More on Tax Prepayments: Note from the Scarsdale School Board and the IRS

- Details

- Written by Joanne Wallenstein

- Hits: 6741

As time winds down for resolution of the issue surrounding prepayment of 2018 property taxes to decrease next year's tax burden, here's the latest information from the school board and the IRS.

As time winds down for resolution of the issue surrounding prepayment of 2018 property taxes to decrease next year's tax burden, here's the latest information from the school board and the IRS.

School Board President William Natbony and Vice President Scott Silberfein responded to angry residents who called for the district to permit the collection of 2018 school taxes, without a warrant. They asked the district to simply collect estimated payments before year-end and reconcile the difference in paid vs. actual after the school budget for next year is passed. However, Natbony and Silberfein explained why they were unable to comply. See the full explanation below.

Also, today's New York Times alerts readers to an advisory notice posted on the Internal Revenue Service website that says, "To qualify for the deduction, property taxes not only need to be paid in 2017, they must also be assessed in 2017 — meaning that homeowners who prepaid their taxes based on estimated assessments, or who tried to pay several years' worth of taxes at once, will probably be out of luck."

If this advisory holds up, it will mean that none of the prepaid local property taxes will be deductible from 2018 tax returns.

See more below:

Letter from School Board President William Natbony and VP Scott Silberfein:

The Board of Education has received many emails in response to our communication today concerning the School District's legal inability to issue a warrant relating to 2018-2019 school taxes. We do understand the frustration expressed in these emails. We share your frustration. However, our legal inability to issue a warrant is not the result of inaction or choice, but based on consistent advice and information carefully reviewed, including advice from the District's outside counsel. That advice is consistent with the advice we know other School Districts have received. We are not aware of any School District that is planning to issue a warrant now for 2018-19 school taxes. Our best information and continued received advice is that we cannot issue a warrant for 2018-19 school taxes because the budget process for that budget cycle has not occurred and the budget has not been approved, after proper notice is provided to the community, by community vote as required by law before a warrant can issue.

A number of emails have suggested that other Villages, Municipalities and School Districts are allowing for prepayment. Again, we are not aware of any School District that is issuing a warrant now for 2018-19 school taxes. There are a number of Districts where prepayment of 2017-18 school taxes (where a portion is due in early 2018) is being permitted. Those circumstances involve assessments and warrants that were previously issued and approved for the 2017-18 tax year in accordance with State law. In Scarsdale, we do not have that payment schedule and all 2017-18 school taxes are payable in 2017. To the extent some Villages and Municipalities are allowing for prepayment of some taxes, I note that Villages and Municipalities are not subject to the same budgetary process and procedural requirements before issuing a warrant as New York non-City, public school districts.

Other emails have inquired about prior communications and messages from the Village (not the School District) regarding prepayment. It is the School District's understanding that a prepayment opportunity for school taxes was offered based on the best information available to the Village at the time in order to allow Scarsdale residents time to consider the benefits of prepayment and as much time this week to commence payment. We understand the Village only collected the money to hold and has not deposited any checks. All of this was done with the understanding that the three taxing jurisdictions (County, Village and School District) would ultimately decide if they are legally permitted and wish to move forward with this apparent opportunity based on their independent reviews relative to the Executive Order and the applicable statutory requirements which are different for all three.

Relevant here, the Governor's Executive Order did not suspend any of the legal requirements concerning the budgetary process and community vote applicable to the School District and, in any event, did not specifically authorize prepayment of 2018-19 school taxes. The Executive Order does not allow for the prepayment of school taxes for the 2018-2019 school year (July 1, 2018 through June 30, 2019). Unlike villages, towns and counties, a school district fiscal year runs from July 1st to June 30th. Further, in accordance with New York Law, prior to the collection of taxes, school districts are required to construct a school budget, seek approval of the budget by its voters, and finalize the tax warrant, where applicable, or set the tax levy. Boards of Education will not be considering final approval of those budgets until March and/or April of 2018. Pursuant to New York State Education Law, required taxpayer voter approval of these budgets will not occur until the third Tuesday in May, as fixed by statute. The Executive Order does not modify or suspend any of these Education Law requirements for the adoption of a school budget. Likewise, the Order does not suspend any provision of Article 13 of the Real Property Tax Law which governs the levy of property taxes for most school districts. Before the local assessing jurisdiction issues the tax warrant to collect taxes for 2018-19 school year, the law requires that the school budget be approved by the voters. Accordingly, the Order does not provide any legal authority for school districts to now adopt estimated 2018-2019 budgets and/or set tax levies for the 2018-2019 school year, nor to authorize the collection of taxes corresponding to those levies.

A number of emails from community members have expressed anger, disappointment and some harsh words about the School District's and Board's position. Some community members have gone so far as to accuse the School District and Board of not caring about Scarsdale's residents or to threaten voting "no" on the upcoming bond proposal and 2018-19 budget unless there is a "change of mind" on this issue.

We hope that the community understands that the School District's conclusion has been reached in good faith and that the School District and Board want to do what is legally possible to provide the opportunity to taxpayers to prepay the 2018-19 school taxes. Unfortunately, our advisors, consistent with other opinions and analyses reviewed, continue to conclude and advise that the School District and the Board, as fiduciaries, cannot legally issue a warrant at this time for the 2018-19 school taxes. We will continue to work hard and inquire about creative or alternative options to enable us to issue the warrant.

IRS Advisory on Deductibility of Prepaid Taxes

The New York Times article concerning deductions for prepaid property taxes warns that they may not be permitted by the IRS.

Even though Governor Cuomo signed an executive order authorizing municipalities to collect prepayments, the IRS could bar filers from making these deductions.

Why? The article says, "In an advisory notice posted to its website on Wednesday, the I.R.S. said that maneuver could work, but only under limited circumstances. To qualify for the deduction, property taxes not only need to be paid in 2017, they must also be assessed in 2017 — meaning that homeowners who prepaid their taxes based on estimated assessments, or who tried to pay several years' worth of taxes at once, will probably be out of luck."

However, the article states, "The I.R.S. guidance is advice to taxpayers and tax preparers, not a legal ruling. And the agency did not define what it means for a tax to be "assessed." Read more here:

Oversized Houses on Undersized Lots

- Details

- Written by Joanne Wallenstein

- Hits: 9433

(This article was first published in 2014 - but there have been no changes to Village Code since then. Given the debate about preservation and new construction, we thought it was worth a second look.) During the debate over the use of gravel to extend lot coverage on home sites, many asked, "If people are concerned about the size of new and renovated homes, why not change the laws that regulate the size of homes, rather than the use of gravel?"

(This article was first published in 2014 - but there have been no changes to Village Code since then. Given the debate about preservation and new construction, we thought it was worth a second look.) During the debate over the use of gravel to extend lot coverage on home sites, many asked, "If people are concerned about the size of new and renovated homes, why not change the laws that regulate the size of homes, rather than the use of gravel?"

We took a look at the Village's existing floor area ratio (FAR) regulations that specify the maximum allowable size of homes on various size lots in the Village. The good news is those rules look perfectly generous and reasonable.

For instance, on a home on 1/3 acre, or about 14,500 square feet, the maximum allowable home size is about 4,300 square feet. Sounds adequate to me, but apparently builders are finding ways to build much larger homes on these lots.

For instance, a new home under construction next to the Greenacres School at 42 Huntington Avenue is advertised as a 6,115 square foot home on a lot of .31 acres.

How can the builder construct a home that is almost 50% larger than the permitted 4,300 square feet, and taller than all the neighboring homes?

The answer lies in the exemptions to the floor area ratio (FAR) requirements that are outlined in section 310-103 of Village code. Local builders and architects have grown adept at using these exemptions to build homes that are far larger than the ones the trustees originally envisioned when they enacted this code in 2003 and 2008.

The exemptions allow some full basements, dormered attics, garages and the space above them all to be exempt from the maximum floor area rules.

For instance, many of the new homes have front facing garages with rooms above the garage. In this case both the garage and the room above it are exempt. If a typical two-car garage is 20 x 20 feet, the space above it could be 400 square feet, and that space is exempt from the FAR.

For basements, if the foundation wall of the basement is not more than 3 feet above grade on the front of the house, the entire basement does not count in the calculation. That means that if a house is on a sloped property, it may have a full finished basement with full-length windows on the side and back of the house.

The area under dormered roofs on the third floor of a house does not count either – if builders extend the dormers for less than 1/3 of the linear footage of the front, and set the dormers beyond 5-feet of the sidewalls on the back. This allows third floor spaces that add considerable square footage to a house.

And why do the new houses appear to tower over their neighbors ... Because they actually do extend beyond the 35-foot height limit. With a peaked roof the house can be taller as the building height can be calculated to the mid-point rather than the peak of the roof. That's why so many of the new homes feature a peak or two like the one shown here.

Therefore, from what I see, the Village does not need to amend the maximum allowable size of a house. Instead they should take a second look at the exemptions. By tightening those exemptions, the Village can require that appropriately-sized homes be built on residential lots. Or, as one reader suggested, simply by counting all finished interiors spaces in the Floor Area Ratio calculation, home sizes could be reduced.

Two other changes could also be considered if Trustees are serious about preserving open space and reducing the appearance of bulk.

Some of the newer bulkier homes are built closer to the street than the teardowns they replace. Since the new homes are also taller and wider, by moving them closer to the curb, they appear to loom over their neighbors and don't conform to the site line of the existing homes. Perhaps laws can be changed to require that the front setback of a replacement home is consistent with the footprint of the original home.

Subdivisions of Village lots continue to be a lucrative way for developers and property owners to add homes to Scarsdale's already densely populated streets. Once a lot is subdivided, two new homes can be built where just one originally stood. This often results in crowding, destruction of trees, new curb cuts, and less breathing space for neighbors. In the past few weeks, the land use boards have considered and approved subdivisions at 21 Rodney Way, 12 Stonewall Lane and 2A Normandy Lane.

Do you have ideas for controlling development and land use in Scarsdale? Share them in the comments section below.

New Tax Code Could Hit Scarsdale Hard

- Details

- Written by Joanne Wallenstein

- Hits: 10557

Scarsdale residents and Scarsdale home values could both take a big hit when the new tax bill is enacted. At present the differences between the House and Senate versions of the tax bill will be reconciled by a conference committee and then enacted into law, but both versions include provisions that will be costly to many Scarsdale residents.

Scarsdale residents and Scarsdale home values could both take a big hit when the new tax bill is enacted. At present the differences between the House and Senate versions of the tax bill will be reconciled by a conference committee and then enacted into law, but both versions include provisions that will be costly to many Scarsdale residents.

Both versions would hurt New York residents and especially residents in areas with high property taxes like Scarsdale as they limit the property tax deduction to $10,000 per year and completely eliminate deductions for state and local income taxes (SALT). According to the New York Times, Westchester County taxpayers are among 12 national counties that take the highest SALT deductions, with 47% of residents taking an average deduction of $34,300. However in Scarsdale, where the homeowner of an average house pays about $35,000 in real estate taxes alone, the impact of the loss of this deduction would be far greater.

The two bills differ on the deduction for mortgage interest. The limit for mortgage interest deductions are $500K for the House bill and $1mm for the Senate bill.

Moody's Analytics predicts that the elimination of the SALT deduction will cause housing prices to fall about 10%, as homes will have greater carrying costs per month and be less affordable to prospective buyers. If the House version of the bill is passed and mortgage interest deductions are capped at $500,000 in debt, this could further impact homebuyers and the Scarsdale real estate market.

David Gussman a Scarsdale resident and mortgage professional provided this back-of-the-envelope example of how a typical Scarsdale home buyer stands to fair under the new code:

Assuming a $10K property tax deduction is passed and the mortgage limit is reduced to a maximum size of $500K for deductibility of interest, Gussman determined that a new home buyer making about $500K per year buying a $1.7mm home in Scarsdale and taking a $1mm dollar mortgage could see the after-tax cost of the mortgage payment and property taxes increase by about 20% in comparison to the payment under the current tax code. The after tax cost of the 30-year fixed rate mortgage and property tax payments under the current law is $5,140 per month and after the changes it would be $6,140 per month, for a difference of $1,000 a month.

The impact will be different for different homebuyers depending upon their level of income, particular tax situation and which elements are included in the final version of the tax bill.

David Gussman is a mortgage professional who has managed ~$80B of non-agency mortgage bonds at Fannie Mae and ran product and technology for a company that collected information on every mortgage in America and provided data and analytics to holders of mortgage risk. He currently makes investments in start-up specialty finance companies and advises companies in the real estate/mortgage space. He lives in Scarsdale with his family.

Beware of Postal Mailboxes

- Details

- Written by Justin Cooper

- Hits: 6906

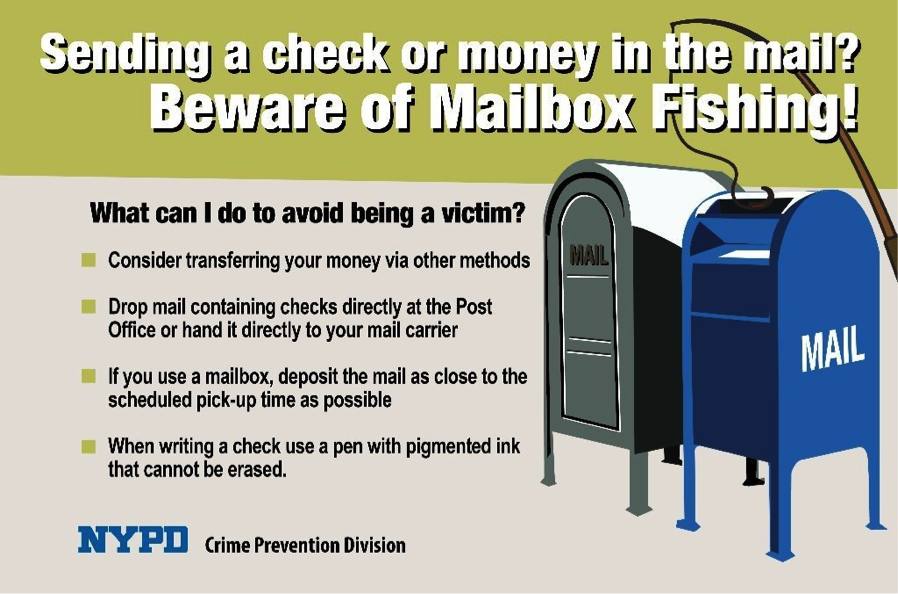

As we move into a digital age, cyber crime has become our primary security concern. However, using devices no more high-tech than a string and some glue, thieves successfully steal checks, mail, and identities through a process so simple that we often miss it. It's called "Mailbox Fishing."

As we move into a digital age, cyber crime has become our primary security concern. However, using devices no more high-tech than a string and some glue, thieves successfully steal checks, mail, and identities through a process so simple that we often miss it. It's called "Mailbox Fishing."

The crime is simple: thieves create a makeshift fishing rod by attaching an adhesive substance such as a rodent glue trap to a pole or string and "fish" mail out of blue US postal mailboxes. While unsuspecting victims believe they are safely mailing their cards, letters and bills, thieves have other plans. As the Westchester County District Attorney's office explains on its website: "Once your mail is stolen, any enclosed personal checks might be "washed," or wiped clean of all handwriting using an acetone solution and rewritten to change the payee and payment amount. The check will later be cashed or deposited and the money withdrawn. Often times, the check writer won't know for a month or more that the check has gone missing."

Last week, a Scarsdale resident was the victim of mailbox fishing, which resulted in theft of over $20,000 from her bank account through check forgery. She mailed nine checks at the US postal mailbox located on the corner of Maple and Summit Aves in White Plains. Five days later, she learned from her bank that her checks were stolen out of the mailbox and the amounts and payees were altered. Her signature was the only thing to remain from the original checks. Thieves presented three checks for cashing at there different banks, two such checks were rewritten for $9980.00, and upon the attempted cashing of the fourth check, the bank suspected fraud and the account was closed. While the money has been returned, the thieves still remain at large, and the Scarsdale police are now involved in trying to track down the criminals, who are likely part of a larger ring that is plaguing Westchester with this mailbox fishing scheme.

Earlier this year, Scarsdale Police arrested a man who had fished mail out of the mailboxes located on Woodland Place and on Chase Road in front of the Scarsdale Post Office. Mailboxes at other locations in Scarsdale, including the mailbox at the five corners in Heathcote, and a mailbox on Boulevard, have also been the targets of mailbox fishing. Other Westchester towns are confronting similar issues. The Yonkers Police Department has reported that the postal service is in the process of upgrading door style mailboxes in Yonkers to the drop-slot variety to help prevent mailbox theft. In Tuckahoe, residents also have complained about being victims of mailbox fishing, and in Tarrytown Police posted a warning on Facebook to "Beware of Mailbox Fishing!"

New York City has been struggling with this crime for a while, prompting NYPD to send out a tweet with tips to help stay safe from mailbox theft.

Scarsdale Detective Joe Serio has been investigating mailbox fishing and working with the other police departments in the county and the US postal police to help reign in the criminals responsible for the rash of mailbox theft. He recommends always walking your mail into the post office to either deliver it into a mail slot inside the post office or to hand it to a postal worker directly. As the Scarsdale resident who recently fell victim to mailbox theft summed it up: "I always thought that the blue mailboxes were a safe way to mail letters and bills. I wish I had known that they are no longer secure. It would have only taken me a few extra minutes to walk my mail into the post office. I definitely will make this my routine from now on."

Mold Found in Greenacres School Classrooms and Basement

- Details

- Written by Joanne Wallenstein

- Hits: 11705

(Updated November 23, 2017) Confirming what many have suspected for years, the Scarsdale School District released recent findings of mold testing at Greenacres School in an email to parents from School Superintendent Dr. Thomas Hagerman and Assistant Superintendent Stuart Mattey on Wednesday November 22nd. The report says the testing was done on October 11 and October 28, 2017.

(Updated November 23, 2017) Confirming what many have suspected for years, the Scarsdale School District released recent findings of mold testing at Greenacres School in an email to parents from School Superintendent Dr. Thomas Hagerman and Assistant Superintendent Stuart Mattey on Wednesday November 22nd. The report says the testing was done on October 11 and October 28, 2017.

Interior mold scores are measured in relation to mold scores on the outside of a building. Mold scores greater than 150 indicate a moderate probability that mold is originating inside the building and mold scores greater than 250 indicate a high probability.

According to the report, fungal growth has occurred in the basement of the school.In most samples from the basement, the mold score was 300, which is the maximum value on this scale, indicating the highest probability that the mold is from an interior source.

The humidity in the basement ranged from 63% to 71% and in the classrooms from 43% to 53%. In the gym humidity reached 65%. These readings were taken when the temperature in the rooms were in the 50's. According to the report, "Humidity levels greater than 30% increase the potential for mold growth, and high humidity, 60% or greater can cause biological contamination."

Samples collected in the psychologists office, classroom 7A and 9 had scores of ranging from 164-204.

In classroom 2B, 22 and 35, the teacher's lounge, the scores range from 191-250 which indicate a moderate probability that the spores originated inside the classrooms. Mold was found on all three levels of the school.

It should be noted that the building does not have a full concrete foundation. Some areas have dirt crawl spaces and it appears that the rooms above these crawl spaces are the areas with the mold. The report done by Regulatory Compliance of Thornwood does not include testing of the dirt crawl spaces or information on how mold could be remediated there. Dehumidifiers were installed in the basement on one side of the school but these do not seem to be effective at eradicating mold in that area.

The letter says, "Because there were some elevated scores for mold, the District will be following all the recommendations in the last few paragraphs of the abstract. This work will be performed over the Thanksgiving weekend. Re-testing of the affected areas will be scheduled for next week. We will also be sharing these results once in hand."

After years of hearing anecdotal reports about mold in the school, Scarsdale10583 sent a Freedom of Information Law (FOIL) request to Assistant Superintendent Mattey on July 21, 2017 requesting environmental reports, work orders for mold remediation and complaints from parents, students and teachers about excess moisture or mold from 1996 to 2015. The FOIL request was acknowleged, but despite multiple reminders to Mattey and School Board President William Natbony to date no information has been received. Their lack of response is against the law. You can see the FOIL request here.

The Board of Education and Administration are in the process of finalizing plans for a major bond referendum to fund an addition to Greenacres School that leaves the older of the portions intact. If the mold is deemed to be an issue, they may need to rethink the proposal.

See the report on the district website here: