Trustees Provide Scenario Analysis Of Village Finances in Light of the Crisis

- Wednesday, 15 April 2020 17:00

- Last Updated: Thursday, 16 April 2020 11:11

- Published: Wednesday, 15 April 2020 17:00

- Joanne Wallenstein

- Hits: 2524

Crisis or not – life goes on. The Village of Scarsdale filed their tentative 2020-21 budget in accordance with state law and held a budget hearing, via Zoom, on Tuesday night April 14. Due to the timing of the COVID crisis, the Village filed the $59.5 million budget during a time of much uncertainty about potential losses in revenues and rising expenses. This budget called for a $818,298 increase in the tax levy which translates to a 1.986% increase in the budget, resulting in an increased tax bill of $128 for the average homeowner with a house valued at $1,505,000.

Crisis or not – life goes on. The Village of Scarsdale filed their tentative 2020-21 budget in accordance with state law and held a budget hearing, via Zoom, on Tuesday night April 14. Due to the timing of the COVID crisis, the Village filed the $59.5 million budget during a time of much uncertainty about potential losses in revenues and rising expenses. This budget called for a $818,298 increase in the tax levy which translates to a 1.986% increase in the budget, resulting in an increased tax bill of $128 for the average homeowner with a house valued at $1,505,000.

However, in the intervening weeks, the Board learned that they could save an additional $210,000 from the library fund, as the library opening will be delayed two months in the fall. Those funds will be used to further decrease the tax levy. With the inclusion of these funds the tax levy increase will be $606298, a 1.4% increase which comes out to just $95 per household.

In a press briefing about the Village Budget held on the morning of April 14, the Mayor emphasized that the Board and Village Managers will continue to adjust the budget in the coming months to respond to any shortfalls in revenues or increases in expenses due to crisis response. He said it will be a “dynamic” process.

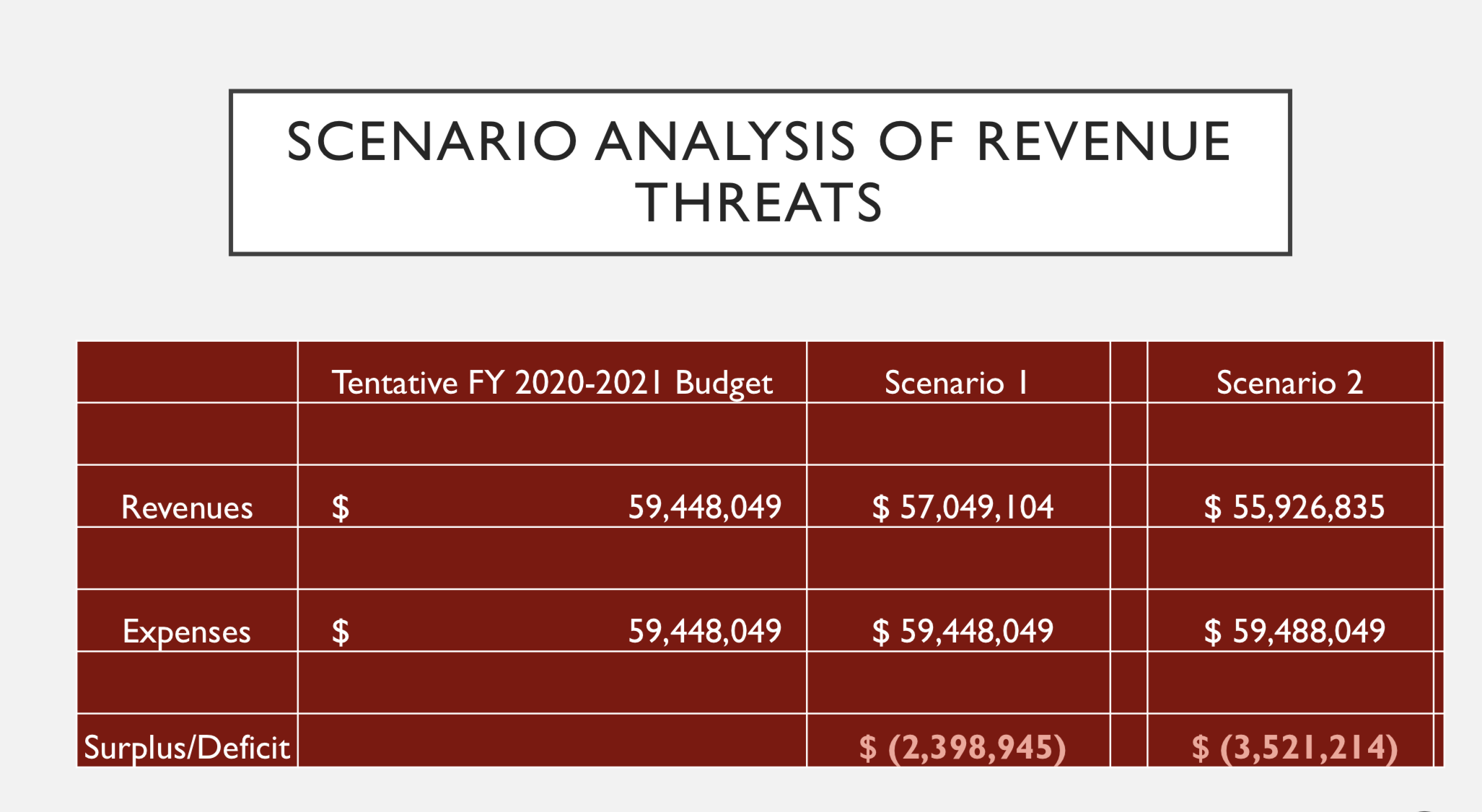

Toward that end the Board and Village Managers prepared a scenario analysis of threats to the budget, presenting Scenario 1 that results in a $2,398 million deficit and Scenario 2, a $3.521 million deficit.

Since roughly 70% of Village revenues are derived from property taxes, which are usually totally paid, the Mayor called those revenues “money good.”

Other village revenues are derived from:

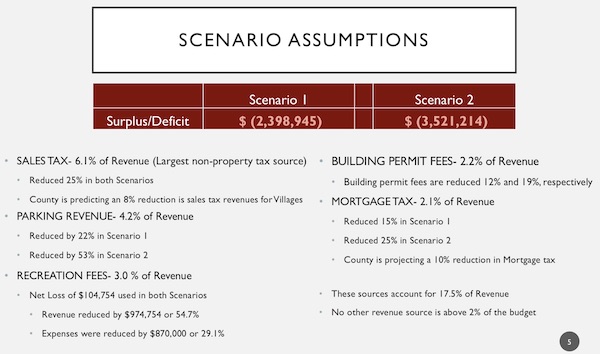

Sales Tax (6.1%)

Parking Revenue (4.2%)

Recreation Fees (3.0%

Building Permit Fees (2.2%

Mortgage Tax (2.1%)

These account for 17.5% of Village revenues. For each of these revenue streams, two sets of assumptions were made for potential reductions and these numbers were included in the scenario analysis.

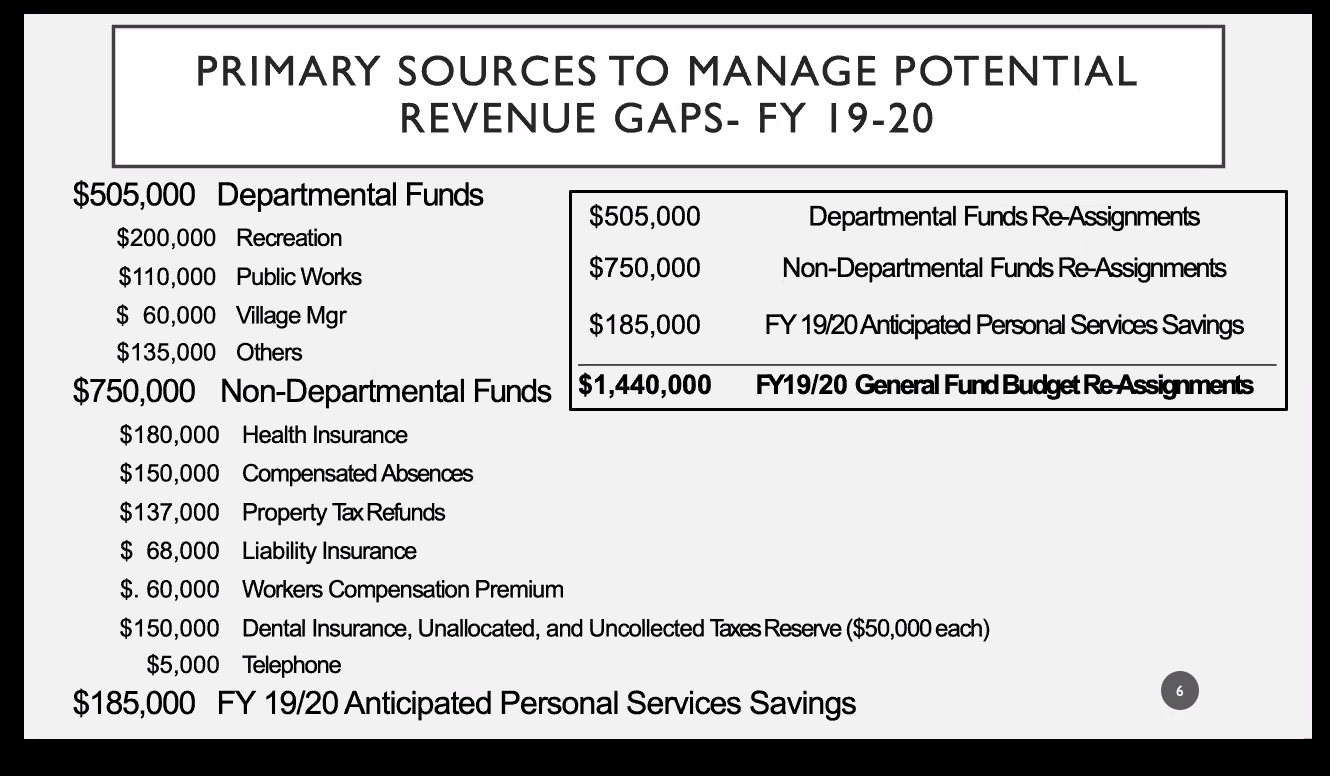

Village Managers then identified $1,440 million in potential savings from the general fund and another $340,000 in reductions to spending on facilities, road resurfacing, traffic safety and the tree planting program, including another $40,000 from the central garage.

Additional savings could come from deferring capital improvements including:What

Heathcote Road Bridge Repair

Hutchinson River Drainage Project

Library Debt Mitigation

Girl Scout House Improvements

Village Hall HVAC Repair

All told, there are $3,485,000 in funds available should they be needed to meet Village obligations.

What if the defecit grows even larger? If more funds are needed the Village can consider use of the fund balance, borrow, further adjusting spending, services and projects, raise non-property tax revenues and as a last resort raise property taxes.

Trustee Justin Arest reviewed the advantages and disadvantages of using each of these funding levers. For example, the 2020-21 fund balance is projected to be $7,990,015, and $1 million of that is already allocated in the budget for tax relief. If the trustees opt to spend more of this balance next year, they risk the Village’s AAA bond rating and they would also need to find a way to replenish those funds next year.

If the Village decided to move to a fee for service model it might require increased staff to administer the program and reduce the financial benefit of the decision.

Raising fees for recreation, camp and the pool are also an option, however Scarsdale’s Village fees and charges are already at the high end of municipal fees county-wide.

The Board of Trustees and Village Managers pledged to continue to make changes to the budget as needed and to use “hard data and reasoned fact-driven assumptions.”

In the interim, they are taking many austerity measures during the crisis while continuing to provide vital services.

Village Hall is now closed due to an executive order from the Governor, however many key members of the Village staff continue to work.

Village Manager Steve Pappalardo explained that “austerity spending should be limited to covid emergency response; the police, fire, water, and public works departments are still on the job.

He said, “limited staff are coming to work, but we still have to operate the Village…. Police still have to patrol. Village health, public safety and welfare services need to be maintained. We had a storm – we had to keep one crew out after hours to pick up the trees. Sanitation collection needs to continue. Sanitary and storm sewer repairs need to be made… there are emergency tree removals. The Water Department needs to maintain pumps. The Building Department has to investigate open building permits. Any unsafe conditions on these homes or streets need to be rectified.”

Pappalardo continued, “The Administration needs to meet some statutory deadlines. We have to get a temporary assessment roll out by June 1. There are people in the Treasurer’s Office who are essential. Property and water bills were sent out. Our Human Resources Manager is busy with people who are exposed, ill, etc.”

“The Parks and Recreation Department is doing some maintenance and grass cutting – it needs to be done. There is limited planning being done for summer camp and the opening of the pool. We think these are important to the community. We’re hoping to have the day camp up and running this year but we’re not so hopeful about the pool.”

We asked if the austerity spending plan would limit funds for road repair and Pappalardo explained that the 20-21 budget still includes $800,000 for road repair. However, now that Con Edison is required to do curb to curb repaving of any areas they dig up, they spent an additional $498,621 on road repair, bringing the total to $1.3 mm.

Asked about the assumptions for sales tax, the Mayor said they had a call with county officials who are predicting an 8% reduction in sales tax revenues for Villages.

Is there a possibility that residents will receive some relief on their property tax payments? Mayor Samwick explained, “Taxes are controlled by NYS real property tax law. The only option that Treasurer Mary Lou McClure sees is for municipalities to petition the Governor to allow for an extension of the penalty-free period to 21 days. Our period is now July 1 – August 1-- this would add another 21 days on top of this.” He said, “We have far less flexibility that we would like. The current scenario is suited to a natural disaster, not a pandemic.”

The budget presentation was also given at the Board of Trustees evening meeting on April 14.

Trustee Jonathan Lewis said, "This crisis highlights the critical role that government plays in our society by providing essential services like our police and fire department, and water and sanitation services. I want to thank the heroes of our police and fire departments, as well as all of our village employees who have ensured that our village has run safely and efficiently during this national emergency.

I would like to thank our village manager, Stephen Pappalardo and our staff for all the dedication they have shown during this time of crisis. I applaud the effort of the Mayor and village manager to revise our budget and propose a lower tax rate.

I believe that if we engage the full board and the public in more frequent conversations about the proper level of taxes and the proper cost structure, it is possible that we can revise the budget even further to sufficiently reflect the current fiscal realities.

While we have reviewed two possible scenarios that could adversely impact our revenues at our working group meeting on March 31, I believe we need to evaluate and consider a worst case scenario that impacts not only our revenue for adverse outcomes, but our cost structure for adverse outcomes, and greater uncertainty in the timing of cash flows. We need a debate on how to construct Scenario 3. It is likely we will have differing views on this scenario - only though open debate will we craft a useful scenario for planning purposes.

As I mentioned on March 31st, the timing of our cashflows may become less predictable. I believe it will be important to have a conversation about the timing of cashflows, how our cashflow may be impacted under various scenarios, and the decision tree we might use to make further cost adjustments should our reserves fall lower than advisable. It will be more important than ever to manage our cashflow and cash reserves carefully.

I do not believe we should be raising taxes at this time, there is too much pain now, and in fact, I believe we should be finding ways to reduce expenses and taxes further. So, while I am pleased with the direction that is being taken by the Mayor and the Village Manager, I believe we need a more engaged public process to take a closer look at our cost structure, investment process, and adjust appropriately.

Trustee Jane Veron said, "As Mayor Samwick and Trustee Arest explained in great detail this evening (thank you for your clear communication) and as we’ve stated at our other work sessions and board meetings, this Board and Village staff immediately responded to the COVID19 crisis by engaging in budget and scenario analyses. We are all keenly aware of our responsibilities to our taxpayers and to the long term health of Scarsdale, and our goal continues to be prudent fiscal management driven by real time data.

To that end, we have devised a three part plan:

Redirect funds from the 19-20 budget and institute austerity measures

Revise the 20-21 tentative budget with added taxpayer relief

Evaluate multiple scenarios with projected revenue shortfalls and expense management alternatives - keeping in mind both operating and capital improvement levers.

I strongly encourage this board to have regular deliberative sessions to monitor, plan, and pressure test our financial assumptions. There are many conversations to be had with the community on the myriad tradeoffs to consider. We need to understand what the community will tolerate.

Tonight I support a revision to the tentative budget that relates to the second prong of our three part plan. We understand the stress and uncertainty these times bring, and I support the recommendation to reduce the tentative planned tax rate from 1.986% to 1.46%.

This proposed reduction is made possible by the careful fiscal management of the library budget, and more explicitly, by the tireless and meticulous efforts of our Library Director Beth Bermel. As you will also hear later this evening, Director Bermel’s oversight of the library budget has been extraordinary. She cautiously postponed filling open positions, waiting to hire until we were as close as possible to the renovated and expanded Library’s reopening. And throughout the project, she scrimped on normal operating expenses. Now, given the slowdowns relating to the COVID health emergency, we are enormously grateful for her stewardship. Given the restrictions imposed on social distancing and construction, the anticipated library reopening will be delayed from what had been previously discussed at our winter budget meeting. Director Bermel will again postpone anticipated expenses. I do want to underscore that the change in this current budget represents a deferral of a planned expense not an austerity cut, and the board intends that the library’s well-documented needs will be met.

Public comments were invited as well:

Randy Whitestone from 94 Sprague Road said, “This is a moment of human tragedy and we should remember that. Our first responders are keeping things running. Safety is critical. I support the Mayor’s comments about continuing to adjust and continue to see this year’s budget as a dynamic process. As Governor Cuomo said, “We got a state budget done but it is contingent on what happens. …. Residents are now more than ever relying on the Village to do its work during these tragic times.”

Bob Berg of 32 Tisdale Road said, “I strongly object to the proposed village budget because it calls for an increase that our residents cannot afford. I identified over $2 million in cuts that can be made – but did not hear back.” He commented on what he learned during a call with the University of Chicago, saying, “many professionals will lose their jobs.” He outlined some suggested cuts he recommended in a memo to the Village including asking that volunteer firefighters be used rather than paying Village firefighters overtime and said that municipal bonds can be used to pay for general obligations, especially in an epidemic.” He said, “The Village has more flexibility -- our residents need a tax cut this year. You can do this without cutting or furloughing staff.”

Yin Yong said, “I would like us to consider a budget that does not raise property taxes. This could be a good time to do some long-term planning and right size our services.”

Bob Harrison said, “Goldman Sachs says this crisis will be four time worse than the 2008 recession…. I am asking for the Village Manager and senior employees to take a freeze on their wages for the coming year. I don’t think it’s too much to ask. I would think that they would do this voluntarily…. I would like to see you go to a zero increase in the village budget for the coming year. I think Freightway is dead and we shouldn’t spend another dime on that.

There is no reason you couldn’t delay the opening of the library for another 2-3 months.”

Mayra Kirkendall Rodriguez said, “I continue to believe the projections are too rosy. There are already 17 million unemployed and it will likely to get to 20 million on Thursday… I am not hearing anything about the income sensitivity of our residents…This is not the time for any kind of tax increase…We never got a response to our working paper… We are likely to be at about 4 quarters of a recession. I would love to be wrong! I urge you to make every possible reduction that Bob suggested.”

LWVS President Leah Dembitzer read a statement on behalf of the League of Women Voters of Scarsdale that you can read here, and the Scarsdale Forum submitted a report that can be read here.