Long Terms Financial Model for the School District Points to Worrisome Scenario

- Monday, 11 November 2024 17:08

- Last Updated: Thursday, 30 January 2025 07:32

- Published: Monday, 11 November 2024 17:08

- Joanne Wallenstein

- Hits: 2902

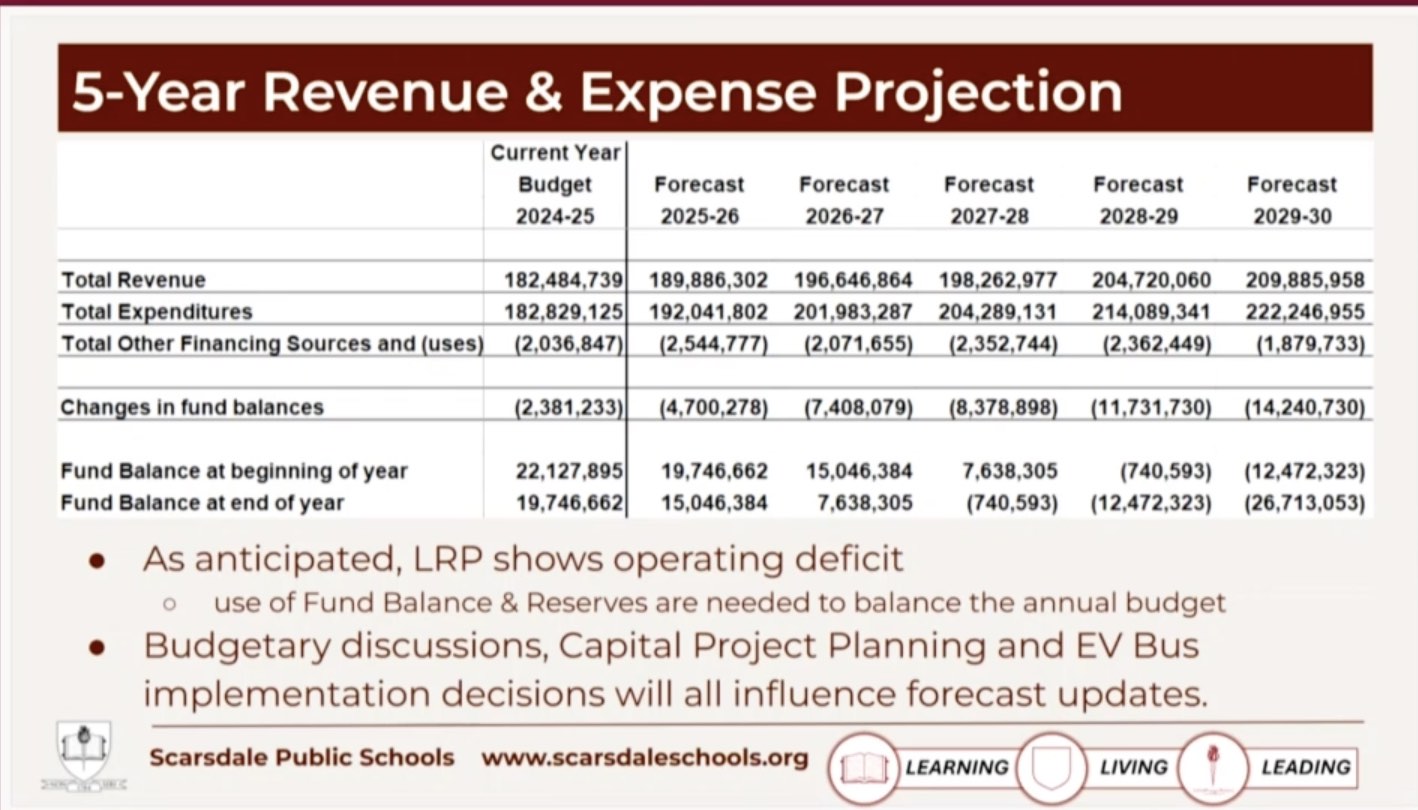

A long-term plan shows that if projections are accurate, the district's fund balance would go into negative territory by 2027-28.A long-range financial plan for the Scarsdale Schools presented by Assistant Superintendent Andrew Lennon at the November 4 School Board meeting, paints a worrisome future for the finances of the Scarsdale Schools.

A long-term plan shows that if projections are accurate, the district's fund balance would go into negative territory by 2027-28.A long-range financial plan for the Scarsdale Schools presented by Assistant Superintendent Andrew Lennon at the November 4 School Board meeting, paints a worrisome future for the finances of the Scarsdale Schools.

In recent years, the district has used reserves and excess revenues from prior years to help balance the following year’s budget. But this strategy has drawn down reserves, and with expenses forecasted to outpace revenues in the next few years, in just two years, a new financial model shows that the district will have used up all their reserves to balance the budget if changes aren’t made. It is important to note that these are projections, based on many assumptions. The actual figures would likely change as a result of annual budget discussions as the administration and Board would be unlikely to propose an annual budget with such low fund balances.

Specifically, Lennon’s projection shows that for the 2027-28 school budget, if the district continues to meet the tax cap and no other changes are made to revenues or expenses from the projections reserves will go into negative territory.

The district has held around $20 million in various reserve funds each year. But if Lennon’s projections hold up, the $19.5 million fund balance projected for the end of the 2024-25 school year, would fall to a negative ($740,000) by the end of the 2027-28 school year.

And without surplus funds to underwrite the 2028-29 school budget, the fund balance would decline to a negative $12.4 mm at the end of the 2028-29 school year. The deficit could cause the district to be forced to drastically cut staffing or programming.

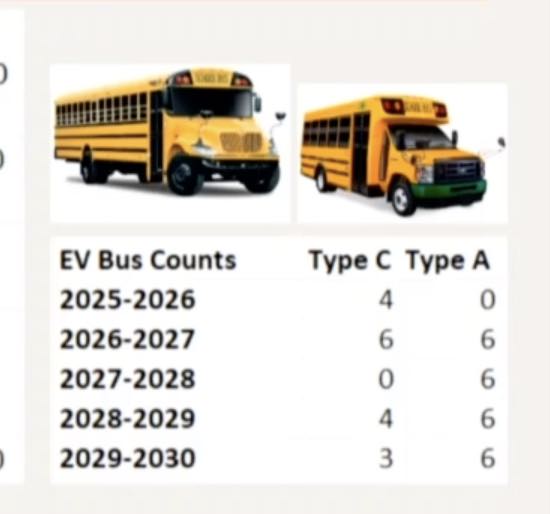

Why the shortfall? With new programs and services, continued increases in budget items such as health insurance, and revenues that mostly come from property taxes, there has been increasing pressure on the annual budget. There are also state mandates such as the conversion to EV buses that are only partially being funded through grants and incentives. The EV buses make up a meaningful amount of additional expenses in the financial model, but even without these buses the projections are troubling. * See a note on the buses below.

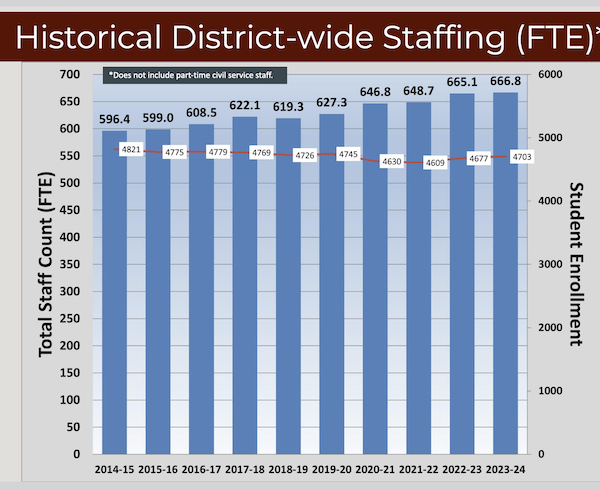

Staffing is the largest component of the budget and in the past 10 years, the number of full time employees has grown by 70, from 596 to 666 with school enrollment decreasing from 4821 students in 2014-15 to 4,703 students in 2024-25.

Factoring in these bus purchases, staff contracts and other expenses, here’s how projected costs will outpace revenues in the coming years:

Expenses would rise from $184mm in 2024-25 to $224mm in 2029-2030 while revenues go from $182 mm in 2024-25 to $210mm in 2029-30, leaving a gap.

Lennon was hopeful that a few factors might ameliorate the dire scenario. He said that interest income might possibly grow from revenues invested during the school year. Staff retirements could decrease the overall district payroll when more senior staffers are replaced with lower paid new hires. And rather than simply purchase the buses, the district could explore financing the buses via bond offerings or borrowing.

However, if this scenario is what the modelling now shows, what should the district do now to change the economics down the line. Budget discussions are scheduled to start in just a few weeks.

Former Board President Ron Schulhof noted the implications of the report. He said, “Our fund balance is projected to run out in 3 years – that’s a big red flag. What is our plan? Even if this is off, our fund balance would be at an unacceptable level. This is a glaring red flag about this year’s budget.”

Lennon replied, “We need to look closely at expenses – how will retirements affect these numbers? We are going to have to make some tough decisions.”

Board member Bob Klein asked, “What would be a strategy to preserve our fund balance in three years? This might happen. We need to understand so that we’ll know whether we can do anything new next year. What do we need to do to turn this into a positive? We need to know this soon – we are on a path that is very concerning. I am shocked at the magnitude of this problem.”

Lennon said, “When we are asked to do something new or different, consider the long term cost of the initiative.”

The Board then asked Lennon to analyze the effects of various scenarios to fund the new EV fleet which he will present at a later meeting. See the presentation here. In order to comply with a state mandate, the school district will need to acquire 41 EV school buses by 2030.

In order to comply with a state mandate, the school district will need to acquire 41 EV school buses by 2030.

EV Buses:

*One item driving expenses is a NYS mandate that the district convert their fleet of gas powered buses to zero emission electric vehicles. These zero emission buses are 3-4 times more expensive than gas powered buses. By 2027 all new buses must be EV’s and by 2035 the district’s entire fleet must be electric vehicles. This means that from 2025 to 2030, the district would need to buy 17 full size EV buses and 24 smaller EV buses. Scarsdale received an $800,000 grant from the EPA for their initial purchase, but the potential expense for the entire purchase is over $10 mm, which is just one factor impacting the long term budget projections for the district.

Michael Otten submitted the following comment:

The good news is that there is an administration in place that at last takes seriously long-term planning rather than the 1-2 yr planning horizon previously used. I wish I could attend the meeting on Monday, but am committed to be at a different School Board meeting as a Board member that evening. I am truly delighted at the open communication approach being taken.

I believe that there are at least three factors that need to be seriously further examined:

1. "...in the past 10 years, the number of full-time employees has grown by 70, from 596 to 666 with school enrollment decreasing from 4821 students in 2014-15 to 4,703 students in 2024-25." This almost certainly includes a significant number of Indirect administrative staff, some of which might relate to the mental stress of the COVID years, but intuitively feels to me just like administrative bloat. As the District has had the courage to look forward more than two years, I would suggest that they also look backwards a few years (maybe two decades?), to understand better how the Directs/Indirects ratio for the District has changed, and if all the assumptions for increased indirect staff still hold.

2. Technology and Supplies: Technology should result in savings as well as expense. I suspect that some 'tools' have been added in response to marketing glitz rather than proven value-add. I also expect that there are many unused books and other prior generation media lying around with little practical use. A zero-based review might be worthwhile.

3. Unfunded State and Federal 'mandates' have been a problem of irresponsible government since the beginning of time. The Electric Bus program is probably unreasonably aggressive in terms of phasing out gas buses well before their effective life expectancy has been exceeded. What are the penalties if the District only follows a schedule supported by State reimbursements? I suspect that the penalty for ignoring mandates might be difficult to enforce and rejecting them through court action has been under-exercised as an option.

I am not sure about the Scarsdale Forum Education Committee this year, which has new leadership, but responding to the budget long-term plan challenges would seem to be an unavoidable responsibility.

Yours truly,

Michael Otten, former Scarsdale School Board Member (1988-94) and President,

and former Scarsdale Forum Education Committee Chair