Scarsdale Little League Names Recipient of 2013 Michael H. Ludwig Sportsmanship Award

- Details

- Hits: 8252

The Scarsdale Little League presented Mattingly (Mattie) Weirl, a Fourth Grader on the Rock Hounds with the Michael Ludwig Sportsmanship Award on Thursday June 20 at Crossway Field. The award was created by Scarsdale Little League in memory of fourth grade Little Leaguer Michael H. Ludwig who died from an undetected cardiac condition in 2007. Michael's parents, Ed Ludwig and Lisa Nelson, present the award to a 4th grade player who, like Mattie, shows a love for the game, great sportsmanship, and excellent skills. This year, Mattie displayed all of these qualities on the field. When being nominated by his coaches they highlighted Mattie's always-positive attitude, complete commitment, encouragement of his teammates, solid level of performance on the field with his mind in the game, and dedication to improve himself and the team by way of discipline.

The Scarsdale Little League presented Mattingly (Mattie) Weirl, a Fourth Grader on the Rock Hounds with the Michael Ludwig Sportsmanship Award on Thursday June 20 at Crossway Field. The award was created by Scarsdale Little League in memory of fourth grade Little Leaguer Michael H. Ludwig who died from an undetected cardiac condition in 2007. Michael's parents, Ed Ludwig and Lisa Nelson, present the award to a 4th grade player who, like Mattie, shows a love for the game, great sportsmanship, and excellent skills. This year, Mattie displayed all of these qualities on the field. When being nominated by his coaches they highlighted Mattie's always-positive attitude, complete commitment, encouragement of his teammates, solid level of performance on the field with his mind in the game, and dedication to improve himself and the team by way of discipline.

Mattie's strong qualities go beyond the field. For the past three years Mattie and friends at his grade level have played a pick up baseball game at Edgewood school. The objective of playing the game is to raise money for Mattingly Charities, which was created to serve underprivileged youth by supporting programs, which promote baseball and softball participation in conjunction with other developmentally related activities.

Scarsdale Little League also would like to recognize Alex Almeida (Iron Pigs), Hudson Lafayette (Thunder), Shiv Mehra (Thunder) and Ethan Abraham (River Cats), who were also nominated by their coaches this year for the award.

The award was given to Mattie prior to the start of the 4th grade Championship Game, between the Sand Gnats and the Bats. The Sand Gnats won the 4th grade championship with a score of 3 to 1 over the Bats. Congratulations to Mattie, his family, his coaches and teammates on receiving the Michael Ludwig Sportsmanship Award.

Pictured at top: (from left to right)

Ivan Rodriguez, Scarsdale Little League Board member and 2013 4th grade

coordinator;

Lisa Nelson, Michael Ludwig's mother;

Mattie Weirl, Michael H. Ludwig Sportsmanship Award 2013 recipient;

Ed Ludwig, Michael Ludwig's father; and

Mike Greenberg, Scarsdale Little League Board Co-President.

To learn more about the Michael H. Ludwig Memorial Foundation go to:

http://www.michaelludwigfoundation.org

To learn more about Mattingly Charities go to:

http://www.mattinglycharities.org

Edgemont School Newsletter Wins Award

- Details

- Hits: 3394

The Edgemont Public Schools' electronic newsletter has won an Award of Merit in the National School Public Relations Association's 2013 Publications and Electronic Media Contest.

The Edgemont Public Schools' electronic newsletter has won an Award of Merit in the National School Public Relations Association's 2013 Publications and Electronic Media Contest.

Southern Westchester BOCES Director of Communications Evelyn McCormack, whose communications team does work for nine of the region's school districts, was the recipient of NSPRA's Award of Merit for a twice-monthly electronic newsletter she produced during 2012-13 for the Edgemont School District. Between November 2012 and May 2013, Ms. McCormack wrote, designed and published nine electronic newsletters for Edgemont, along with three print newsletters.

Ms. McCormack also serves as secretary of the New York School Public Relations Association, the New York chapter of NSPRA.

NSPRA received 894 entries for the 2013 contest, including 679 entries in the Publications category and 135 entries in the Audio/Visual category. A list of winners nationwide will be posted on the NSPRA website, www.nspra.org, on June 21. Take a look at these award-winning newsletters here:

Local Honorees: UJA and Eagle Scouts

- Details

- Hits: 5214

Karen and Edward Friedman Honored by UJA: Nearly 500 guests joined UJA-Federation of New York's Westchester Region as it honored Karen and Edward Friedman of Scarsdale and Ellen and Michael Brown of Purchase. During this event — Westchester Celebration 2013 — special tribute also was paid to Rabbi Lester Bronstein of Bet Am Shalom Synagogue in White Plains.

Karen and Edward Friedman Honored by UJA: Nearly 500 guests joined UJA-Federation of New York's Westchester Region as it honored Karen and Edward Friedman of Scarsdale and Ellen and Michael Brown of Purchase. During this event — Westchester Celebration 2013 — special tribute also was paid to Rabbi Lester Bronstein of Bet Am Shalom Synagogue in White Plains.

The celebration took place on Thursday, May 30, 2013, at Brae Burn Country Club in Purchase, where guests came together as a community to pay tribute to the honorees for their enduring leadership in the Westchester Jewish community and to support UJA-Federation and its network of nearly 100 local and global agencies. The event raised nearly $350,000.

"As Jews we are also called upon to do something. Being, yes, but also doing. Being, but also giving," said Rabbi Bronstein. "We like to say 'If not now, when.' The 'when' is rhetorical, you know. Yes, the answer is in our hands, but only for the briefest moment. The 'when' is now — and then it is past."

Scarsdale residents Karen and Edward Friedman are dedicated to helping Jews in need around the world, as well as finding ways to support the community at large. Karen Friedman serves on UJA-Federation's Executive Committee and Board of Directors and is chair of Women's Philanthropy. She also is a member of its Caring Commission Cabinet and the Commission on the Jewish People's Task Force on Engaging Interfaith Families. Previously, she was on the Nominating Committee for Officers and the Nominating Committee for Directors. In addition, Karen recently was appointed to the National Women's Philanthropy Board of Jewish Federations of North America. Edward Friedman is a founding partner of the law firm Friedman, Kaplan, Seiler & Adelman LLP, and serves on the Board of Trustees at Westchester Reform Temple in Scarsdale.

A treasured leader of the Westchester Jewish community, Rabbi Lester Bronstein of White Plains has served Bet Am Shalom Synagogue in White Plains as its religious leader since 1989. Currently Westchester's rabbinic chair of SYNERGY: UJA-Federation of New York and Synagogues Together, he is a past president of the Westchester Board of Rabbis and UJA-Federation's Westchester Rabbinic Roundtable. He has long engaged in interfaith work through the White Plains Religious Leaders Association and the Westchester Interfaith Clergy Network. A proud participant in the study circle of White Plains rabbis from four streams of Judaism, Rabbi Bronstein is a board member of Hillels of Westchester.

Eagle Scouts Named in Scarsdale: Scarsdale Boy Scouts Troop 2, based at the Immaculate Heart of Mary Church in Scarsdale recently conferred five of its boy scouts with the Eagle Scout badge. They include Anthony Carella, Keith and Kevin Hernandez, Casey Lutz and Michael Siciliano.

The boys are among a distinguished group of 158 boy scouts from across Westchester and Putnam counties to attain the rank of Eagle Scout this year.

They were also recognized June 5 by the Westchester-Putnam Council of the Boy Scouts of America during a special event held at the CV Rich Mansion in White Plains.

Eagle Scouts must fulfill specific requirements before gaining the prestigious badge. To qualify they must earn a total of 21 merit badges, complete a service project, take on a number of leadership roles within their troops and complete additional requirements.

Athletes Honored at Maroon and White Picnic

- Details

- Hits: 5352

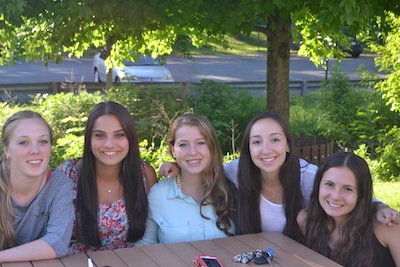

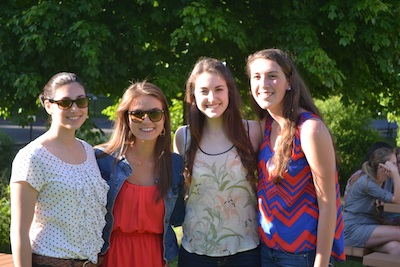

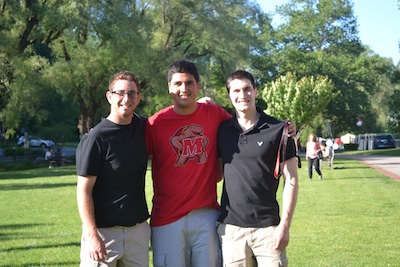

Students, parents, faculty and coaches gathered to recognize the athletic and academic achievements of student athletes at the annual Maroon and White Spring Picnic on Tuesday, June 5. The event was sponsored by Maroon and White, the parent booster organization that supports and encourages athletics at Scarsdale High School. The night kicked off with a delectable feast on the main lawn of SHS's Brewster entrance. Student athletes and their families gathered together to take pictures and reminisce about fond past sports seasons, all while enjoying the extensive spread of hamburgers, hot dogs, Caesar salad, caprese salad, tortellini pasta and baked goods, and plenty of refreshments.

Students, parents, faculty and coaches gathered to recognize the athletic and academic achievements of student athletes at the annual Maroon and White Spring Picnic on Tuesday, June 5. The event was sponsored by Maroon and White, the parent booster organization that supports and encourages athletics at Scarsdale High School. The night kicked off with a delectable feast on the main lawn of SHS's Brewster entrance. Student athletes and their families gathered together to take pictures and reminisce about fond past sports seasons, all while enjoying the extensive spread of hamburgers, hot dogs, Caesar salad, caprese salad, tortellini pasta and baked goods, and plenty of refreshments.

Following the meal, students and families were ushered inside the auditorium for the award ceremony. First to speak was SHS Principal Kenneth Bonamo. He showed strong support for the Scarsdale Athletic Program and all four hundred and twenty athletes that played on one of the eighteen different teams this spring. Those teams, ranging from freshman to varsity, included: Baseball, Softball, Boys' Lacrosse, Girls' Lacrosse, Boys' Tennis, Track, Golf and Crew. Principal Bonamo "saluted all of these athletes for their hard work" and "thanked the coaches for their commitment and dedication."

Next to take the stage were Maroon and White Co-Presidents Liz Whitney and Charlotte Carr, who expressed their sincerest gratitude to the following  individuals that made this event possible: Beth and Danny Bernstein for "donating the hamburgers and hot dogs for the picnic," Keith and Teresa Goldberg for "donating the paper to make the Raiders Sports Journal over the years," Greg Leone for his "valuable help to the sports journal" and Bob Syracuse and his staff, who has "made sure that athletic teams and athletes maintain high standards expected at Scarsdale." They thanked them for their thorough generosity and dedication to the Scarsdale Athletics Program as a whole.

individuals that made this event possible: Beth and Danny Bernstein for "donating the hamburgers and hot dogs for the picnic," Keith and Teresa Goldberg for "donating the paper to make the Raiders Sports Journal over the years," Greg Leone for his "valuable help to the sports journal" and Bob Syracuse and his staff, who has "made sure that athletic teams and athletes maintain high standards expected at Scarsdale." They thanked them for their thorough generosity and dedication to the Scarsdale Athletics Program as a whole.

Last, but certainly not least, came the awards. Maroon and White recognizes student athletes for their excellence and dedication both on and off the field. The selected students must not only excel in their sport, lead and support their teammates and demonstrate excellent sportsmanship, but they must also be dedicated to their academics and perform honorably in the classroom. These standards are rigorous, and the five award winners were credited with excellence on the field and in the classroom.

See our photo gallery with pictures taken by SHS senior and photographer Becky Schwartz:

Here are the 2013 award recipients:

Peppers Award: The Peppers family award is a leadership and spirit award given to one male and female senior athlete. Assistant Principal Sue Peppers and her husband Jerry, for whom the award was named, were there to give the award. The female recipient of the Peppers Award was Christina Del Orto. Christina, captain of the Swim and Golf Team, "has excelled academically and integrated classroom skills with athletic ability to become a respected student athlete" says her coaches. She is a "role model" with undying "perseverance" that showed when she swam across the Hudson River to raise money for cancer research. She has displayed "leadership and sportsmanship" on the field, along with "a contagious enthusiasm" that is an "inspiration to her coaches and teammates." Jacob Cannon, varsity football captain and SHS Student Body President, was the male recipient of the Peppers Award. Jacob was described by his coach as "the type of player you wish you could clone." He is not just "big and strong" but also "has an amazing work ethic" says his coach. He "works hard in the weight room, on the practice field and has a rigorous academic course load." That work ethic is a big reason why Jacob was voted first team all league, won the David Buchanan Award, attended the senior all star game and will be playing college football at Princeton next year.

The Nina F. Mooney Memorial Award is presented to honor a female varsity player who exemplifies spirit, dedication, hard work and passion. Nina had a special place in her heart for female athletes who didn't receive enough credit for their passion. Amanda Reed of the volleyball team was the winner of this year's award. Amanda "brought the team together on and off the court and was a true role model for younger players." She "left a legacy for future volleyball players to look up to," said her coaches.

The Nonie Knopp Memorial Award is presented to a senior male varsity player who has demonstrated passion, and this year's recipient "exemplifies that attribute." Matt Mccan, a member of both the Track and Football teams, received the award for his "dedication, commitment, concern for others, spirit, enthusiasm, positive work ethic and leadership with an emphasis on leadership." When the coach was late, "Matt was the one to get warm ups started." As shot put league champion, Matt helped to "teach his teammates the fine art of throwing."

The Elizabeth Timberger Memorial Award honors a senior who helps a team, not as a player, but through some other form such as a manager, audiovisual specialist or a fan. Elizabeth was an avid fan and enthusiastic rooter on the sidelines, and this award honors her spirit. This year's recipient was Brittany Gerstein, who chose not to compete as a cheerleader, but to remain a part of the team of the manager. She attended every game, practice and competition. Her coaches "can't even describe how much of a help she has been." She "can be trusted with responsibilities inside and outside of practice." Brittney has "truly dedicated herself to the program" and is the rightful recipient of the Elizabeth Timberger Memorial Award.

Baseball

Coaches: David "DOC" Scholl, Dave Paquette

Record: 7-15

All League: Grant Goodman, Kurt Shuster

All League Honorable Mention: Raj Palekar

All Section Honorable Mention: Jacob Aboodi

Comeback Player of the Year: Raj Palekar

Softball

Coaches: Dave Scagnelli, Kevin Carrigan

Record: 7-13

All League: Greta Bodine, Dana Goldstein

Boy's Tennis

Coach: Jennifer Roane

Record: 10-5

All League: Jonny Dorf, Sam Gray, Anito Inirio-Akuetey, Zach Shulman, Richard Bennett

All Section: Jonny Dorf, Sam Gray

Boy's Lacrosse

Coaches: Tim Weir, Brendan Curran

Record: 1-14

Girl's Lacrosse

Coaches: Cece Berger, Genette Zonghetti

Record: 12-4-2, Section 1 Class A Semifinalists

All League: Lindsey Repp, Dannah Strauss, Julia Ross, Sarah Mehlman, Abigail Stone, Lindsay Root, Lauren Farfel

All Section: Lindsey Repp, Danna Strauss

All Section Honorable Mention: Julia Ross

Track and Field:

Coaches: Rich Clark, Devin Hoover, Patrick Healy, Chris Mullen

Record: Boys 2nd in League IIB and Girls 3rd in League IIB

All League: Patrick Clark, Robert Plummer, Maggie DesRosiers, Helen Clapp, Laura Cutlip, Christina Hebner, Matt McCann

All County: Patrick Clarke, Robert Plummer

All Section: Patrick Clarke, Robert Plummer

Crew:

Coach: Alex Greenberg

Melanie Norman and Olivia Garcia qualified for Nationals with the PCRA. They raced in the Girls Lightweight 8 Boat, which also won Gold at States.

Chris Martin won Gold at states for the PCRA Boy Novice 8

Boy's Golf

Coach: Andy Verboys

Record: 16-0, League Champions

All League: James Nicolas, Ethan Bunzel, Josh Goldenberg, Jacob Lenchner, Scott Solomon, Jonny Emmerman, Anthony Scarcella, Nikhil Sodhi

All Section: Josh Goldenberg, Anthony Scarcella, Ethan Bunzel

State Qualifiers: Josh Goldenberg, Anthony Scarcella

Girl's Golf

Coach: Barney Foltman

Record: 5-7

All League: Christina Dell'Orto, Alison Whitney

Scarsdale's Jeff Koslowsky Honored by the Greyston Foundation

- Details

- Hits: 5987

As chairman, Jeff led Greyston through a financial restructuring that has transformed the organization and enabled it to grow and invest in the Yonkers Community. In addition to delicious and plentiful hors d'ouevres, guests enjoyed brownies made at the Greyston Bakery, which thanks to Jeff's efforts, now generates $10 million annually.

Joining Jeff was his wife, Denise, sons Sam and Kyle, his sister Jill, mother Rhoda and step-father Stan, brother-in-law and sister-in-law Glenn and Kelly, and his in-laws, Roz and Ron Binday, founders of Advocate Brokerage.

Bernie Glassman, founder of the Greyston Bakery, Deputy Mayor Susan Gerry and long-time friend of Jeff and Denise, Westchester County District Attorney Janet DiFiore, were also present.

Advocate Brokerage works closely with Chubb Insurance, which contributed $10,000 to Greyston. Audrey Brenya, Kathleen

In his acceptance speech, Jeff credited his parents with instilling in him the desire to give back to the community. "I have been blessed with a wonderful family and a great career. When I was called upon to help Greyston, I knew that I had to help this wonderful organization that so many people depend upon," he said.

Mr. Koslowsky also announced the kick-off of a new Scholarship Fund for Greyston's Child Care Center. Named after Greyston's long-time director Sarah Brown, who recently retired from the board, the fund will provide critically needed support for hard-working parents who can't afford child care. Thanks to the generosity of the Gary Saltz Foundation, all pledges made at the benefit will be matched dollar for dollar.

In a letter published in the evening's journal, Gov. Andrew Cuomo congratulated Jeff and other honorees. "Their efforts demonstrate all that can be accomplished when you give of yourself for the advancement of a grateful society."