Scarsdale Bowl Committee Seeks Nominations

- Details

- Written by: Joanne Wallenstein

- Hits: 3967

The Scarsdale Bowl Committee invites the community to nominate Scarsdale residents who would be worthy candidates for consideration as the honoree for the 2015 Scarsdale Bowl.

The Scarsdale Bowl Committee invites the community to nominate Scarsdale residents who would be worthy candidates for consideration as the honoree for the 2015 Scarsdale Bowl.

Nominations may be submitted to the Committee electronically on a confidential basis using the on-line form accessible on the Scarsdale Foundation website or by e-mailing the Committee at [email protected].

Heathcote in the Lead in Players Cup Challenge

- Details

- Written by: Joanne Wallenstein

- Hits: 4019

The Scarsdale Players Cup sponsored by Scarsdale Parks, Recreation and Conservation Department is well underway and with the fall recreation youth programs coming to a close in November, the race to 1st place is a close one!

The Scarsdale Players Cup sponsored by Scarsdale Parks, Recreation and Conservation Department is well underway and with the fall recreation youth programs coming to a close in November, the race to 1st place is a close one!

The Players Cup was created to build neighborhood pride and encourage participation in youth recreation programs with a focus on health and wellness. Youth participants in grades Kindergarten thru 5th are being highly rewarded by participating in recreation youth programs each week and earning points for their neighborhood school. As of October 28th, Player Cup programs included the recreation soccer league, kick start soccer program, youth football league, flag football program and the Halloween window painting.

If you haven't registered for any of the current Scarsdale Cup programs don't forget to register for the upcoming winter and spring programs such as the winter youth basketball league, spring youth tennis league, and the youth softball league. Points for the Players Cup are awarded by registration, participation, and bonus points for those that may come in first, second, or third place in standings. It could be anyone's race in claiming the trophy for your neighborhood school.

We hope that all children in grades K-5th participate and more importantly have fun!

Current Standings as of 10/28/14

1st Place – Heathcote (572 Points)

2nd Place – Fox Meadow (561 Points)

3rd Place – Edgewood (551 Points)

4th Place – Greenacres (540 Points)

5th Place – Quaker Ridge (515 Points)

Weekly standings can be found on the Recreation Department main page of the Scarsdale recreation website.

Jews Without Dues: Is It Possible?

- Details

- Written by: Stacie M. Waldman

- Hits: 13835

Nationally, only about 30% of people who describe themselves as Jewish are members of a synagogue. Concerned about this trend Jewish leaders at the Union for Reform Judaism and the United Jewish Appeal have studied the issue and found that declines in membership can be attributed to more factors than just money, though certainly membership fees are a contributing factor.

Nationally, only about 30% of people who describe themselves as Jewish are members of a synagogue. Concerned about this trend Jewish leaders at the Union for Reform Judaism and the United Jewish Appeal have studied the issue and found that declines in membership can be attributed to more factors than just money, though certainly membership fees are a contributing factor.

What's behind the decline: Some Jews say they don't feel engaged by at a synagogue or find this sense of belonging in other venues. Time pressure is another reason cited by Jews for their failure to affiliate with a temple. Parents say that homework and children's tightly scheduled activities leave little time for religious practice. Furthermore, 50% of Jews intermarry, reducing Jews commitment to support their local synagogues.

Declines in synagogue membership may also be caused by demographics. Jewish singles tend not to belong to a temple and prefer to attend their parents' synagogues rather than join on their own. One Jewish woman I spoke with said, "I don't get it. Synagogues are willing to lose Jews for the years between the time they leave for college and the time they have a third grader who needs to start studying for her Bat Mitzvah. Not only are temples losing out on more potential members and a larger Jewish community, they are losing out on 20-25 years of donations even if it's not for the full amount of membership." Some empty nesters drop their memberships after their kids celebrate their Bar/Bat Mitzvahs because they no longer feel engaged and they are, "... sick of paying high membership dues and ultimately paying for other people who can't afford it," said a Greenacres mom.

Gary Katz, former Executive Director of Scarsdale Synagogue Tremont Temple Emmanuel blames the introduction of Chabad in Scarsdale as another cause of the decrease in synagogue membership here and elsewhere. Chabad recruits on college campuses, securing the commitment of students who enjoy participating but don't have the means to pay. Chabad does not require any initial investment.

Clearly membership fees are an issue. Membership at most local synagogues in this area involves annual dues, typically ranging from $3,000 to $3,500 well above the national average. Some have "building funds" of $3,000 to $7,500, charged to new members as a one-time payment, payable over several years though there may be a "discount" if it is paid up front.

Religious school costs are additional and are usually more during the years that kids are studying for their Bar/Bat Mitzvahs in third through seventh grades when they spend more time studying in class. Bar/Bat Mitzvah charges are additional and include private tutoring. Unique in its approach, Commack's Temple Beth David in Long Island charges nothing for seventh graders for religious school.

In our area there are some lower cost options: In June 2014, Greenburgh Hebrew Center, a Conservative congregation in Dobbs Ferry, began offering new members an introductory rate of just $180 per adult per year for two years. "Dues may increase thereafter," said Judy Calder, Vice President of Membership Activities, "but the manner or degree of increase is still uncertain as we're currently reviewing our overall dues structure."

Westchester Jewish Center (WJC) in Mamaroneck charges less for membership dues than most other synagogues in the area, so it may be more affordable to people looking for a conservative congregation. According to WJC's administrative assistant, they do require that all members purchase their High Holiday tickets. Seating is tiered, and members can spend as little as $134 per ticket to watch services in a room on a big screen (which, of note, sold out during the summer,) or as much as $457 per ticket for seats towards the front of the sanctuary.

Pay-per-seat arrangement are offerend at some synagogues but some people such as Rabbi Dan Judson with the Union for Reform Judaism (URJ) feel this is not aligned with Jewish values.

Christian institutions use a different model to finance operations. Most churches collect money at services or ask for voluntary donations via email. One Scarsdale woman who is in an interfaith marriage said, "Trying to convince my husband to spend $3,000-$5,000 a year just to join a Jewish congregation is hard when he's used to a voluntary donation at church of maybe a thousand dollars a year." Another woman who has been very involved with her synagogue for years cautioned that comparing churches and synagogues is not comparing apples to apples. "The Catholic church distributes money to local churches," she said, "so they are not dependent on the congregation like synagogues are. Also, churches do not need security. Synagogues hire security because they are at risk of attack." The argument that the "cost of being Jewish" is too high and that cost is a barrier to membership is one that synagogues hear regularly.

Synagogues are finding that they need to develop creative ways to engage (and retain) current members and to market to potential new members. Free Sunday school for the first year and open tot Shabbats are just some of the incentives offered by synagogues. Gary Katz said, "We work with potential members to find something that will work for them. We have a non-member rate for religious school prior to third grade, for example." Jessica Lorden, Vice President at Kol Ami, insisted that they do not turn anyone away who cannot pay: as did five other synagogues that provided information for this article. Some synagogues take a member's word that they can't pay full dues while others require tax returns as proof. Still others offer gratis membership or reduced dues if children are attending the synagogue's preschool. "That's great," said one mom, "but Jewish preschool in Scarsdale is $1,000-$2,000 more a year than non-Jewish preschool in Scarsdale. So, she continued, "its just one more way I feel like I'm being bumped from being part of the Jewish community. If you can't pay the high rates of a Jewish preschool, you can have your child attend a secular church preschool for $1,000 less."

I raised this topic with an unaffiliated mom with young children who married within the faith and would like to be a part of a synagogue and Jewish community. "I just can't wrap my head around it. A synagogue on Long Island has dues that are less than half of what we are asked to pay in Westchester. At a temple in Long Island, their building fee is $1,700 over five years or $1,360 if you pay it all at once. Religious school fees are very reasonable and their social, religious, and educational programming is phenomenal. Why can't Westchester synagogues operate similarly? Until then," she continued, "I'll just be thankful that I live in a place where I'm comfortable being Jewish."

For some, synagogue membership is worth the fees. Alison Litofsky who serves on the executive board of SSTTE says her family enjoys the benefits of membership. "I do think being a part of a synagogue is worth it even though it's expensive because it's important for us to have a place to worship and keep Jewish traditions alive," she said. "I also believe synagogues have a higher function. Participating in programs such as a mommy-and-me music class, packing food for the interfaith food pantry, and attending a women's retreat are all programs that have allowed me to make meaningful relationships with synagogue members of all different generations." (As a side note, SSTTE offers a free new moms group to anyone in the area whether you're Jewish or not.) Judy Calder of the Greenburgh Hebrew Center noted, "The value of membership is intangible, personal to everyone, and ever-changing as needs evolve." Likewise, the UJA-Federation Synergy report concluded that in order for synagogues to survive and thrive, "...members [need to] know in what they are investing and can explain why they are making this investment." That being said, should synagogues consider offering free "introductory memberships?"

Rabbi Dan Judson, a doctoral candidate at Brandeis University wrote his dissertation is on voluntary funding models for synagogues and he has become the recognized expert on this issue. Judson thinks that synagogues don't do a good job of being transparent with their finances. "Many synagogues make the budget available to membership," Rabbi Judson said, "but there remains a substantial difference between making the numbers available at select board meetings and publishing them proactively on a website." He pointed to secular non-profits and their ratings on sites like Charity Navigator which measure their transparency.

Judson noted that after the Chabad House of Brandeis made the Rabbi's salary and and the temple's budget public, donations increased. "People want to know how their money is being spent when they give," he said. He thinks that if dues are voluntary and budgets are transparent, members will step up to finance their synagogues. "Commitment and engagement on the part of the membership will lead to monetary donations," he said, "and we need to decouple membership and money for Judaism to be sustained. People are motivated to give by a sense of belonging when a need is being met."

A task force has been meeting at Kol Ami studying the potential for an alternative dues structure. "Improving relational Judaism needs to come first," Kol Ami's Jessica Lorden said. "We need to improve our culture," she continued, "and get people to feel committed and connected to the synagogue. We need to determine what causes successes or failures with alternative models of membership." A former temple board member said that she believes that the temple needs to engage congregants – "physicially, emotionally and spiritually. Once they feel the connection, they will be willing to pay their fair share to support the synagogue."

Westchester Reform Temple (WRT) is not yet considering any changes. They had a recent face-lift and their congregation of 1,200 families is large and growing. With three rabbis and a cantor and a half they consider themselves a vibrant and active synagogue with exceptional programming. WRT seeks to attract young families with a 50% discount until the oldest child is in third grade. When asked why WRT and other Westchester synagogues are so much more expensive to join than synagogues elsewhere, Executive Director Alan Halpern said he thought it was because, "...Synagogues here are younger, volunteerism is down, and members are more demanding. Members want more educational and social programming, all of which cost money."

Last year, the UJA (United Jewish Appeal)-Federation of New York released a document entitled "Synergy- Connected Congregations: From Dues and Membership to Sustaining Communities of Purpose." The document outlines ways for synagogues to increase their connectedness to their Jewish communities with the focus being on the community's commitment and involvement. They found that a "transformation of synagogue engagement paradigms accompanies a transformation of membership structures. Membership, dues, and engagement work together; a dues change cannot succeed without working on the engagement of congregants in Jewish life. Meaningful synagogue relationships and commitments allow Judaism and Jewish life to flourish."

The report acknowledges the need for funds to operate and recommends models of membership including Mishkan, Kitchen, or a hybrid of the two.

Mishkan means "Each member a partner," and is based on free will dues or fair-share. The Mishkan model encourages increased participation in the synagogue by naming individuals as vital stakeholders. Rabbi Rachel Nussbaum of Seattle is quoted in the document as saying, "...to start with the money is backward." She suggests that people join the community first and pay later, once they place a value on the synagogue. The Kitchen model is an a la carte model of synagogue membership. Each additional activity (luncheon, high holiday service) comes with a recommended donation. The hybrid model combines the two and is describes a model where membership is a partnership opportunity but not required for participation.

Is your synagogue considering changing its dues structure in the near or distant future? Why or why not? What is your synagogue doing to attract and retain members if it wasn't included here? Let us know in the comments below.

Reval Recap: Who Filed the Most Grievances and Where Do We Go From Here?

- Details

- Written by: Joanne Wallenstein

- Hits: 7628

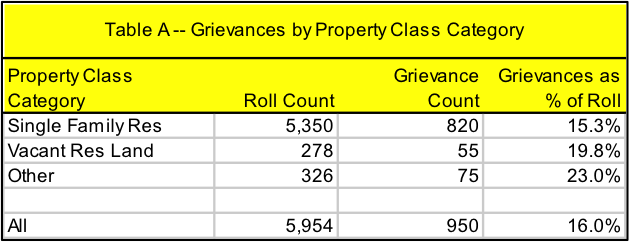

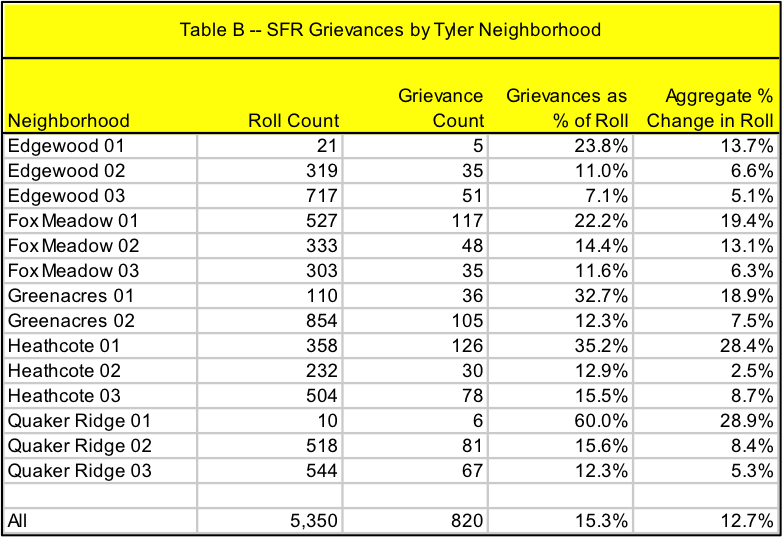

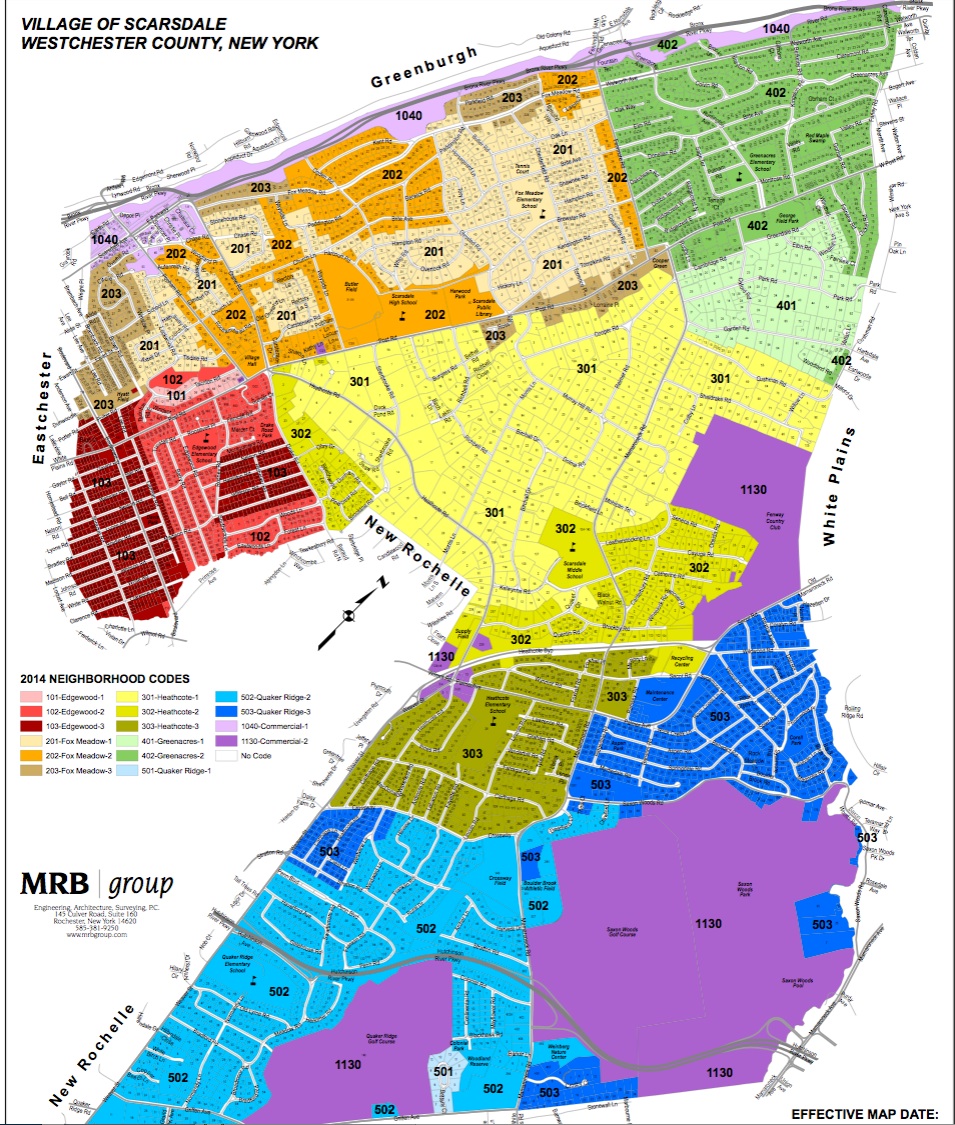

Scarsdale resident and statistician Michael Levine provided the Board of Trustees with some interesting data about the Scarsdale revaluation. He analyzed the 950 grievances that were filed following the first village-wide reassessment in 49 years and showed the number and percentage of grievances by neighborhood. Not surprisingly the highest percentage of grievances were filed in the neighborhoods with the greatest changes in valuations between 2013 and 2014. So which neighborhoods have the highest percentage of unhappy homeowners ... it looks like Heathcote 1 and Quaker Ridge 1. The neighborhoods correspond to the map shown below.

Scarsdale resident and statistician Michael Levine provided the Board of Trustees with some interesting data about the Scarsdale revaluation. He analyzed the 950 grievances that were filed following the first village-wide reassessment in 49 years and showed the number and percentage of grievances by neighborhood. Not surprisingly the highest percentage of grievances were filed in the neighborhoods with the greatest changes in valuations between 2013 and 2014. So which neighborhoods have the highest percentage of unhappy homeowners ... it looks like Heathcote 1 and Quaker Ridge 1. The neighborhoods correspond to the map shown below.

Here are Mr. Levine's charts – see his notes below:

The "Grievances as % of Roll" column shows the "Grievance Count" as a percentage of the "Roll Count". This rate is 15.3% for Scarsdale overall, but it varies significantly by neighborhood.

The "Aggregate % Change in Roll" column is the change in total assessed values from 2013 FMV to 2014 Tentative. Not surprisingly (but without getting statistically technical), there is a degree of correlation in that the neighborhoods with the greater increases in valuations tend to also have the greater rates of grievance. This report does not opine on the question of whether the variances among neighborhoods, driven in part by the Tyler land valuation, are correct or justifiable.

In other news about the revaluation, the Finance Committee of the Scarsdale Village Board of Trustees met on October 14 to make plans for cyclical updates of the revaluation. John Wolham from the NYS Office of Real Property Tax Services was present along with John Ryan of J.F. Ryan Associates who was brought in to consult on the last revaluation conducted by Tyler Technologies.

The discussion was about how often to do updates and what methodology to use. In order to encourage municipalities to keep their assessments updated, the Office of Real Property Tax Services gives municipalities $5 per parcel for reappraisals done at least once every four years. In addition they require municipalities to do an inventory of all properties at least once every six years. The inventory is an evaluation of the property from the street and not an interior inspection. Though frequent reassessments are not legally mandated, they are considered best practice as valuations are maintained near market value.

Village Manager Al Gatta and Assessor Nanette Albanese proposed that the next reassessment be done for the 2016 assessment role which would be effective in 2017. In order to accomplish this, the Village would need to retain a firm to do the update and the work would need to begin in December 2014. This would not be a revaluation that included interior inspections of homes – except in cases of a sale or where a building permit was issued for the property. Rather the inspectors would evaluate condition and grade by observing homes from the street. The cost to keep the role updated on an annual basis was estimated to be $100,000. A firm would be retained to do the work – so no additional staff members would be added at Village Hall.

John Ryan suggested that the Village use a "direct market model approach" to determine valuations. This model would use the sale prices of all homes sold in the prior two-year period to develop an algorithm to price all properties. The model would be continually updated and provide a "solid database" of information to use when assessing properties.

Since only a few evaluators would be retained, Ryan believed the results would be more consistent than during the prior revaluation when Tyler had a very large staff doing inspections. Gatta indicated that the staff would like to retain Ryan's firm to do the next assessment.

At the conclusion of the meeting, Mayor Steves asked the Village staff to provide the trustees with a recommendation on these cyclical updates including the timing, scope and estimated cost. The trustees will evaluate the proposal and decide how to proceed.

In the Spotlight: Special Education

- Details

- Written by: Joanne Wallenstein

- Hits: 7912

Almost 800 students, or 16% of the population of the Scarsdale Public Schools qualifies for special services from the district and this program was the focus of the education report at the work session at the October 6 Board of Education. Newly-appointed Director of Special Education, Eric Rauschenbach presented an overview of the students served by Scarsdale Special Education Programs, the breadth of services in the District, a review of the budget and goals for the year.

Almost 800 students, or 16% of the population of the Scarsdale Public Schools qualifies for special services from the district and this program was the focus of the education report at the work session at the October 6 Board of Education. Newly-appointed Director of Special Education, Eric Rauschenbach presented an overview of the students served by Scarsdale Special Education Programs, the breadth of services in the District, a review of the budget and goals for the year.

Who does the program serve? Mr. Rauschenbach identified Special Education students as classified in two groups. First, he mentioned students classified as Section 504. Scarsdale has 325 students (7% of total Scarsdale student population) in this group. Section 504 is a federal law that protects students with disabilities from being discriminated against at school. It requires schools to give children the same opportunities as students without disabilities through reasonable accommodation or modification. An example is the use of an elevator, or installation of a wheelchair ramp, or handrails. It may also include allowing a child with diabetes to have a snack in the classroom, or allowing a child with ADHD to stand up when needed during class.

The second group he mentioned is students who fall under the Individuals with Disabilities Education Act (IDEA). The district has 465 students (9% of total Scarsdale student population) classified in this group. To qualify, a child must have one of 13 identified disabilities (Autism, Blindness, Deafness, Emotional Disturbance, Hearing Impairment, Mental Retardation (Intellectually Disabled), Multiple Disabilities, Orthopedic Impairment, Other Health Impaired, Specific Learning Disability, Speech or Language Impairment, Traumatic Brain Injury, Visual Impairment) and it must adversely affect their educational performance.

What does the district offer? Mr. Rauschenbach explained the types of services offered at each school level (elementary school, middle school, high school). He noted that at all levels fundamental principles of the curriculum are inclusion and flexibility. The goal is for Special Education students to interact with the General Education students to the full extent possible and to be provided with the opportunity to participate in all activities in which their non-classified peers participate. Further, flexibility within the curriculum design allows Special Education students who have strengths in a particular area to be placed in a General Education class in the area of strength. Also common to all levels of schooling is the Learning Resource Center (LRC), but each LRC operates a little differently and focuses on various skill sets.

At the elementary school level, the LRC work is focused on literacy and math skills. Students may receive help in small groups within the LRC. Students who need help are taken out of the classroom at specific times when new lessons are not being taught. An LRC teacher may also help students during a lesson in the classroom. Also, in the elementary schools are one designated special class per grade with 12 Special Education students per one teacher and one aide. These students may move in and out of the General Education classes based on the subject and participate in homeroom and specials with their General Education class peers.

In middle school, the LRC adds to the academic focus the beginnings of self-advocacy, study strategies and time management. Additionally, middle school offers a parallel curriculum in English and Math with a ratio of 12 students to 1 teacher and 1 aide. There are integrated Social Studies and Science classes that are co-taught with Special Education teachers. As in the elementary schools, classified students can move in and out of General Education classes as necessary and participate in all the special quarterly offerings with their non-classified peers. The middle school also has a self-contained program for students with more severe disabilities. The focus of this program is basic academic skills, life skills and social skills.

In high school, in addition to providing support services in small groups on a pull out basis, the LRC functions as a drop in center. Students can go to the LRC during their free periods and it is also open after school four days per week. There is a continued focus on self-advocacy and time management. The high school also offers a Skills Curriculum of General Education classes that are smaller in size than other classes. In ninth grade, these Skills Curriculum classes are co-taught by Special Education teachers.

The high school also offers a comprehensive support program that builds on the self-contained program at the middle school. Students earn credentials from New York State rather than a diploma. There is a focus on functional math and reading as well as independent living skills such as cooking and hygiene. Students in this program may also participate in vocational experiences during which they spend 30 hours a week at an internship.

How much does it cost?: Mr. Rauschenbach discussed the budget for Special Education which is $12,873,949 spent as follows:

- Salaries 54%

- Direct Services (i.e., speech therapy, occupational therapy) 33%

- Transportation 6%

- Undesignated Fund (legal fees, settlements) 3%

- Other (supplies, travel, professional development) 3%

As indicated above, the majority of the budget goes directly to providing for students through teaching and direct services.

What are the objectives for the school year? Mr. Rauschenbach closed by highlighting his goals for the year in three categories: Communication, Professional Development and Community Understanding. He would like to develop a framework to facilitate the sharing of information on an on-going basis. He also stated the importance of keeping his faculty up to date on trends in Special Education and relevant laws and regulations through continued professional development opportunities. Finally, he wants to continue to communicate with the community as he has done this evening to develop a strong community understanding of Special Education programs. Mr. Rauschenbach indicated that he hopes to do some additional presentations later in the year discussing the progress he has made on his goals.

After the presentation, Dr. Hagerman and several BOE members highly commended Mr. Rauschenbach on his work to date. They noted that he just started the job in the spring and has already made an impact.

Please view Mr. Rauschenbach's presentation at the Board of Education Video-on-Demand site.