Scarsdale Bowl Recipients BK Munguia and Jon Mark Honored at Private Reception

- Details

- Written by: Joanne Wallenstein

- Hits: 3887

Jon Mark and BK Munguia, 2020 Recipients of the Scarsdale BowlThough it was not the celebration that was originally planned to recognize the 2020 recipients of the Scarsdale Bowl, a warm and unique gathering was held on Thursday night September 24 to finally bestow the coveted bowl on this year’s honorees, husband and wife Jon Mark and BK Munguia.

Jon Mark and BK Munguia, 2020 Recipients of the Scarsdale BowlThough it was not the celebration that was originally planned to recognize the 2020 recipients of the Scarsdale Bowl, a warm and unique gathering was held on Thursday night September 24 to finally bestow the coveted bowl on this year’s honorees, husband and wife Jon Mark and BK Munguia.

The two were originally scheduled to be honored at the 77th annual Bowl celebration on April 22 but larger forces prevailed and prevented the traditional affair. The Scarsdale Bowl Committee was deep into the planning of a reimagined Bowl Dinner, scheduled for the first time at Brae Burn Country Club, when the COVID crisis hit, causing the delay of the dinner. Hopeful that the virus would loosen its hold on New York by the fall, the Bowl Committee rescheduled the dinner for September, only to find that it was still impossible to gather.

Rather than put off the celebration until April 2021, the Bow Committee opted to hold a small gathering in the backyard of the home of Scarsdale Foundation President Randy Guggenheimer on Thursday September 24. They invited the members of the foundation, members of the bowl committee, the mayor, representatives of the board of education and the board of trustees and a few others to witness the ceremony and cheer two very deserving honorees. In accordance with COVID guidelines, chairs were set up six feet apart, attendants were masked and snacks were distributed in individually wrapped boxes.

Scarsdale Bowl Chair Nancy Michaels led the proceedings and explained “Nothing about the past six months was expected - The Covid pandemic, Hurricane Isiais and power failures, forest fires out west, and needing to quarantine here in New York. We were off to an amazing start before everything went bonkers: we changed venues to Brae Burn Country Club, raised over $5,000 from the Honor Roll alone, honoring more than 300 community volunteers, secured 11 table hosts and about $25,000 in corporate sponsors, introduced a Bowl Theme of Shine on Scarsdale, and sent out a reformatted, bright, colorful invitation to a much expanded mailing list. Imagine how far we would have gone if things had gone as planned! What is the saying- “man plans, and God laughs?”

Scarsdale Foundation President Randy Guggenheimer thanked the members of the Scarsdale Bowl Committee who planned the dinner and the members of the Scarsdale Foundation, who raises and distribute scholarship funds to Scarsdale students in their sophomore, junior and senior years of college. About Jon and BK, Randy said, “Both Jon and BK show us how to live the Scarsdale motto “non sibi” and I am proud to call them friends.” Hosts Randy and Liz Guggenheimer

Hosts Randy and Liz Guggenheimer

In her remarks, Munguia said, “We all know what the corona virus has taken away from us--personally, as a community, as a nation. But it has also given us an opportunity to reassess what is important in our lives, our community and our nation. All around us, we have witnessed sacrifice, bravery and resilience in our children, our neighbors and complete strangers. While cancelling the 2020 Scarsdale Bowl dinner, twice, pales in comparison to the many life cycle events that were affected this year, your desire to honor Jon and me with tonight’s celebration has touched us very deeply. Each of you represent the selflessness of the Scarsdale community we have witnessed over and over again.”

Mark gave more lengthy remarks, saying” BK and I are honored to be recognized by the Scarsdale Bowl Committee. It is not why we volunteered in Scarsdale, but it is deeply moving to be recognized so publicly by our community.

We are here tonight for at least two reasons. One is to acknowledge the robust commitment to volunteerism in our community. That is the historic purpose of this annual celebration – and it is a laudable reason to bring our community together. The second reason is to provide some financial support to those in our community who could use help in following through on their college educational goals, and to support the community organizations and individual civic projects in the Village that play a part in supporting those goals. That charitable purpose has long been an important mission of The Scarsdale Foundation, but in past years it has not been explicitly linked to the Scarsdale Bowl dinner. This year the Bowl Committee decided to make that link – and why not? However, I will save my remarks on that objective for our larger gathering next April since our group tonight is comprised solely of those already fully vested in that mission.

Scarsdale Bowl Chair Nancy MichaelsTherefore, as to the first of the two reasons for this gathering I would like to say that while BK and I happen to be standing before you this evening, tonight is equally about all of you who volunteer in myriad ways in tasks that matter to the Village of Scarsdale. The mere existence of the annual Scarsdale Bowl award speaks volumes about what we value. It is true that Scarsdale is distinguished economically, but we are so much more than fine homes and beautiful surroundings. First and foremost, we value education and strive to provide the best for our children. The high quality of our schools is what attracted Ruth and Sandor Mark to Scarsdale in 1951 – and the same was true for BK and me in 1992 – more than four decades later. It continues to be true today, even as the School District struggles mightily with the large scale social and economic disruption brought on by the pandemic. What comes next on the list of our community’s priorities can be debated, but I believe volunteerism on the part of residents is an appropriate candidate as a close second. The fact that an award, and one night a year, has been set aside to honor volunteers – each year for 77 years, even in the face of our global health crisis – supports my claim.

Scarsdale Bowl Chair Nancy MichaelsTherefore, as to the first of the two reasons for this gathering I would like to say that while BK and I happen to be standing before you this evening, tonight is equally about all of you who volunteer in myriad ways in tasks that matter to the Village of Scarsdale. The mere existence of the annual Scarsdale Bowl award speaks volumes about what we value. It is true that Scarsdale is distinguished economically, but we are so much more than fine homes and beautiful surroundings. First and foremost, we value education and strive to provide the best for our children. The high quality of our schools is what attracted Ruth and Sandor Mark to Scarsdale in 1951 – and the same was true for BK and me in 1992 – more than four decades later. It continues to be true today, even as the School District struggles mightily with the large scale social and economic disruption brought on by the pandemic. What comes next on the list of our community’s priorities can be debated, but I believe volunteerism on the part of residents is an appropriate candidate as a close second. The fact that an award, and one night a year, has been set aside to honor volunteers – each year for 77 years, even in the face of our global health crisis – supports my claim.

So what does volunteering in Scarsdale look like? Well, the experience BK and I have had provides some instruction on this question. Volunteering can range from the task of planting gardens at an elementary school – to the task of sitting on the dais in Village Hall to address important decisions affecting our residents. Helping at our children’s schools, coaching our children’s sports teams and yes, addressing the School Board with respect to the school budget and, this year, re-opening plans are all in the spirit of volunteerism at its best. Volunteering means training to be a firefighter to lend a hand to the professionals in dire situations or joining an ambulance corps that has come to the rescue of Village residents for years. Volunteering means stepping up to contribute time, thought and energy to a community activity for the collective good. Family and friends gathered on Zoom to watch the proceedings.

Family and friends gathered on Zoom to watch the proceedings.

The extent to which all of you here tonight have done some or many of these things is extraordinary – and distinguishes the community in which we live. It provides a means for sharing our values – our hopes and aspirations – for ourselves, our families, our neighbors and our village. On a good day – and most of them are, volunteering helps us work toward common goals and to knit us together as a community. Like any community, there are less good days as well. But on those days, our commitment to each other and an understanding that we are all in this together, helps us work through them. One only need to look around at this gathering together to honor a concept of giving back to conclude that Scarsdale is a very special place indeed.

BK and I thank you for this honor and for joining us this evening to celebrate volunteerism in Scarsdale.”

Though the evening was planned to shine the light on an extraordinary couple, they reflected that light back onto the attendees and the community at large. The two are exemplars of the spirit of volunteerism in Scarsdale, and their work improves the lives of everyone who is fortunate enough to live here.

Chair Nancy Michaels Gives the Bowl to Mark and MunguiaBoth recipients have lengthy volunteer resumes. Here are the details:

Chair Nancy Michaels Gives the Bowl to Mark and MunguiaBoth recipients have lengthy volunteer resumes. Here are the details:

Jon Mark, grew up in Scarsdale and moved back to town to raise his own family. He served as a two-term Village trustee before becoming the Mayor in 2015. He chaired the Scarsdale Bowl Committee in 2014-2015. In 2017, following his service on the Village Board, Mark joined the board of trustees at Westchester Reform Temple, where he currently serves as a vice president. Concurrently, he was the president of the Scarsdale Forum. Additionally, Mark chaired the Citizens Nominating Committee and then co-chaired the Scarsdale Non-Partisan Party Campaign Committee. In the most recent election, scheduled for March, but delayed until September, Mark again co-chaired the Non-Partisan Party Campaign committee, and put in countless hours over the past six months to defend Scarsdale’s Non-Partisan system of governance.

BK Munguia has a long history of volunteering to serve Scarsdale. She began her volunteer work at Heathcote School, where she organized gardening projects in the atrium and around the school grounds. She served on the School Board’s Legislative Committee, and the School Board Nominating Committee and Administrative Committee. Munguia also served on the Scarsdale Bowl Committee. Munguia, a tireless advocate for youth and teens, has spent several decades volunteering for the Girl Scouts in various capacities. Munguia served on the Citizens Nominating Committee, the Procedure Committee, and chaired the Scarsdale Citizens Non-Partisan Campaign Committee. She served on the Board of the Scarsdale Forum and as its president in 2011-2012. Most notably, Munguia was a board member and president of the now closed Scarsdale Teen Center, starting her service in 2001 and concluding with the closing of the center in 2018. She is also a trustee of The Scarsdale Foundation. Along with Jon, she worked tirelessly to support the non-partisan slate of candidates in the Village election on September 15, 2020.

Celebrants were masked and distanced.

Celebrants were masked and distanced.

Scarsdale Bowl Committee Members:

Farley Baker, Karen Ceske, John Clapp, Dorothy Finger, Melpo Fite, Dara Gruenberg, Bob Miller, Matt Martin, Dana Matsushita, Jeff Robelen, Andrea Seiden, Janice Starr, and Amber Yusuf.

Scarsdale Foundation Members:

Randy Guggenheimer, BK Munguia, Jane Veron, Tom Giodano, Marc Greenwald, Michelle Lichtenberg, Jennifer Love, Anne Lyons and Suzanne Seiden.

Trustees Offer Kudos to Jane Veron at her Final Village Board Meeting

- Details

- Written by: Joanne Wallenstein

- Hits: 3996

Trustee Jane Veron completed 4 and half years on the Village BoardTrustee Jane Veron, who served four years and an additional six months as Scarsdale Village Trustee due to the delay in electing her successor, sat at her final Village Board meeting on Tuesday night September 8, 2020. The postponed Village election is scheduled for Tuesday September 15.

Trustee Jane Veron completed 4 and half years on the Village BoardTrustee Jane Veron, who served four years and an additional six months as Scarsdale Village Trustee due to the delay in electing her successor, sat at her final Village Board meeting on Tuesday night September 8, 2020. The postponed Village election is scheduled for Tuesday September 15.

Village Clerk Donna Conkling let the Board know that whoever wins the election will take office almost immediately and be sworn in on September 20, 2020. So Veron, who is now the longest serving trustee in Scarsdale’s history, appeared on the dais for the last time as trustee.

Mayor Marc Samwick called Veron “nothing short of a dynamo.” He added, “Scarsdale is a much better place because of what she has done,”…. and thanked her, saying “It has been an absolute pleasure working with you.”

Lena Crandall said it was an honor to serve with Jane saying she was “intelligent, kind, hardworking and always prepared.” She thanked Veron for “helping me to become a better public servant,” and reminded her to take some time to “eat and put your feet up.”

Justin Arest said, “Getting to know you as a friend has been an honor; learning from you has been a privilege.” He added, “ Obviously this is not goodbye -- I expect your work for Scarsdale to continue.”

Jonathan Lewis said, “Jane, you set a high bar for public service and an extraordinary example for collaboration. You have the vision to see what’s important and you sweat the details. Thank you for your years of service.”

Seth Ross said, “I had high expectations for serving with you. You foster collegiality while getting the right things done.” Hinting at a possible run for Mayor, Ross said, “This is not goodbye – its not the end of anything – it’s just a transition to the next phase. Expectations for your future service remain sky high. You never let us down in the past and I am sure you won’t in the future.”

Rochelle Waldman said, “I am sorry that this is our last meeting together. You will be missed. I want to thank you for your guidance and support. I know we will work together in the future in some capacity.”

During public comments, Dara Gruenberg called in and thanked Veron for exceptional service. She said, “I loved working with on the communications committee” and “You have been a champion of the library…. I can’t wait to celebrate the opening with you.”

Veron thanked said, “It has been a privilege to do this job.”

Village Clerk Donna Conkling provided information for voting either in-person or by absentee ballot until Monday September 14. Voting will take place on Tuesday September 15 between 6 am and 9 pm at the Scarsdale Congregational Church at 1 Heathcote Road. Conkling said the Village will take precautionary safety measures. The area will be sanitized and there will be extra gloves and masks on hand. Anyone who prefers to vote before hand, can go to Village Hall through Monday and apply for an absentee ballot and then cast their vote immediately.

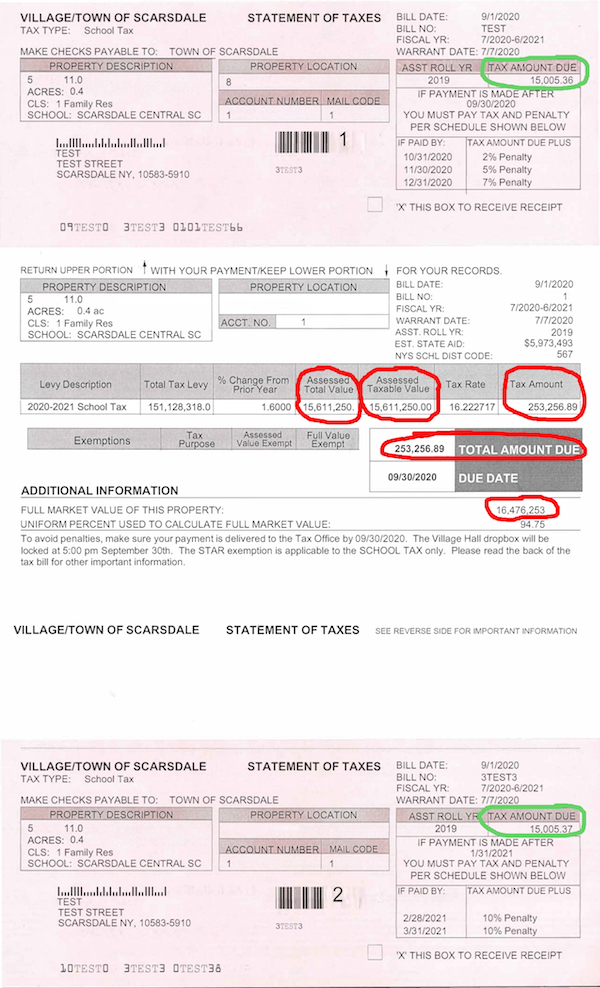

Village Manager Steve Pappalardo reviewed the problem with the school tax bills. Though  the two installment payment coupons are correct, the property tax assessment and the total tax on the bottom of the bill was incorrect. “ He said, “The amounts on the two pink coupons are correct. Homeowners should pay the amount shown.”

the two installment payment coupons are correct, the property tax assessment and the total tax on the bottom of the bill was incorrect. “ He said, “The amounts on the two pink coupons are correct. Homeowners should pay the amount shown.”

However he reported that Village Hall has fielded over one hundred phone calls from residents about the error in the bills. After consulting with their attorney they decided to send corrected tax bills to each property owner at the end of this week. They will be mailed to all property owners – whether or not they already paid. The Village will also meet with their vendor to see what went wrong.

Pappalardo also reviewed the sanitation schedule saying, “the majority of services have returned to normal operation. Trash, recycling and food scraps are all back to their normal schedules however the furniture donation bin is closed.

When visiting the Recycling Center, Pappalardo reminded everyone to social distance and wear masks.

He reported that a visit from the county’s mobile shredder on Saturday attracted a crowd, with cars lined up to Mamaroneck Road to participate.

Public Comments

Bob Berg, now from Black Birch Lane, reported on the proceedings of the Board of Assessment Review of which he is a member. He praised the new Village Assessor Victoria Sirota, calling her a “breath of fresh air.” He said, “She fights for the Village but deals with the public in an effective way.” He reported that the BAR received 492 grievances, 15 were withdrawn and they considered 477 applications. They granted reductions to 24.3%. He also told residents that they can file a grievance on their own by getting an appraisal of their home and completing the application.

Mayra Kirkendall Rodriguez had questions about the Ad Hoc Council to Combat Racism and Bias. She said, “What are the objectives? Have you been able to include more residents? If people are interested how does that work? If there are any minutes of these meetings, it would be good to be transparent.” She said, “I am grateful that you created this committee – but that will not solve the issues of bias.”

Mayor Samwick explained that “Some of these discussions are sensitive and it’s important that people feel free to openly discuss.”

Bob Harrison also complimented Veron saying, “The Scarsdale Business Alliance is one of your babies – the dining tent is a big success.” He reported that the use of Village tennis courts is on the rise, with 1,591 permits sold this year as compared to 900 last year. He invited players to sign up for the Scarsdale Youth Tennis Tournament to be held next week.

Trustees were invited to make liaison reports and Trustee Waldman announced the Lunch and Learn program for seniors to take place on Mondays beginning on September 14 from 1 – 2 pm in the dining tent in the Village. The events will be educational, safe and socially distant. More information can be found at www.sfcsinc.org or by contacting Maryellen Saenger at [email protected]

Trustees were invited to make liaison reports and Trustee Waldman announced the Lunch and Learn program for seniors to take place on Mondays beginning on September 14 from 1 – 2 pm in the dining tent in the Village. The events will be educational, safe and socially distant. More information can be found at www.sfcsinc.org or by contacting Maryellen Saenger at [email protected] Cars lined up to use the mobile shredder at the Recycling Center. Photo by Cynthia Roberts

Cars lined up to use the mobile shredder at the Recycling Center. Photo by Cynthia Roberts

Trustee Jane Veron announced that the “Dine the ‘Dale tent as well as our more liberal use of sidewalk space have kept our Village buzzing this summer.” She said, “As the colder weather approaches we have decided to explore ways to continue to use outdoor space. Village staff has been working behind the scenes with their legal, engineering and public safety colleagues to iron out the details. At our next Village Board meeting, the Village Board will announce a public hearing to discuss proposed code changes to extend the time for merchants to take advantage of outdoor space to sell wares and to host sidewalk cafes.”

About the library she said, “Furniture and shelving are being delivered, and movers are also bringing books back from storage. In addition, the Library currently has an RFP out for vendors to run the cafe at the Library.” In the interim she encouraged everyone to use the Library Loft for books and media and online programming.

In other business, the Board approved a resolution to hold a public hearing on the number of taxicab licenses. Though ridership has dropped due to the lack of commuters, according to Trustee Lewis, “It is onerous to reduce the number of licenses so the recommendation is to continue with the same number of cabs.” The public hearing will be held on Tuesday September 22, 2020.

The Board approved a $5,000 gift from the US First Responders Association to the Scarsdale Firefighters.

Randy Whitestone thanked the Mayor for his comments about Con Edison at the hearing of the NYS Legislature. He also said that he was downtown and the dining tent was being used and retail stores were open and busy. Last he reminded everyone to vote.

Let's Continue to Breathe Life into Scarsdale Village

- Details

- Written by: Joanne Wallenstein

- Hits: 3658

This letter was written by Marcy Berman-Goldstein, Co-President of the Scarsdale Business Alliance: Dear Editor: As the summer is drawing to a close, the Scarsdale Business Alliance (SBA) would like to extend its gratitude to Scarsdale Village, Scarsdale Forum, Friends of the Scarsdale Parks, local property owners and corporate sponsors for partnering with us to reinvigorate our Village Center during these challenging times.

This letter was written by Marcy Berman-Goldstein, Co-President of the Scarsdale Business Alliance: Dear Editor: As the summer is drawing to a close, the Scarsdale Business Alliance (SBA) would like to extend its gratitude to Scarsdale Village, Scarsdale Forum, Friends of the Scarsdale Parks, local property owners and corporate sponsors for partnering with us to reinvigorate our Village Center during these challenging times.

Since the onset of the pandemic, the Village Board and staff have helped us to reopen our businesses safely and creatively. They have been responsive, flexible, and forward-looking. They have focused on supporting all stakeholders -- merchants, property owners, customers, and residents -- and have worked with us to ensure it was done prudently and Covid-consciously, with public health and safety at the forefront. Initiatives that might not have been possible in the past have been made a reality. There is finally vitality in the Village Center after months of relative dormancy.

The Board and Village staff were early to recognize the need to expand the use of outdoor space. They amended codes to allow sidewalk usage for the display and sale of wares, and have worked with our local restaurants to expand their sidewalk cafe footprints to allow for safe outdoor dining. Additionally, the Village approved a week-long Sidewalk Sale with road closures in the Village center to allow for safe, socially distanced shopping, minimizing crowds and drawing a constant flow of traffic in support of our merchants.

The ‘Dine the ‘Dale’ tent has been a huge success in the downtown center. We are grateful to our donors, both local property owners and corporate sponsors, whose generosity has helped to create a buzz in our Village Center as shoppers and diners utilize the dining tent and stay to shop.

The Scarsdale Forum and Friends of the Scarsdale Parks identified Boniface Circle as an area that was underutilized and overgrown. These two groups have helped return this special area to our community through their generous financial contributions, time, and expertise. President Madelaine Eppenstein (of both the Forum and Friends of the Parks) and Forum Committee Chair Susan Douglass were driving forces behind this project.

Special thanks to Trustees Justin Arest and Jane Veron, Assistant Manager Ingrid Richards, Engineer David Goessl, and Planner Greg Cutler. Along with representation from the SBA, this group has met at least once every week over the past few months and has been the driving force on these initiatives. Without the collaboration and hard work of this group, none of this would have been possible.

We are excited to announce that the dining tent will remain up through October, and we encourage residents to continue to Dine and Shop the ‘Dale. We, your local merchants, are here to serve you and appreciate your business. Let’s continue to breathe life back into our Village Center in a safe and Covid-conscious way.

Marcy Berman-Goldstein, SBA Co-President, on behalf of the Scarsdale Business Alliance Board of Directors

SHS Grads Launch Kickstarter Campaign to Fund Interplanetary Conquest Board Game

- Details

- Written by: Joanne Wallenstein

- Hits: 5498

Game Designers Greg Dietz and Josh Pollack SHS Grads, science fiction fans and fast friends since their days in elementary school at Fox Meadow, Greg Dietz and Josh Pollack just launched a Kickstarter campaign to fund the production of their new game, Syndicate, an interplanetary conquest board game.

Game Designers Greg Dietz and Josh Pollack SHS Grads, science fiction fans and fast friends since their days in elementary school at Fox Meadow, Greg Dietz and Josh Pollack just launched a Kickstarter campaign to fund the production of their new game, Syndicate, an interplanetary conquest board game.

Dietz and Pollack have ambitious plans for this highly interactive game that can be played by one to five players. Rather than sell the game to an established publisher, the two hope to produce and sell the game themselves and maintain the rights to the license. In order to learn more about the development process and how they will move forward we asked them to respond to some questions and here is what they shared:

Please describe the game:

SYNDICATE is an interplanetary conquest thematic, 4x (expand, explore, exploit, exterminate) board game for 1 to 5 players. You control a young, enterprising criminal syndicate on the outer fringe of Arcturus, trying to stay under the radar of the Sovereign while competing with other criminal syndicates for money, power, loyal crew and advanced technology. Complete missions, set up criminal operations, and take down anyone that stands in your path to building the most formidable interplanetary criminal empire in the system.

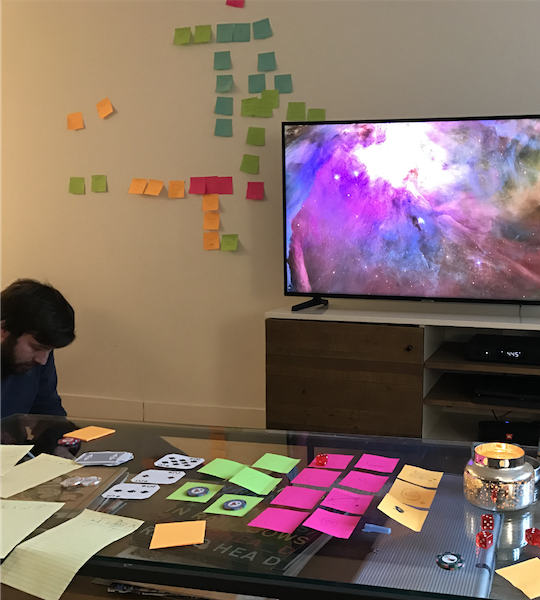

How did you and Josh come up with the idea for the board game?

Both of us are avid board game players and big science fiction fans. Naturally, a science fiction themed game is the direction we wanted to go. Deeper than that the idea of SYNDICATE came in the many steps and iterative process of board game design. We started with sticky notes on the wall and table along with some poker chips and then through hundreds of tests and scores of game models the game mechanics formed. Simultaneously, we exercised another passion Josh and I share, which is writing science fiction. As we built the game mechanics we wove in an immense universe of world building, which adds to the thematic element and player immersion of the game.

Why did you decide on a tabletop game rather than a digital one? The creative process.

The creative process.

Board games, RPGs and other types of tabletop games form something many call the magic circle. Players are transported into a collective story in which they are the lead characters and writers. It differs from video games in many ways, but we like to call out two in particular. One, a deeper emotional connection between players around the table as opposed to across distant screens. Two, rules in board games are not as fixed as a video game written in code. How many of us have different house rules for Monopoly? The ability for players as a collective to become more of the writers of their own story and game also leads to a greater emotional connection and the effect of the magic circle.

This emotional connection is a major reason why over the last decade we have seen a renaissance in the table top industry, and large market growth, as society becomes more increasingly connected but emotionally distanced in an increasingly digital world.

Board games have been a pillar of our friendship, and we have made it our mission to give back to the community and create that emotional connection between friends, family and even strangers.

Did you explore the option of developing the game for a traditional board game company rather than producing it on your own? If so, why did you decide to go this route?

Along our two year journey we have met many other board game designers. Many of them design games with the intention of licensing or selling them to an established publisher. We are taking on the challenge of self publication for many reasons. We are confident we have the creative skills, business skills and entrepreneurial drive to travel the hard path we have chosen. It will be incredibly fulfilling to see our game go from idea to a game store shelf. Another simple reason is that we want to preserve the rights and IP of the game. We don't intend to stop with one game. We have created an expansive universe of lore that can be explored with more games, and perhaps we will expand out of games as well. Star Wars started somewhere, right?

Tell us about yourselves: What are your backgrounds - what did you do before you decided to launch the game?

The two of us have been fast friends since childhood. We both grew up in Fox Meadow. We started a high school band and recording studio together. And we always knew we would form a company together.

Greg Dietz (29) is a Lafayette College and Columbia University graduate with degrees in geology and masters in sustainability management. From geology he moved into a marketing and sustainability role at the software tech giant SAP where he continues.

Josh Pollack, (also 29) completed his undergraduate in economics at Tulane and recently finished his MBA at Columbia University. Josh has led a successful career in investment banking and private equity first at Lazard and then at Rhône Group, respectively, where he continues.

You launched your first Kickstarter campaign in June. Why did you decide to relaunch it now?

For first time game designers and first time Kickstarter creators, our first Kickstarter launch on June 23 went quite well. Of the $55,000 funding goal we raised just over $30,000 in under two weeks of the 30-day campaign. So why relaunch? We made the difficult decision to end our first campaign early and do a quick turnaround for a relaunch on August 18 because there was a lot of amazing feedback from the Kickstarter community. The best way to incorporate that feedback and offer an even better game reward and campaign was to create a new one. Relaunching like this is not uncommon. We are confident that the REDUX will make an even bigger splash.

How much do you need to raise to produce the game?

There are many components that go into pricing the game and establishing a funding goal. We have settled on a price of $55 for a core package that includes a copy of SYNDICATE: An Interplanetary Conquest Board Game, a single player campaign expansion, and any unlocked stretch goals which are special upgrades, such as a lore book and high quality components, backers get if the campaign reaches above funding goal targets. We have concluded that $35,000 is the minimum funding goal we need to get the game on its way to gamers around the world.

How has the pandemic affected your plans?

As with all companies in this time, the pandemic raises uncertainty in the market and the supply chain. At the outset of the crisis, several manufacturing negotiations were stalled which forced us to delay the launch. It is tough to measure, but the economic effects of the virus are surely impacting board gamers' wallets and willingness to pay as well. That said board games are collectively still raising millions of dollars. From 2018 to 2019 funding dollars for tabletop games grew 6.8% to $176 million, which is a continuation of a steady growth it has had for many years. It will be interesting to see what the 2020 numbers show.

Contribute to the Kickstarter campaign to help fund the production of Syndicate and receive your own copy.

A Rainbow of Color on Chalk Night

- Details

- Written by: Anna Cho

- Hits: 2388

At Scarsdale’s first "Chalk the Dale"’ on Friday July 31, parents and children gathered on Spencer Place, Boniface Circle, or Harwood Court, to enjoy an evening of chalking along with boxed dinners and snacks from Scarsdale eateries. The event, produced by sophomores Anna Feldstein and Katie Han, offered Scarsdale residents a great opportunity to spend time outside to safely participate in a fun activity while munching away on delicious food. With each family spread out in accordance with social distance rules, parents and kids worked on their hands and knees to create beautiful drawings on the street. An explosion of creativity filled the village, with an array of drawings including colorful depictions of rainbows, flowers, and animals. Laughter was heard all around, and smiling eyes were seen everywhere, though smiles were hidden behind masks.