Grievance Day: How it Went in Scarsdale

- Details

- Written by: Joanne Wallenstein

- Hits: 9681

June 17th was Grievance Day in Scarsdale .... a day for those who wanted to appeal their tax assessment to go before the Board of Assessment Review to state their case. Given the revaluation, and discontent by some with their new valuations, we wondered how it went at Village Hall. Village Assessor Nanette Albanese promised to send some statistics on the day and will do so. In the interim, we received the following comment from Robert Berg, a member of the Board of Assessment Review along with Tom Giordano, Paul Sved, Gary Ellis and Ken Sklar.

June 17th was Grievance Day in Scarsdale .... a day for those who wanted to appeal their tax assessment to go before the Board of Assessment Review to state their case. Given the revaluation, and discontent by some with their new valuations, we wondered how it went at Village Hall. Village Assessor Nanette Albanese promised to send some statistics on the day and will do so. In the interim, we received the following comment from Robert Berg, a member of the Board of Assessment Review along with Tom Giordano, Paul Sved, Gary Ellis and Ken Sklar.

Here is what Bob said followed by observations with a resident who was less than thrilled with his session:

From BAR Member Robert Berg:

Yesterday (6/17) was property tax Grievance Day in Scarsdale. That means it was the last time for property owners to file any challenges to their tentative property assessments resulting from the first town-wide property tax revaluation since 1969. Grievance Day also provided property owners with the opportunity to present evidence at a live hearing to the Scarsdale Town Board of Assessment of Review to support their challenges. The Board of Assessment Review is an independent town board comprised of five residents of the Village of Scarsdale who are familiar with local real estate property values. The Board members are all community volunteers who have been appointed by the Village Board of Trustees. The primary responsibility of the Board of Assessment Review is to determine whether the assessment of each complainant is illegal or erroneous by reason of inequality or overvaluation, without regard to the methods employed by the assessor in making her own determinations. Thus, the Board of Assessment Review provides an important, independent "check and balance" on the accuracy of the assessment roll as we decide the grievances based on the evidence presented by the property owners.

We hear, in person, all grievances by property owners who have requested an in-person hearing on Grievance Day. Most grievances, however, are submitted by the property owners "on the papers" without a live hearing. The Board meets frequently over the summer to deliberate, and the decisions we reach are mailed to property owners on September 15, 2014, the date the assessment roll becomes final. If a property owner of a qualifying property disagrees with our determination, he/she may file a simple Small Claims Assessment Review petition with the Supreme Court, and owners of all types of property may bring an Article 78 action in the Supreme Court.

Because of the revaluation, the number of grievances filed, unsurprisingly, is very high. The Assessor's Office has been hard at work processing these filings, and the actual number will not be known until the end of the week. However, the number of property owners who scheduled a live hearing before the Board and appeared yesterday was much higher than usual. Given the revaluation, and certain property owners' unhappiness with the tentative property assessments determined by Tyler Technologies, this was expected. Last year, I recall about 2 or 3 owners appearing for a live hearing. Yesterday, we had close to ninety (90)! Given this large number, we tried to limit each hearing to five minutes, but we really wanted to give each owner the opportunity to speak his/her peace and present whatever evidence he/she wants us to consider. As a result, we fell behind schedule, and some property owners had to wait for an hour or two past their scheduled hearing time. For that, we apologize, but no property owner was shortchanged. Every one who wanted a live hearing received one. We thank the taxpayers for their patience and understanding. We actually heard cases for about 11 hours, including a short dinner break. We thank the Village Assessor and her staff, the Village Attorney, and the court reporter for sticking with us, hour after hour, so that all property owners could be accommodated.

We did not make any determinations yesterday. Instead, as we told grievants, we are in an information-gathering mode with respect to their complaints. One thing property owners need to understand is that, by law, the tentative property assessments they have received are presumptively correct. In order to prevail in their grievance, the taxpayer must produce evidence to rebut this presumption. The type of evidence necessary to rebut this presumption will vary. But as we told taxpayers yesterday, the Board finds that the submission of an independent appraisal from a licensed professional real estate appraiser is oftentimes very helpful evidence to support a taxpayer's claim for an assessment reduction.

Nonetheless, we took pains to tell taxpayers that we do not require them to submit such a professional appraisal and that we will consider any and all evidence that they submit. By way of example, other very helpful evidence includes:

-An executed contract for the purchase of a property in an arm's-length transaction between unrelated parties for a property that was offered on MLS,

-Other evidence of the purchase price on a recently closed transaction,

-An active MLS listing of a property being offered for sale.

Many grievants or their representatives have submitted, or have stated that they will submit, independent appraisals to support their claims. We invited grievants, if they have not done so, to submit an independent appraisal in the next two to three weeks, again reminding them that they are not required to do so in order to have their assessment reduced. We have the authority to reduce an assessment, under the law, whenever we determine, in our judgment, that the proof submitted by the complainant is sufficient to overcome the presumption that the tentative assessment is correct. The Board takes its responsibility very seriously, and the members of the Board will be spending many hours meeting and deliberating this summer as we carefully evaluate the merits of each grievance.

From a Resident:

I was warned in advance by the Assessor's office not to be late for my 7 pm scheduled hearing, so I arrived on time and was told the hearings were an hour behind schedule. Since the evening hearings were 2 hours behind schedule, I was called before the board at just after 9 pm.

Although the board took a recess, when the hearings resumed a pizza delivery was made and several members ate pizza while listening to citizen's grievances.

Board members were not provided with nameplates for their seating as is typical of Village meetings.

Nanette Albanese, the Village assessor who sat with the board, was aggressive; she countered every argument she heard. She was especially aggressive towards attorneys speaking on behalf of property owners.

Bob Berg seemed to chair the board. He was patient and sympathetic and he let everyone have their say, hence the delays.

Most owners were prepared with statements, but focused on trivial issues, e.g., small differences in property square footage, quality conditions of homes and rooms. Most owners were not prepared with relevant material to support their arguments, e.g., recent third-party appraisals.

In all cases I heard that evening, Bob Berg suggested to all that lacked a third-party appraisal to get one and deliver it to the Assessor's office within 2 weeks so it could be considered when a final review of grievances would be conducted. For those who did already have appraisals available to deliver, Bob Berg and Nanette Albanese said emailed PDFs would be accepted.

Most property owners seemed ill-equipped to present an argument that would result in any substantial changes to their assessments, focussing on personal opinions and affections towards their property. Some brought to light that their property's location was in a unique setting, such as elevated land or flood zones.

I had submitted 3 appraisals from 3 consecutive years within the last 5 years, personally delivering a stack of 100 pages to the assessor's office when filing my grievance, and received a receipt for the delivery. All of my paperwork was lost by the Assessor's office. After the meeting I emailed the Assessor's office copies of my appraisals as PDFs and requested another confirmation of receipt -- which I have yet to receive.

I reminded the board that they were in violation of a lawsuit settlement that had offered me and agreed to 2 years prior.

Nanette Albanese argued against me that the lawsuit settlement (which she personally initiated and signed into contract) was not substantial to this year's grievance. Other board members were quick to interrupt her and requested I resubmit all of my appraisals, assuring me that the lawsuit and multiple appraisals would strongly be considered.

I explained to the board that Tyler Corps first assessment of my property was 50% above the agreed lawsuit settlement, and that Tyler's revised assessment was sent out late, missing its end-of-May deadline, which made it difficult for property owners to be prepared with the most up-to-date assessments available. In my case, the correction I received was substantial, adjusting the majority of the excessively high first valuation — I told them that was a good start.

Did you go before the BAR on Tuesday? What was your experience? Email [email protected] or comment in the area below to share your thoughts with other readers.

Greenacres Celebrates Retiring Faculty Members

- Details

- Written by: Joanne Wallenstein

- Hits: 5570

Faculty, parents, students, PTA Presidents and alumni gathered in the courtyard of the Greenacres School for a bittersweet goodbye to seven members of the staff who will retire at the end of the school year. Retiring this year are Principal Gerry Young, classroom teachers John (Jack) Dean and Oksana Slywka, School Psychologist Nancy Karagis, Music Teacher and STA President Trudy Moses, Speech and Language Teacher Eva Sax-Bolder and Physical Therapist Harriet Siegel.

Faculty, parents, students, PTA Presidents and alumni gathered in the courtyard of the Greenacres School for a bittersweet goodbye to seven members of the staff who will retire at the end of the school year. Retiring this year are Principal Gerry Young, classroom teachers John (Jack) Dean and Oksana Slywka, School Psychologist Nancy Karagis, Music Teacher and STA President Trudy Moses, Speech and Language Teacher Eva Sax-Bolder and Physical Therapist Harriet Siegel.

With a combined 225 years of service to the school, these Greenacres veterans are a part of the heart and soul of the school. A hearty table of refreshments was available and everyone took turns reminiscing until the speeches began.

PTA Presidents, present and former, arranged the tributes and gifts from Tiffany's were provided by the PTA Executive Committee. A cake with a memento for each teacher was presented and the retirees were toasted individually.

Departing Principal Gerry Young got his own roast from the PTA Presidents with contributions to his Greenacres time capsule, each to remind him of his tenure at the school. Among the many gifts presented were paint chips and carpet swatches as Young loved to paint and redo, a framed photo of him from the Scarsdale Inquirer, pennies-- because one year the children collected a million, a deed to Huntington Avenue which parents have long wanted to close, a parking citation for those who leave their cars parked next to the school during pick-up, a wrapped brick to remind him of the work he did to rehabilitate the Greenacres courtyard, a water bottle for Brain Gym, a Chia pet for his green initiatives, a book about the south of France where he attended school, a basketball hoop in honor of the courts that were built, a fan because the school asked for but never got air conditioning, Greenacres memorabilia and a Life is Good mug – because, well, it is!

Departing Principal Gerry Young got his own roast from the PTA Presidents with contributions to his Greenacres time capsule, each to remind him of his tenure at the school. Among the many gifts presented were paint chips and carpet swatches as Young loved to paint and redo, a framed photo of him from the Scarsdale Inquirer, pennies-- because one year the children collected a million, a deed to Huntington Avenue which parents have long wanted to close, a parking citation for those who leave their cars parked next to the school during pick-up, a wrapped brick to remind him of the work he did to rehabilitate the Greenacres courtyard, a water bottle for Brain Gym, a Chia pet for his green initiatives, a book about the south of France where he attended school, a basketball hoop in honor of the courts that were built, a fan because the school asked for but never got air conditioning, Greenacres memorabilia and a Life is Good mug – because, well, it is!

Baseball Classic is a Hit in Scarsdale

- Details

- Written by: Joanne Wallenstein

- Hits: 9070

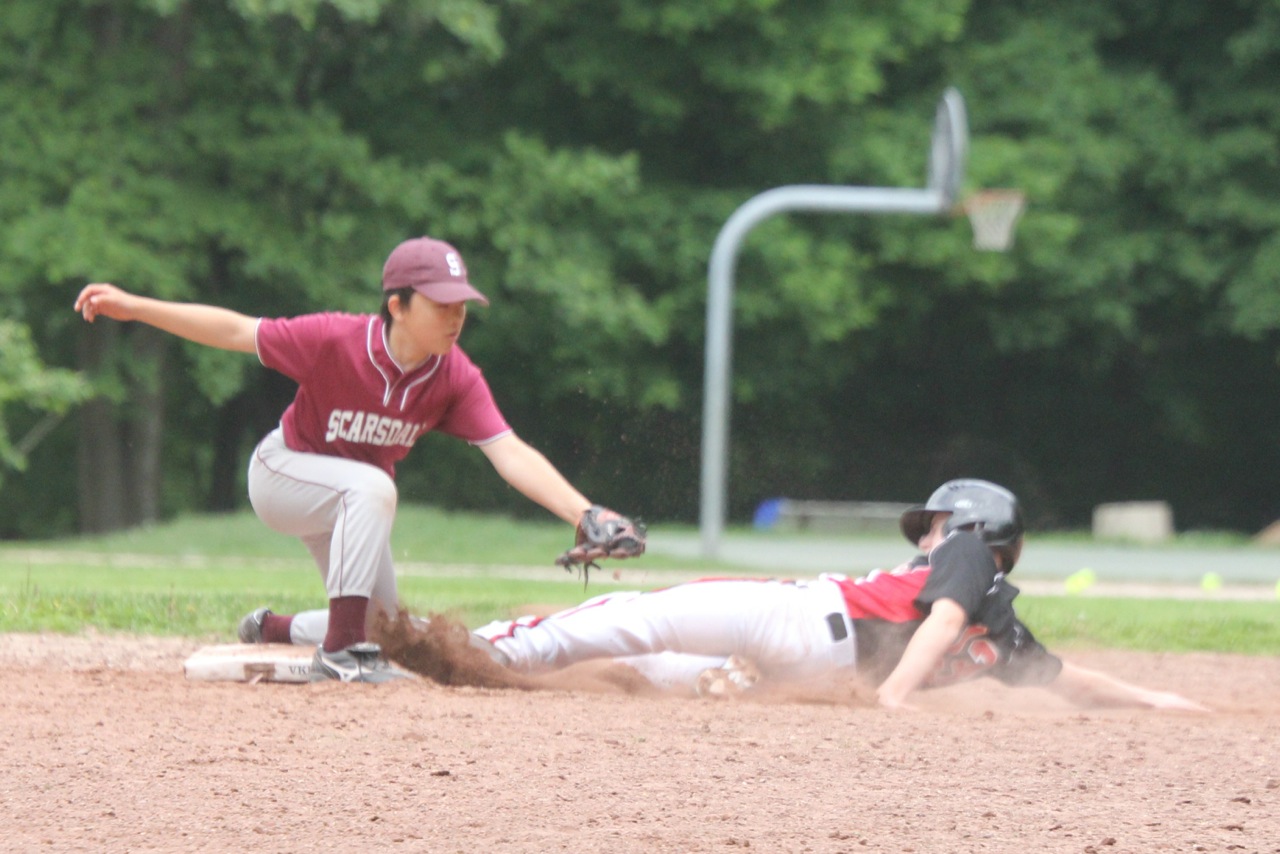

The Scarsdale Baseball Club hosted the 12th Annual Westchester Baseball Classic Memorial Day weekend tournament and close to 300 baseball players from 15 teams in Westchester came to town for the annual summer classic. Scarsdale fielded teams in each of the 14u, 15u and 16u brackets with the 16u Raiders taking the runner-up trophy after falling short to Westchester Academy in a thrilling championship game. This year the tournament was fortunate to be sponsored by the new Smashburger on Central Avenue. They did a great job feeding the many hungry players and fans.

The Scarsdale Baseball Club hosted the 12th Annual Westchester Baseball Classic Memorial Day weekend tournament and close to 300 baseball players from 15 teams in Westchester came to town for the annual summer classic. Scarsdale fielded teams in each of the 14u, 15u and 16u brackets with the 16u Raiders taking the runner-up trophy after falling short to Westchester Academy in a thrilling championship game. This year the tournament was fortunate to be sponsored by the new Smashburger on Central Avenue. They did a great job feeding the many hungry players and fans.

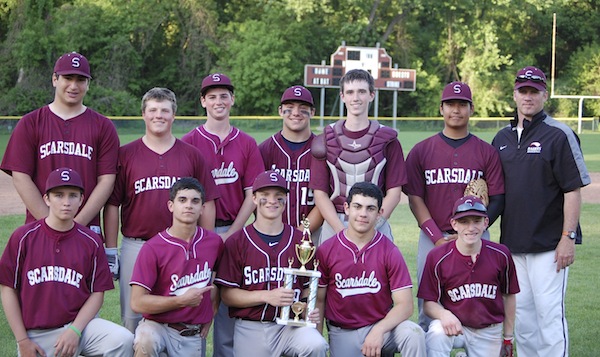

(Pictured at top) 16u Raiders Team

Back: Ethan Raff, Josh Cromwell, Michael Wallach, Tyler Mandel, Dylan

Doughty, Koji Sakulrat, Jeff Weigel (Coach)

Front: Pat Lyons, Nate Ware, Scott Kelly, Teddy DeLorenzo, Harry Chalfin.

Not pictured: Masashi Kawabata

14u Team Picture (above)

14u Team Picture (above)

Back - Eric Alessio (Coach), Brad Waterhouse, Kiran Ramachandrin, Jack

Callahan, Michael Green, Joe Weintraub, James Conlan, Kodai Morikuni,

Sam Bernstein, Joe Kelter (Coach)

Front: Cole Thaler, Jonah Schneider, Hayato Ide, Jack Waxman, Michael

DiSanto, Dan Karp

Not pictured: Ben Lehrburger

Delay the Revaluation?

- Details

- Written by: Joanne Wallenstein

- Hits: 4522

This letter was sent to Scarsdale10583 by Donald Dietz III of Brewster Road: Contrary to the Scarsdale Inquirer's commentary on last week's Village Board meeting, I thought the Heathcote homeowners who spoke did understand the revaluation process very well. They presented legitimate arguments, asked reasonable questions and made sensible suggestions as to how the Village might move forward in order to improve the revaluation and make everyone more comfortable with Tyler Technologies' methodology.

This letter was sent to Scarsdale10583 by Donald Dietz III of Brewster Road: Contrary to the Scarsdale Inquirer's commentary on last week's Village Board meeting, I thought the Heathcote homeowners who spoke did understand the revaluation process very well. They presented legitimate arguments, asked reasonable questions and made sensible suggestions as to how the Village might move forward in order to improve the revaluation and make everyone more comfortable with Tyler Technologies' methodology.

In contrast, I found many of the Village's responses to be less than forthcoming and, in some instances, even deflecting and dismissive, as if the revaluation were already a fait accompli. Not a confidence builder in my book.

As I see it, there are two key issues the trustees ought to tackle and resolve before Tyler's preliminary assessments are adopted by the Village Assessor and set in stone. The first is the accuracy and, therefore, the reliability and legitimacy of the Tyler revaluation. The second has to do with transparency and trust, and correcting the perception around town that something is just not right, that the Tyler revaluation is not any more equitable or fair than what we have now.

As to the first, it is clear that what Tyler has wrought is not right and can be legitimately questioned. At a minimum, 927 homeowners scattered throughout the Village (me included), not just in Heathcote, say this is so, and it is no secret that there are others out there who were unable to contact Tyler during the Village's abbreviated review period. Collectively, these good citizens own at least 16% of the revalued properties in the Village, if not more, which is not insubstantial. They certainly should not be marginalized by anyone, including the Inquirer, as merely a few inevitably disgruntled citizens.

In addition, by the Village's own admission (to wit the Mayor, the Village Manager and the Village Assessor), there are many mistakes in Tyler's work. This includes an indeterminate number of properties undervalued by Tyler, whose owners are inexplicably silent at this time. But we have been told not to worry, since it will take the Village only three years or so to find and fix these errors. Wow! Since when is anything in this community other than excellence acceptable? A valuation error rate possibly approaching 35-40% to start does not seem to meet that standard.

Perhaps the more difficult problem to resolve is that of trust, without which any revaluation will come under constant scrutiny and criticism and even potential legal challenge. Is this really what the Mayor and Trustees want as their legacy?

Why not embrace the appeal made by the Heathcote constituency last week and defer the revaluation for a year so that there is adequate time to correct obvious errors, share information and hear everyone out without their having to file formal grievances at potentially significant cost, as they are being told by the Village to do now? Why not make every effort to demonstrate that the revaluation is in fact not only equitable and fair, but accurate and a marked improvement over the system in place today? That would be a proper outcome and a logical way to proceed.

Alternatively, if for some as yet unknown reason there is insufficient time (or lack of political will) to delay implementation, the Village ought to put in place a mechanism to ensure that those who have been wronged or improperly benefitted are, respectively, made whole or incrementally assessed by the Village at some future date. The idea would be to restore taxpayers to the position they would have been in had the revaluation not been instituted prematurely, but instead had been done correctly the first time. In this way, balance, credibility and equity could be reestablished after the fact.

Respectfully submitted,

Donald E. Dietz III

66 Brewster Road, Fox Meadow

Community Pitches in to Conserve Bronx River Reservation

- Details

- Written by: Pam Fuehrer

- Hits: 4216

The Day of Service - Pitch in For the Parks event held to honor Dr. McGill upon his retirement was a terrific success. Jim Sutton, Executive Director of the Bronx River Reservation Conservancy assigned our group the area from the wooden bridge at the Scarsdale Train Station southbound to Harney Road. Almost forty members of our community - children, parents and local business owners ranging in ages from five to over fifty years - showed up at 9:00 a.m. on Saturday 5-17, ready to make a difference in our community. The results were astounding; please see for yourself. The energetic group removed huge sections of the invasive knotweed plant along the path, clearing multiple areas of its threat. Dr. McGill and his wife both participated, adding a special touch to the effort to act Not for Self - or Non Sibi. The McGill Farewell Committee is grateful to all those who were able to attend the event, those who wished to do so but couldn't, and to those who participated in their own activity that day, helping others in Dr. McGill's honor.

The Day of Service - Pitch in For the Parks event held to honor Dr. McGill upon his retirement was a terrific success. Jim Sutton, Executive Director of the Bronx River Reservation Conservancy assigned our group the area from the wooden bridge at the Scarsdale Train Station southbound to Harney Road. Almost forty members of our community - children, parents and local business owners ranging in ages from five to over fifty years - showed up at 9:00 a.m. on Saturday 5-17, ready to make a difference in our community. The results were astounding; please see for yourself. The energetic group removed huge sections of the invasive knotweed plant along the path, clearing multiple areas of its threat. Dr. McGill and his wife both participated, adding a special touch to the effort to act Not for Self - or Non Sibi. The McGill Farewell Committee is grateful to all those who were able to attend the event, those who wished to do so but couldn't, and to those who participated in their own activity that day, helping others in Dr. McGill's honor.