How Scarsdale School Taxes Stack Up to Other Westchester Districts and Why

- Sunday, 05 May 2019 09:40

- Last Updated: Sunday, 05 May 2019 09:52

- Published: Sunday, 05 May 2019 09:40

- Joanne Wallenstein

- Hits: 14016

With many in Scarsdale impacted by the loss of our deduction for state and local taxes, and a vote coming this month on the proposed 2019-20 school budget, real estate taxes are top of mind. If you do not frequent Board of Education meetings, you might wonder why Scarsdale’s school taxes, which represent about 62% of your real estate taxes, seem so high – and how Scarsdale stacks up to other communities in Westchester.

With many in Scarsdale impacted by the loss of our deduction for state and local taxes, and a vote coming this month on the proposed 2019-20 school budget, real estate taxes are top of mind. If you do not frequent Board of Education meetings, you might wonder why Scarsdale’s school taxes, which represent about 62% of your real estate taxes, seem so high – and how Scarsdale stacks up to other communities in Westchester.

Greenacres resident Michael Levine recently performed an analysis in order to answer some of these questions and has drawn some interesting conclusions.

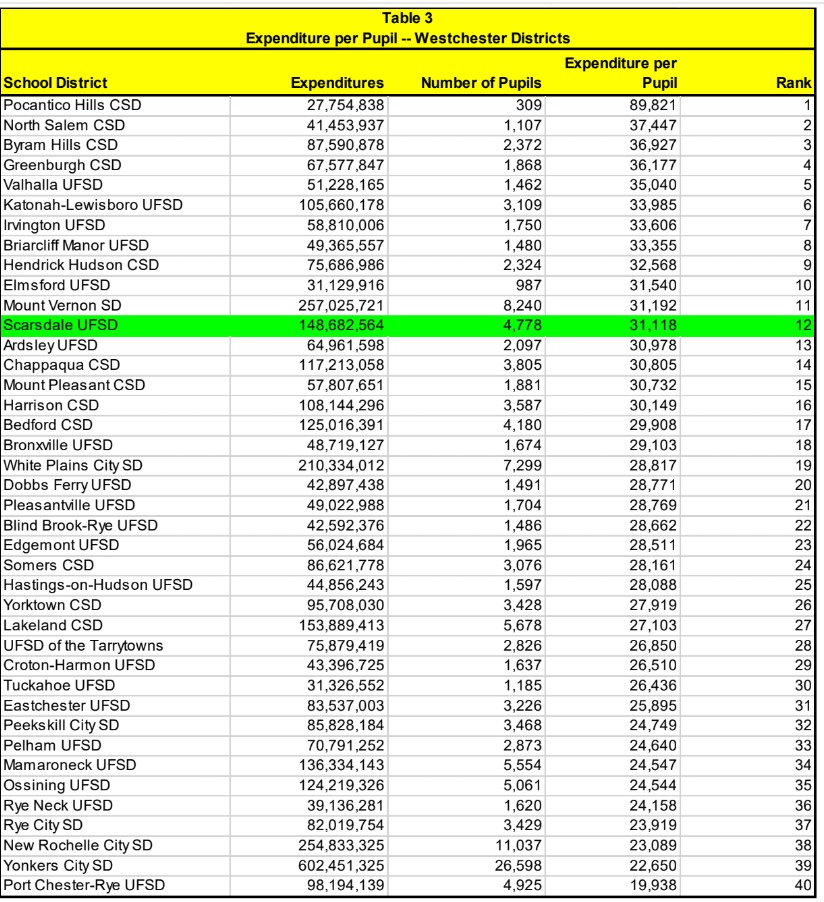

His analysis shows that although our school taxes are the highest in Westchester, our spending per pupil ($31,118) ranks only 12th out of the 40 school districts in the country. Byram Hills, Irvington and Briarcliff Manor are among the districts that spend more per pupil. Scarsdale’s spending per pupil “is higher than the middle, but not extremely high” and is consistent with the goal of “fund[ing] an excellent public school district, and one of the best in the country, the state and the county.”

Instead, Mr. Levine identifies two “unsurprising” factors that primarily explain our high taxes and that are not “management issues.” The first key contributing factor is that Scarsdale is an affluent community and “therefore receives less state and federal support than other districts and must pay a higher percentage of expenses using School Taxes.” In fact, Scarsdale ranks 1st out of 40 in the percentage of expenditures funded by school taxes (91.8%) and 40th out of 40 in the percentage funded by state and federal support.  The second key contributing factor is that Scarsdale is desirable. The district’s fine reputation leads young families to move here and enroll children in the school system. As a result, Scarsdale also ranks 1st out of 40 when measuring pupil population as a percentage of the total district population (26.0%). “If two districts have the same total population but one has more children enrolled in the schools, the one with the more pupils will have more expenses.”

The second key contributing factor is that Scarsdale is desirable. The district’s fine reputation leads young families to move here and enroll children in the school system. As a result, Scarsdale also ranks 1st out of 40 when measuring pupil population as a percentage of the total district population (26.0%). “If two districts have the same total population but one has more children enrolled in the schools, the one with the more pupils will have more expenses.”

Mr. Levine’s analysis provides tables that show, for each district in Westchester, the school tax per capita, the school tax as a percent of expenditures, the spending per pupil and the pupil population as a percentage of total population. It also includes an appendix that explains why he used the school tax per capita as the metric for comparing the relative levels of school taxes and discusses some possible alternative metrics.

He concludes by saying, “So, yes, the perception that Scarsdale’s School Taxes are notably high is a valid perception. Since School Taxes are a dominant percentage of total taxes, it follows that total taxes are also notably high…. [T]he predominant reasons for the high taxes are not surprising and not under the control of the school leadership – we have chosen to live in an affluent community, and to raise families and send our children to school here…. It does not make sense to fault anyone for causing this situation. But I suppose if I did want to view this as some sort of problem and I was looking for someone to blame, I would have to paraphrase Pogo: ‘We have met the enemy and they are us.’”

See the full report here: