From Village Hall: Sale of Village-Owned Property, Knotweed Removal and Approval to Demolish 24 Morris Lane

- Details

- Written by: Joanne Wallenstein

- Hits: 4674

Here are a few items of interest from the Village Board meeting on Tuesday night July 11. You can watch the meeting in its entirety here:

Here are a few items of interest from the Village Board meeting on Tuesday night July 11. You can watch the meeting in its entirety here:

32 Ferncliff Road: The Village announced the sale of a foreclosed home at 32 Ferncliff Road for $956,300. These funds will be placed in the Village's coffers and used for additional road repairs and the purchase of equipment including a new fire truck.

Knotweed: Scarsdale received a grant from New York State for $24,000  for the removal of invasive knotweed along the south Fox Meadow watercourse in Harwood Park. This grant will be matched with monies from the school and village budgets as the watercourse is primarily on school grounds. The knotweed will be removed manually over a 7-month period.

for the removal of invasive knotweed along the south Fox Meadow watercourse in Harwood Park. This grant will be matched with monies from the school and village budgets as the watercourse is primarily on school grounds. The knotweed will be removed manually over a 7-month period.

Graffiti: Village Manager Steve Pappalardo announced that the state would remove graffiti from the Hutchinson river Parkway, between exits 20 and 22.

Food Scrap Recycling: The Village Manager announced that the village's new food scrap recycling program is a big success and 67,000 pounds of food scraps have been collected over the past six months and turned into compost. The Village is collecting approximately 2 tons of food scraps each week, and 750 food scrap kits have been sold to date. A similar program has been launched in Bedford and Mamaroneck, Larchmont, Greenburgh and New Castle will start their own programs in the fall.

24 Morris Lane: The trustees announced that they have approved the application to demolish  an 8,050 square foot, eight bedroom house that was built in 1917 at 24 Morris Lane. The trustees found that it met none of the criteria for preservation as it was a mélange of architectural styles and although notable, the former residents could not be considered to be figures of historical significance.

an 8,050 square foot, eight bedroom house that was built in 1917 at 24 Morris Lane. The trustees found that it met none of the criteria for preservation as it was a mélange of architectural styles and although notable, the former residents could not be considered to be figures of historical significance.

Gifts to the Library: The Village Board accepted two gifts for the library renovation – one check of $64,000 from the Friends of the Scarsdale Library and another for $50,000 from the Scarsdale Foundation. See photo above.

Fireworks And Fun On July 4th

- Details

- Written by: Hannah Glickenhaus

- Hits: 5172

Thousands of people crowded the Scarsdale Pool on June 29th to watch the spectacular and beloved fireworks show. The fireworks were visible from Crossway and Boulder Brook Field, which unsurpisingly were also packed with people. The Independence Day festivities continued at the Scarsdale Pool Carnival on July 4th. With the help of a DJ, lifeguards and swim instructors, there was a fun day of many activities including freestyle swimming races, parent-child swimming relay races, kick board races, donut float races, and a penny hunt. For those kids who were not aquatically inclined, there was a free-throw basketball competition and a giant blow up slide for them to enjoy. With extra staff on hand, there was individual face painting and Fourth of July themed temporary tattoo application. The kids loved the events and especially loved seeing lifeguards dressed as some of their favorite animated characters, Dory from Finding Dory, and Chase from Paw Patrol. In the spirit of the Fourth of July, there was also a lifeguard dressed as Uncle Sam. It was a fun-filled day for all!

Thousands of people crowded the Scarsdale Pool on June 29th to watch the spectacular and beloved fireworks show. The fireworks were visible from Crossway and Boulder Brook Field, which unsurpisingly were also packed with people. The Independence Day festivities continued at the Scarsdale Pool Carnival on July 4th. With the help of a DJ, lifeguards and swim instructors, there was a fun day of many activities including freestyle swimming races, parent-child swimming relay races, kick board races, donut float races, and a penny hunt. For those kids who were not aquatically inclined, there was a free-throw basketball competition and a giant blow up slide for them to enjoy. With extra staff on hand, there was individual face painting and Fourth of July themed temporary tattoo application. The kids loved the events and especially loved seeing lifeguards dressed as some of their favorite animated characters, Dory from Finding Dory, and Chase from Paw Patrol. In the spirit of the Fourth of July, there was also a lifeguard dressed as Uncle Sam. It was a fun-filled day for all!

Fireworks Spectacular on Thursday June 29th, Carnival on July 4th at the Pool

- Details

- Written by: Joanne Wallenstein

- Hits: 6654

The Scarsdale Parks and Recreation Department have announced the annual fireworks spectacular and the July 4th carnival at the Scarsdale Pool Complex.

The Scarsdale Parks and Recreation Department have announced the annual fireworks spectacular and the July 4th carnival at the Scarsdale Pool Complex.

Fireworks Spectacular (Thursday, June 29th)

Scarsdale's Annual Fireworks Spectacular, open to the public, will be presented at the Scarsdale Pool on Thursday, June 29th, at 9:15 PM. Returning to the spectacular will be a performance by the Westchester Band at 7:30PM. Please note that a $2.00 fee will be charged to all non-pool members entering the pool starting at 5PM in conjunction with the scheduled fireworks. Beginning at 8PM ALL individuals entering the Pool Complex will be charged $2.00. Picnicking is allowed on the grounds, but alcoholic beverages and smoking are not permitted. Pool members wishing to avoid paying the $2 fee are advised to enter the pool facility before 8PM.

July 4th Carnival (Tuesday, July 4th)

Throughout the day on Tuesday, July 4th, there will be a variety of carnival attractions and aquatic games at the Scarsdale Municipal Pool between the hours of 11:00 AM and 4:00 PM. A DJ will be on hand playing music! Picnicking will be allowed in the pool complex during the day as well, but alcoholic beverages and glass containers are forbidden.

Road Repair Please!

- Details

- Written by: Joanne Wallenstein

- Hits: 5152

Dear Scarsdale10583:

Dear Scarsdale10583:

This letter was sent to Scarsdale10583 by Sal Gulla of Ferncliff Road:

Walkers, joggers, bikers, roller bladers, baby carts, etc., take their chances while navigating our town streets ! I assisted a health aide struggling to lift her stroke patient whose walker was stuck in a pothole 8 inches deep on Ferncliff Road...My front lawn was destroyed 3 times in two years by cars and trucks not knowing where the curb meets my lawn..most curbs are buried ..I lost 3 profile tires in the village due to potholes...village agent said those holes were not registered, therefore no compensation was due me...what gives ?? !!!

Salvatore Gulla

38 year resident at 1 Ferncliff Road

Village Explores Future of Freightway Site

- Details

- Written by: Elizabeth Marrinan

- Hits: 4315

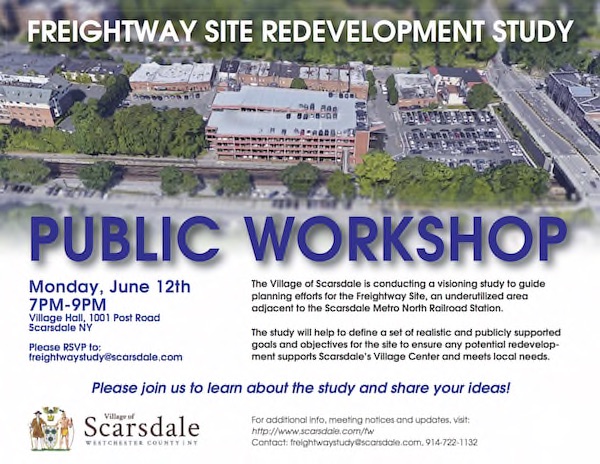

The Walking Tour is one step in the Village's visioning study to guide potential redevelopment of the Freightway Site, the underutilized area adjacent to the Scarsdale Metro North Railroad Station. The purpose of the study is to provide a community-based vision to ensure future redevelopment enhances the Village Center and meets local needs. Over the past 30 years, numerous studies have focused on the site, due to its key location in the Village Center. The Village is renewing its planning efforts, given the current condition of the Freightway Garage and the anticipated need for repairs and improvements.

Toward that end, the Village Board appointed the FSC to create goals and objectives for the future development of an attractive, economically viable project on the site. BFJ Planning has been retained to provide technical support. The First Freightway Redevelopment Study Public Workshop will be held on Monday, June 12th, from 7-9 PM in Rutherford Hall at Village Hall, 1001 Post Road.

The FSC welcomes all interested residents, property owners, merchants and other stakeholders to attend and share their thoughts on the vision, goals and objectives for the site. Two additional workshops will be held in the fall to continue the conversation and provide opportunities for feedback on the vision. An online survey will also be launched over the summer. For further information visit the project web site: www.scarsdale.com/fw . Email comments to [email protected] or contact Elizabeth Marrinan at 722-1132.