative Mondaire Jones currently represents the 17th district and lives in White Plains. Portions of his district would be moved to the 16th district in the redrawn map.

Representative Mondaire Jones currently represents the 17th district and lives in White Plains. Portions of his district would be moved to the 16th district in the redrawn map.

Scarsdale School District Releases Documentation on IRS Tax Issue

- Details

- Written by Joanne Wallenstein

- Hits: 2979

Reversing years of secrecy, on May 10, 2022, in response to a FOIL request, the Scarsdale Board of Education released a trove of documents related to the district’s tax problems. The documents, which are letters to and from the IRS to the district, outline a series of payroll tax errors during 2020 and 2021 that resulted in penalties, fines and a $1.3 million lien against the district. Scarsdale School Superintendent Thomas Hagerman’s failure to divulge the problems ultimately led to his early resignation from his job on Friday May 6, 2022.

Reversing years of secrecy, on May 10, 2022, in response to a FOIL request, the Scarsdale Board of Education released a trove of documents related to the district’s tax problems. The documents, which are letters to and from the IRS to the district, outline a series of payroll tax errors during 2020 and 2021 that resulted in penalties, fines and a $1.3 million lien against the district. Scarsdale School Superintendent Thomas Hagerman’s failure to divulge the problems ultimately led to his early resignation from his job on Friday May 6, 2022.

In addition to shedding light on the clerical and timing errors that caused the trouble, the documents provide a record of the IRS failing to notice and notify the district of their errors. The agency was hampered during COVID and delayed their processing. This may be the reason that the school district was not notified until January 11, 2021 about a penalty of $174,798.60 for a failure to deposit the proper amount in the first quarter of 2020. It took until April 26, 2021 for the IRS to notify the district of an additional penalty of $539,370 for the “total failure to make a proper federal tax deposit in the first quarter of 2020, bring the total penalty with interest to $715,683.71.”

In addition, the IRS applied payments for subsequent quarters to cover penalties and interest for previous quarters, rather than the quarters for which they were intended.

This series of errors resulted in a cascading series of increasing penalties and interest, and a $1.3mm lien on the district, despite the fact that once the district was aware of the issues, they made all required tax payments in full.

The FOILED documents include an affidavit from Scarsdale School District Treasurer Jeff Martin attesting to the fact that the district has “at all times, acted in good faith and its inadvertent clerical error were not due to willful neglect or intentional disregard.” Furthermore, “the taxpayer (Scarsdale Schools) made numerous attempts to contact the IRS to resolve these issues as soon as they were notified,” and “complied with IRS instructions, including providing a reconciliation of the clerical errors, in order to resolve this issue and avoid a Federal Tax Lien, but to no avail.”

The district is applying for an “abatement for reasonable cause" because:

-all required deposits have been made and taxes have been paid by the taxpayer

-all the errors were inadvertent clerical error

-the district has instituted a corrective action plan and new procedures

-the district made good faith attempts to contact the IRS to resolve the issues

-had the third and fourth quarter 2020 taxes been applied to the proper payment for the proper quarter as intended, the district would have incurred only the first quarter 2020 penalty related to the $900,00 shortfall.

See all the documents relating to the tax issue on the Board of Education page of the Scarsdale Schools website under the tab IRS Matter.

Reports about the backlog in tax processing at the IRS have appeared in the Washington Post, Politico and the New York Times. The agency has lost 20,000 employees since 2010. The New York Times reported, “As of late December, the I.R.S. had yet to finish processing six million original tax returns, 2.3 million amended returns, more than two million employer quarterly returns and five million pieces of taxpayer correspondence — with some submissions dating to April and with many taxpayers still waiting for refunds, according to the advocate’s report.”

An article in Politico says that in January 2022, 200 Senate and House members wrote a letter to the IRS Commissioner Chuck Rettig asking the agency to excuse penalties, delay collections and put fewer limits on taxpayer’s ability to claim reasonable cause for relief due to the pileup at the agency and their inability to sort and answer all the mail.

According to the Politico article, “The unprocessed forms have in many cases led to automatic penalty notices, liens and more.”

With issues still unresolved at the Scarsdale Schools, the IRS continues to automatically issue penalty notifications despite the fact that all taxes have been paid.

Board Considers Contract with Internal Auditors to Analyze Payroll Withholding Process

- Details

- Written by Joanne Wallenstein

- Hits: 2297

In their effort to unpack the process that resulted in the Scarsdale School District’s trouble with the IRS, the Board of Education met with accountants Don Hoffmann and Richard Coffey from Cullen & Danowski, LLP to review their proposed agreement to conduct an audit of the district’s recording and payment of payroll withholdings.

In their effort to unpack the process that resulted in the Scarsdale School District’s trouble with the IRS, the Board of Education met with accountants Don Hoffmann and Richard Coffey from Cullen & Danowski, LLP to review their proposed agreement to conduct an audit of the district’s recording and payment of payroll withholdings.

The firm submitted a proposal to do the audit for the period January 1, 2020 to April 30, 2022, and the proposal can be viewed on the district website here:

The auditors will take a look at the district’s internal process and controls for payroll tax processing by interviewing district staff to determine how things are usually done and then test this process for all payrolls processed since January 2020. They will audit the aggregate amounts withheld and remitted to third parties by looking at the recorded amounts in the general ledger and the amounts paid per bank statements. Some of the third parties who receive the withheld funds are retirement funds, health insurers, social security as well as the state and federal revenue services. According to the accountants, the errors made in Scarsdale were identified in a bank reconciliation.

As part of the audit the firm will document the existing process and “identify opportunities for improvement,” and will “discuss findings with the District administration and develop recommendations to further improve the procedures related to the recording and payment of payroll withholdings.”

The proposed fee ranged from $7,000 to $12,000 and they would begin the work in May with the goal of completing it by June 30, 2022.

In a discussion with the board, the auditors explained that there are about a dozen internal areas to audit, and they usually pick one per year. The last time an audit of payroll processing was done was 2014.

Board member Jessica Resnick-Ault asked if the audit would include a review of remittances to the IRS and she was told this was not included. The board subsequently decided they would like to add a review of IRS remittances to the audit and also require the firm to provide check-ins during the two month process. Board member Ron Schulhof asked the firm to provide a copy of a similar report they have done for another district and they agreed to do so.

At the end of the discussion, the Board said they would discuss the agreement and decide no later than their next meeting on May 9 if they would move ahead. Board Vice President Amber Yusuf said this would allow time for the board to consider anything else they want to add to the agreement and to also receive comment from the community.

Discussing the matter during public comments, Mayra Kirkendall-Rodriguez said, “It’s been one month since the board said they found out about the payroll problem. Not one of my questions has been answered. It has taken three weeks to hire an investigator and also three weeks to hire your own internal auditors to review this. They are not independent because they have already worked with the administration.”

“What are the payables and receivables and where are the documents to support the hope that the money will come back? Where are the records from your auditors? How will the penalties affect how this district can educate our kids? You are asking us to accept this school budget on faith. Frankly there is less mystery in the holy trinity than there is in this district. It is very troubling that Brock’s contract (the investigator) is so redacted that we have to guess what it is about. I will continue to ask – who, what, why and where.”

Bob Berg attempted to speak remotely from an airport in Doha, Qatar. Before he was cut off he said, “I want to argue against hiring Cullen and Danowski to do the audit since they missed the boat during the relevant period. Why would you hire the firm to do an investigation since they were responsible for looking out……”

Anthony J. BrockBoard President Karen Ceske also announced that a new section titled “IRS Matter” has been added to the home page of the district website. You can see it here.

Anthony J. BrockBoard President Karen Ceske also announced that a new section titled “IRS Matter” has been added to the home page of the district website. You can see it here.

Posted in this new section is the agreement with attorney Anthony J. Brock to conduct an investigation of the IRS filings and tax lien and to determine “why the Board of Education was not informed of this information until March 2022.”

A second item on the contract for the investigation was redacted from the posted copy of the agreement.

All services will be billed at the hourly rate of $205 per hour.

School Board Issues Request for Proposal for Firm to Conduct Search for New Superintendent

- Details

- Written by Joanne Wallenstein

- Hits: 3185

Superintendent Thomas Hagerman announed his resignation in January, the School Board named Andrew Patrick as Interim Superintendent and now the search for the next superintendent of the Scarsdale School’s is officially on. Last week, the Scarsdale Board of Education posted a request for proposals (RFP) for a firm to conduct the search, with the goal of hiring a new superintendent effective July 2023. The district has created a new link for the Superintendent Search on the Board of Education website where you can find the RFP.

Superintendent Thomas Hagerman announed his resignation in January, the School Board named Andrew Patrick as Interim Superintendent and now the search for the next superintendent of the Scarsdale School’s is officially on. Last week, the Scarsdale Board of Education posted a request for proposals (RFP) for a firm to conduct the search, with the goal of hiring a new superintendent effective July 2023. The district has created a new link for the Superintendent Search on the Board of Education website where you can find the RFP.

Under the terms of the contract, the firm will conduct the search but will also:

-Act as advisors to the Board to “Develop a search plan and timeline in consultation with the Board; support the Board throughout the interview and selection process, including the structure and role of potential advisory committees; ensure compliance with applicable legal requirements; and develop and implement a plan for a national search.”

-Conduct community engagement: “Work collaboratively with the Board to create a plan for extensive engagement with Board members, faculty, staff, parents, students, other school community members and groups, as well as members and groups from the broader community as appropriate.”

-Define qualifications and criteria for applicants.

-Identity, screen and propose candidates and assist with scheduling interviews and evaluations.

-Assist the board with contract negotiations for the selected candidate.

Firms are asked to submit their proposals with fee estimates by May 20, 2022 and the board will make their selection by June 15, 2022.

The past few weeks have been very busy for Scarsdale School Board members. After the revelation about troubles with IRS and a tax lien on March 25, the board has been working on an investigation of what happened and considering an audit of accounting processes. At the same time, they were involved in succession planning for the top job in the administration and this is the first step in identifying the district's next permanent superintendent.

SBNC Slate to Run Unopposed for Scarsdale School Board

- Details

- Written by Joanne Wallenstein

- Hits: 3100

The wait is over. Monday April 18 was the deadline for candidates for Scarsdale School Board to file their petitions to run in the election on May 17, 2022. This year there are three available seats on the board – and the Scarsdale School Board Nominating Committee has nominated three candidates to fill those seats.

The wait is over. Monday April 18 was the deadline for candidates for Scarsdale School Board to file their petitions to run in the election on May 17, 2022. This year there are three available seats on the board – and the Scarsdale School Board Nominating Committee has nominated three candidates to fill those seats.

Since no additional candidates filed petitions by the deadline, these three will run unopposed.

The candidates are Ron Schulhof, who is running for a second three year term along with Colleen Brown and Suzie Hahn Pascutti, who are running for their first terms. All three live in Quaker Ridge. Find information about the candidates here:

The election will also give voters the opportunity to vote on the proposed 2022-23 school budget.

The election will take place on Tuesday May 17, 2022 at the Scarsdale Middle School from 7 am to 9 pm. Find voter information here: