Juno Brings Little Snow to Scarsdale

- Details

- Written by: Joanne Wallenstein

- Hits: 5369

Likening would-be winter storm Juno to the 1966 film, "The Russians Are Coming," Scarsdale Village Manager Al Gatta did not mince words when he expressed his frustration with the circumstances surrounding the Village's storm preparedness drill on January 26-27.

Likening would-be winter storm Juno to the 1966 film, "The Russians Are Coming," Scarsdale Village Manager Al Gatta did not mince words when he expressed his frustration with the circumstances surrounding the Village's storm preparedness drill on January 26-27.

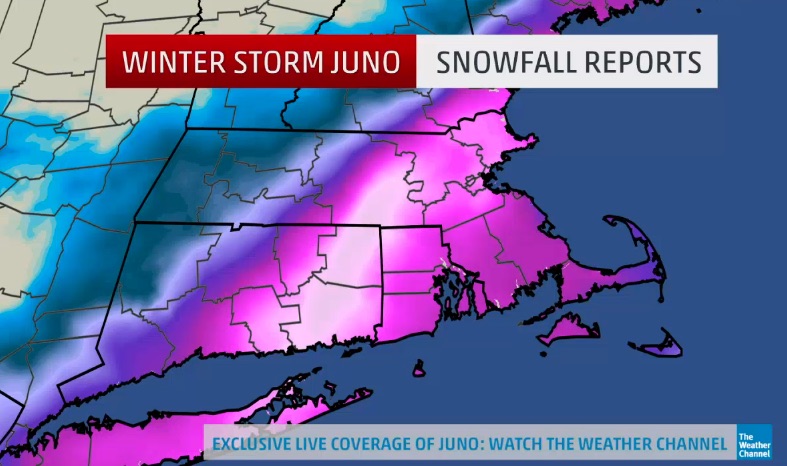

After dire forecasts from the National Weather Service and more communications than he could count from Governor Cuomo and County Executive Rob Astorino, Gatta instructed staff to open an emergency operation center on Monday and kept almost 60 Village employees including police, fire, sanitation and managers on duty all night, awaiting what was supposed to the mother of all storms. Expecting hurricane strength winds and two feet of snow, Gatta and his team were staffed up to confront an Armageddon that failed to arrive.

Plows were out all night clearing scant accumulations, while the Village budget accrued the expense of paying overtime to the staff.

Could this have been avoided? Gatta said, "We did not have accurate information. Even when the storm steered away from New York, the weather service did not alter their forecast. There was no wind – just an overblown report from the Governor."

Was the exaggerated forecast an outcome of social media and the ease of transmitting information? That's something that will take months to investigate. Clearly, after the devastating effects of Hurricane Sandy, politicians and officials are afraid to be blamed for putting constituents in harms way and seem to err on the side of caution. When the Governor was charged on Tuesday with overreacting he told CNN, "Better safe than sorry," "Hindsight is 20/20. You act on the information you have at the time." Later Tuesday morning he told reporters at a press conference, "We've had people die in storms ... I'd much rather be in situations where we say, 'We got lucky.'"

However a total shutdown of New York, including all transportation systems, the airports, schools and businesses will come at a high cost and next time officials may hedge their bets and implement more flexible plans that allow them to adjust to the weather as it occurs. For his part, Gatta is calling for the Governor to reimburse local municipalities for the expenses incurred due to the threatened storm.

In Scarsdale, with the roads clear and snowfall on the wane, Mayor Bob Steves lifted the state of emergency that had been declared effective 9 am on Tuesday. Though roads are open – almost nothing else in town is operating. As of Tuesday afternoon, Metro North announced that train service will resume on a Sunday schedule and return to normal on Wednesday.

This could well be Gatta's last storm drill in Scarsdale as he has announced his plans to retire at the end of the fiscal year. He told Scarsdale10583 that he's "ready for some peace and quite from now until June."

Deputy Manager Steve Pappalardo to Succeed Al Gatta as Village Manager

- Details

- Written by: Joanne Wallenstein

- Hits: 7629

Now that Al Gatta has decided to retire, what's in store for the leadership of Scarsdale Village? We spoke to Scarsdale Mayor Bob Steves who shared the news that Gatta was retiring and offered information on succession plans.

Now that Al Gatta has decided to retire, what's in store for the leadership of Scarsdale Village? We spoke to Scarsdale Mayor Bob Steves who shared the news that Gatta was retiring and offered information on succession plans.

Speaking about Gatta, Mayor Steves said, "We are losing a real good man. Al approached the job with the utmost professionalism. He understood the non-partisan mindset of the community and followed that mindset in the way that he staffed and led – all to the real advantage of the village."

Steves continued, "Al pays attention to the voices of the village trustees and residents and is on top of the community. He brought experienced professional judgment to the job. Gatta's professionalism shows itself in the quality of the senior staff and department heads and in the way all the village departments deal with the public."

We asked Mayor Steves why Al decided to retire this year and Steves replied, "He simply thought it was time to pursue other interests. The decision came as a surprise to me. There was no particular event or situation behind it... he just felt it was an appropriate time to move on and give Steve an opportunity to move up."

According to Steves, when Gatta told him he planned to retire Gatta quickly shared his thoughts on the process for finding his replacement. Though the village could conduct a nationwide search for a new manager, Gatta believed that the best candidate for the job was Deputy Village Manager Steve Pappalardo. Due to his tenure with the village and his training under Gatta, Al thought that Scarsdale would be best served by promoting Steve to the top spot and running a search for a new deputy manager.

But before making a decision, Mayor Steves convened a meeting of the former mayors of Scarsdale to hear their views on the pros and cons of promoting Pappalardo, an internal candidate. Mayor Steves happily reported that all the former mayors agreed that Steve Pappalardo was the best choice.

But their vote was not enough. The decision to select a village manager lies in the hands of the current Scarsdale Board of Trustees. A private session of the Board of Trustees was held to interview Pappalardo, At the conclusion of their discussions, the Board was unanimous in their decision to appoint Pappalardo as village manager.

In an email to village staff, Gatta announced his departure and Pappalardo's promotion saying, "I am pleased to inform you that Steve Pappalardo has been favorably considered as my successor. I trust that you will support Steve and make his time as manager rewarding as you have done for me over the years."

Village to Consider Ban on Plastic Bags and Styrofoam

- Details

- Hits: 5026

It's getting harder and harder to keep track of how many plastic bags we've all stashed up over the years. However, it seems our piles are growing a bit too large. On January 13th, the Village Trustees heard from concerned community member Michelle Sterling about the importance of a county-wide ban on single use plastic bags and styrofoam. Sterling opened her comments by noting that the Westchester County Board has already started work on drafting legislation for a county-wide ban and she strongly urged Scarsdale to consider a similar ban.

It's getting harder and harder to keep track of how many plastic bags we've all stashed up over the years. However, it seems our piles are growing a bit too large. On January 13th, the Village Trustees heard from concerned community member Michelle Sterling about the importance of a county-wide ban on single use plastic bags and styrofoam. Sterling opened her comments by noting that the Westchester County Board has already started work on drafting legislation for a county-wide ban and she strongly urged Scarsdale to consider a similar ban.

Sterling contends that the negative environmental effects of the use of plastic bags has been devastating, saying that pollution caused by the bags has pushed many of our neighboring towns to accept this legislature already. Rye, Mamaroneck, Larchmont and Hastings-On-Hudson are only a few of the areas that saw pollution in their surrounding waters and decided that the ban was in order.

In Scarsdale alone, we use six million bags a year. They don't just disappear after we empty the groceries--they feed into the rivers and oceans, killing animals and blocking important pipelines. Scarsdale resident Madelaine Eppenstein added to this argument for change, saying that "sometimes empirical evidence is too much to ignore." In many areas of Europe, plastic bags have already been banned. In Germany, the tax on purchasing plastic bags discourages many civilians from using them. Legislative bans on styrofoam have already been passed in New York City. Sterling made it clear that it is time for this kind of change in Scarsdale as well.

Sterling did address concerns businesses might have regarding the ban. Some retailers fear that it will drive customers away from their stores and into others. Sterling had an answer for that as well. Since the ban will be county-wide, customers of Scarsdale grocery stores won't be able to hop in the car and drive to the next town for their goods. People in every town will be forced to be more environmentally aware and bring recyclable bags. Though it may admittedly be hard to remember to B.Y.O.B on our shopping trips at first, the positive effects of shoppers care for the environment will be numerous, and should sustain the beauty of our town for many years to come.

Should we consider this ban? Will it protect and preserve our environment for future generations? Will it hurt Scarsdale business? What do you think? Leave a comment with your opinion and see what others think.

Scarsdale Police Chief Retires After 37 Years

- Details

- Written by: Traci D. Ludwig

- Hits: 12536

Approximately 37 years ago, Chief John Brogan started his career with the Scarsdale Police Department. At the end of January 2015, Brogan will retire from his position as chief and will begin exploring a new chapter in his life. His successor will be Andrew Matturro, who is currently serving as captain of the Scarsdale Police Department.

Approximately 37 years ago, Chief John Brogan started his career with the Scarsdale Police Department. At the end of January 2015, Brogan will retire from his position as chief and will begin exploring a new chapter in his life. His successor will be Andrew Matturro, who is currently serving as captain of the Scarsdale Police Department.

It was February 15, 1978, when Brogan started his career with Scarsdale police. Jimmy Carter was president of the United States; a first class stamp was worth 13 cents, and a gallon of milk cost $1.75. John Travolta was a cultural icon, and his disco moves lit up the movie screen in “Saturday Night Fever.”

As a young graduate of the police academy in 1973, Brogan dreamed of joining the New York City Police Department. However, it was a difficult time as the lingering oil crisis strained the U.S. economy and tightened municipal budgets. So, there weren’t many jobs available. Brogan applied for police work across the United States and eventually accepted a seasonal position with the New York State Park police. He also worked construction jobs on the side. After about a year, he was hired for a fulltime position with the City of Newburgh Police Department, where patrol officers kept busy with the city’s high crime rate. The job was exciting, but it was unstable due to dependence on federal funds. Brogan saw several colleagues experience layoffs; so he decided to take the civil service exam for eligibility in Westchester police departments and was quickly offered positions in both Pelham and Scarsdale. Drawn in by the beauty of the village and the community’s friendly environment, Brogan accepted the job in Scarsdale – and the rest is history.

“I could see that police work here would be very different than the typical cops and robbers stuff that I did in Newburgh. Here, the community liked and appreciated their police officers, and the police department worked diligently to be there for the community and to provide a high level of service,” Brogan said in an interview last week. “In some places, policing means chasing criminals, dealing with drug trade, responding to domestic disputes and addressing quality of life violations such as alcohol and disorderly conduct in the streets … but in Scarsdale, we don’t see much of these typical things. Here, police need to be engaged with the community and have a strong visible presence. People need to feel protected and served, with a definite sense of safety and security. It’s a different kind of service.”

Coming from an Irish Catholic family full of men who were proud New York City police officers and firefighters, Brogan grew up with a deep respect for the dedication and professionalism required by a job in public service. However, Brogan also genuinely felt the commitment to police work with an innate sensibility. “It was never just a job for me. I always tried to bring something proactive to it – to be out there really working to make things better, to engage people in meaningful ways and to make tangible contributions,” he said.

After serving the village as a Scarsdale patrol officer for almost ten years, Brogan was promoted to SPD patrol sergeant in 1987. Five years later, in December 1992, he became patrol lieutenant. Ten years after that, in May 2002, Brogan was promoted to chief of the Scarsdale Police Department. He replaced the retiring chief, Don Ferraro, who was an incredible mentor, according to Brogan.

Reflecting on various positions over the years, Brogan identified a special affinity with the patrol division: “Patrol is important because patrol is responsible for the actual delivery of service. It might not be the most glorified position, but patrol is the most visible, active and essential component of any department. Patrol responds to crimes in progress and incidents in which people are at their most vulnerable. It involves a lot of quick thinking on your feet and human compassion. It can be hours of boredom followed by moments of terror. Patrol is the backbone of any department.”

One of Brogan’s most memorable incidents occurred as a young patrol officer in Scarsdale. Brogan had been assigned to a plainclothes squad targeting a suspect accused of approximately 80 village burglaries committed during the late evening and early morning hours. He recalled: “We were put on steady shifts from 10 p.m. to 6 a.m. to try to catch the guy. One night I was dispatched to an alarm and was less than 30 seconds away. As I arrived, I saw an open house door and ran in. The homeowner shouted he had chased the burglar from the house, and the burglar fled over the backyard fence. It was a cold January night, with a full moon and traces of snow on the ground. I began to climb fences and trek through backyards, guided by an occasional footprint in the snow.”

Eventually, Brogan caught up with the perpetrator, who was lying in a backyard next to his jacket. The young man was not attempting to hide; nor was anything nearby that could have caused him to trip and fall. “I ordered him to remove his hands from under his body, and he responded with a string of profanities,” Brogan said. “I called for backup but wasn’t sure where I was because I had been going through backyards. Finally, a woman opened her house window. She asked what was going on and told me the address. When backup arrived, I began to handcuff the man, and he started moaning. I repeatedly asked what was wrong; but he only responded with profanities. It was then that I noticed a small hole in the back of his T-shirt. I lifted his shirt and saw a bullet wound just below his shoulder blade.”

Brogan then broadcasted that the suspect was suffering from gunshot wounds, and he requested an ambulance. When the  department’s commanding sergeant responded to the scene, he asked Brogan about the gunshot wound, assuming Brogan had shot the suspect. Brogan convinced the sergeant he had not fired his gun, and they both returned to the scene of the burglary for further investigation. Eventually the homeowner admitted to shooting the burglar as he fled the house. The suspect, who never told Brogan he had been shot, was barely alive when he arrived at the hospital; but when Brogan was assigned to guarding the suspect at the hospital later that week, “he stopped cursing and thanked me for finding him and saving his life,” Brogan said.

department’s commanding sergeant responded to the scene, he asked Brogan about the gunshot wound, assuming Brogan had shot the suspect. Brogan convinced the sergeant he had not fired his gun, and they both returned to the scene of the burglary for further investigation. Eventually the homeowner admitted to shooting the burglar as he fled the house. The suspect, who never told Brogan he had been shot, was barely alive when he arrived at the hospital; but when Brogan was assigned to guarding the suspect at the hospital later that week, “he stopped cursing and thanked me for finding him and saving his life,” Brogan said.

Other memorable career events included the challenging resolution of a home invasion case involving the same-day arrests of eight suspects, from New Rochelle and the Bronx, who worked together to pull off the crime – as well as a case in which Brogan managed to reunite a 13-year-old boy in Newburgh with his stolen bicycle. “The kid was brokenhearted since his family was of modest means, and the boy had been working odd jobs for some time to save up and purchase the bike,” Brogan said. “About a week after the bike was stolen, I noticed a bike with an evidence tag in the booking room at police headquarters and immediately recognized it as the bike in question. I called the kid’s home and told him to come and pick it up. Although it didn’t take much effort on my part, and no great police work was involved, I still vividly remember how happy and full of gratitude the boy was when his bike was returned to him. For this reason, it stands out as one of the more gratifying experiences I’ve had in my career.”

During his tenure as chief, Brogan has actively cultivated a philosophy of “policing as a people business,” and he has worked toward initiatives that have fostered a greater sense of organizational identity within the department.

The renovation and expansion of the Public Safety Headquarters building was actualized while Brogan was chief. From planning through construction, the total project took more than seven years and required the creation of a redundant communications and booking center that mimicked the previous facilities and ensured no interruption of service to the community during the department’s relocation to temporary headquarters. Now, the resulting permanent structure represents a state-of-the-art facility equipped for best practice in communications, training, investigation, administration and practical needs – for today and for the future.

Other notable achievements include the following. Brogan instituted a Motorcycle Unit, and he expanded and professionalized the department’s Honor Guard. Both are primarily used for ceremonial functions. Brogan started an orientation program for new hires and invited family members to participate, which has worked to build a strong sense of community and camaraderie. Diversity has increased within the department during Brogan’s 12 years as chief, thus allowing the department to better serve Scarsdale residents and the community at large. Under Brogan’s guidance, all members of the department’s command staff are now required to attend the FBI National Academy, a 10-week residential program for law enforcement executives in Quantico, Virginia. During Brogan’s tenure, the department has also actively pursued a set of policies and procedures that fulfill the requirements of several hundred best practice standards covering every aspect of law enforcement for the purpose of national accreditation. As a result, the department has successfully maintained national accreditation since 1995. In 2009, the department was further sited as one of five flagship agencies in the nation; and this coming March, it is expected to achieve gold standard accreditation.

“Everyone comes here wanting to be a police officer. But we want our people to be Scarsdale police officers,” Brogan said. “Thus, all of these efforts add to our professionalism and to the sense of pride and identity that our members have in this organization. This pride manifests itself not only in the heroic work our officers perform when necessary but also in the good community-based work done on a daily basis. The chief sets the tone, but the real police work is done by the patrol officers on the street, the first line supervisors, the detectives and the support personnel like the dispatchers, the animal control officers, police aides, parking enforcement and records room personnel. … Going the extra mile here is not the exception; it’s the rule.”

Following his retirement at the end of January, Brogan is looking forward to keeping busy in the private sector. He has taught criminal justice at Dutchess Community College for four years and is considering an opportunity to work as an adjunct professor at another college in New York. He also plans to expand his involvement with the Rotary Club, either in Scarsdale, where he has been an active member for many years, or in his own community. “I want to stay in a role where I can make a difference in the lives of people, and volunteer work brings a sense of great reward and purpose,” Brogan said.

“I will miss the structure and the excitement of the job, and I will miss the personnel,” the Chief reflected. “I have been blessed to have worked with an incredible group of people, including members of this department, a supportive village administration, talented and dedicated elected officials and others who were always willing and eager to lend a hand. Together, we inherited a great organization from former Chief Don Ferraro, and together we worked to make the Scarsdale Police Department at least a little better than how we found it. Mostly, I will miss being part of the energy of this team.”

And certainly, the team – and the entire community– will miss their Chief.

Trustees Consider Move to Limit Home Sizes in Scarsdale

- Details

- Written by: Joanne Wallenstein

- Hits: 5139

Village Trustees took an initial step toward curbing the construction of oversized homes at a meeting of the Law and Land Use meeting on December 9, 2015. At a previous meeting the committee had asked Village Planner Liz Marrinan to assess the visual impact of proposed changed to the FAR regulations to reduce the bulk of new and renovated homes.

Village Trustees took an initial step toward curbing the construction of oversized homes at a meeting of the Law and Land Use meeting on December 9, 2015. At a previous meeting the committee had asked Village Planner Liz Marrinan to assess the visual impact of proposed changed to the FAR regulations to reduce the bulk of new and renovated homes.

On December 9 Marrinan reported that 3D models of a variety of FAR requirements had been simulated when the trustees considered the FAR regulations several years ago. She proposed that the architect who did those simulations be invited to a meeting of the committee where he could do a live demonstration of the models and answer trustees questions on the visual impact of possible changes to the requirements. The trustees agreed to set up this meeting.

In addition, Village staff will undertake a study of the impact of treating driveways as impervious surfaces for purposes of calculating lot coverage, as is done for storm water purposes.

However, since it assumed that any possible change to the regulations would take a minimum of 6 to 9 months to put into effect Trustee Brodsky proposed a moratorium on building homes with gravel driveways for the next six months as a way of curbing the construction of homes with maximum lot coverage.– Since gravel is considered a pervious surface the area of gravel driveways does not count as lot coverage, and therefore allows for the construction of larger homes.

Village Attorney Wayne Essanason recommended against the moratorium stating that it would impact individual property rights and that he did not believe it would have a big impact on reducing the size of new homes.

However Brodsky disagreed, saying that it will take many months to study the FAR and pass any amendments to Village Code. Trustee Stern agreed, saying " Many have come before this board expressing dismay about the large houses going up. If we do this, we can at least prevent some large houses from being built. And once these homes go up, it's irreversible. If we can do a small thing to have new homes conform to FAR, we should do it."

Trustee David Lee proposed that the moratorium only apply to applications where the installation of a gravel driveway would permit the builder to construct a larger home than if an asphalt driveway was built. In other words, he proposed that the moratorium apply to applications where the use of a gravel driveways puts the house over the lot coverage limit. Brodsky concurred, saying, "We will capture those that are using the disparity as a development tool."

Mayor Steves agreed, saying, "I do not find this requirement to be onerous. There is a general sense of concern from the community about the construction of new houses. If we have misread the community they need to let us know. We are trying to balance individual property rights with community concerns."

Despite reservations from Liz Marrinan and Wayne Essanason, the trustees asked Village Staff to come up with wording for the proposed moratorium and bring it to the committee in January.

The committee then turned to revisions to the Preservation Laws which will be refined and considered in 2015.

At the Village Board meeting that followed, the trustees discussed the following:

- The trustees agreed to schedule a public hearing on changes to the zoning code regarding clarifications related to the dimension of lots and the requirements for construction on non-conforming lots on Tuesday January 13, 2015 at 8 pm.

- The trustees granted approval for Chabad Lubavitch of Westchester County to place a menorah in Chase Park from December 16, 2014 to January 6, 2015.

- They passed a resolution allowing up to 25 White Plains residents to purchase permits to use the five

Scarsdale Village paddle courts for $90. The permits would allow these residents to use the courts from 10 am to 7 pm on Monday through Sunday – which the Recreation Department considered non-peak hours. The permits will be valid from December 10, 2014 to March 15, 2015.

Scarsdale Village paddle courts for $90. The permits would allow these residents to use the courts from 10 am to 7 pm on Monday through Sunday – which the Recreation Department considered non-peak hours. The permits will be valid from December 10, 2014 to March 15, 2015. - Trustee Stern reported that the Sustainability Committee is working with the Village on studying the feasibility of changing all Village streetlights to LED lights. They have installed LED lights on Heathcote Road near Kelwynne and on Kelwynne at Birchall Roads and Stern asked Village residents to look at these lights to see how they compare with regular lights and to send comments on the new LED lights to Village Hall.

- Deb Pekarek said that following the hearing on the proposed new leaf law, the Leaf Task Force was asked to put together a Q&A document about leaf mulching. They are in the process of doing so and it will be posted on the Village website and publicized in a mailing to Village residents. Mayor Steves said that the Village will continue to educate the community about mulching and looking into the leaf pick-up process.

- Pekarek also announced that the Westchester County Soil and Water Conservation District will honor

Scarsdale Village and the Scarsdale Friends of the Park. The Village will get an award for the George Field, South Fox Meadow storm water management project that includes the Cooper Green rain garden. They will give a commendation to the Friends of the Parks for the wetland restoration at the library.

Scarsdale Village and the Scarsdale Friends of the Park. The Village will get an award for the George Field, South Fox Meadow storm water management project that includes the Cooper Green rain garden. They will give a commendation to the Friends of the Parks for the wetland restoration at the library.