Warning: Police Are Issuing Summons for Leaf Piles in Streets

- Details

- Written by: Joanne Wallenstein

- Hits: 2908

Here's another thing to worrk about. The Scarsdale Police are serving summons’ for leaf piles in the street. We just received the weekly police blotter and see that the police are giving summons for piling leaves in the roadway. These leaves can obstruct traffic and provide dangerous obstacles for drivers and walkers.

Here's another thing to worrk about. The Scarsdale Police are serving summons’ for leaf piles in the street. We just received the weekly police blotter and see that the police are giving summons for piling leaves in the roadway. These leaves can obstruct traffic and provide dangerous obstacles for drivers and walkers.

According to Village Code, leaves are to be kept on your lawn, not in the street. A memo from the Village says, “All leaves must be raked to the area between the curb or pavement edge and one’s private property line for collection. Additionally, no leaves are to be deposited into any brook, stream, or open watercourse within the Village.”

If they do find a pile of leaves in the street in front of your house, you might receive a summons and the fee is $75.

So if you’re raking, or your landscaper is doing it for you, keep your leaves on your lawn or mulch mow them. Even if your gardener breaks the law, you are responsible and will have to pay the fee.

Recycle Your Pumpkins and Plastic Bags

- Details

- Written by: Joanne Wallenstein

- Hits: 2874

All the pumpkins and gourds that have been sitting on your front steps or that will decorate your Thanksgiving table can have another valuable use after the holidays--being turned into compost! There are several easy ways Scarsdale residents can recycle pumpkins and gourds:

All the pumpkins and gourds that have been sitting on your front steps or that will decorate your Thanksgiving table can have another valuable use after the holidays--being turned into compost! There are several easy ways Scarsdale residents can recycle pumpkins and gourds:

Place them in or next to your food scrap recycling bin (Need one? Email [email protected] or register here.

Bring them directly to the Food Scrap Drop-off Site at the Recycling Center, 110 Secor Road (Please put them on or in front of the wall behind the food scrap collection bins.)

Place them with your yard waste or leaf pile

By sending our pumpkins and gourds to be composted, we are helping nature recycle her bounty and returning nutrients to our earth!

Plastic Bag Recycling Has Arrived In Scarsdale!

The Village of Scarsdale now has a plastic bag recycling program! Scarsdale residents can bring plastic bags and other plastic film items to the Recycling Center at 110 Secor Road for recycling. The plastic bag recycling bin (pictured) is located next to the Furniture Donation bin (which is reopening Nov. 2) and is open during regular Recycling Center hours (Monday through Saturday, 8am to 3pm).

All plastic bags and plastic film must be clean and dry. Following is a list of the plastic items which are accepted:

• Produce Bags

• Store Bags

• Ice Bags

• Ziploc/Recloseable Bags

• Cereal Box Liners

• Case Overwrap

• Bread Bags

• Newspaper Sleeves

• Dry Cleaning Bags

• Bubble Wrap & Air-filled Packing/Pillows

• Plastic Mailers/Envelopes

• Soda can rings

Scarsdale is the first municipality in Westchester County to collect and recycle plastic bags and film as part of a municipal recycling program. The collected plastic bags and plastic film will be brought to a recycling program where it will be fully recycled into plastic decking and railings made by Trex. Additional information on the program is available on the Sanitation page of the Scarsdale website.

Additional items that can be recycled at the Recycling Center include:

• Plastic Bags and Plastic Film (NEW)

• Electronics

• Textiles

• Scrap Metal

• Tennis Balls

• Furniture (temporarily closed – Reopening Nov. 2)

• Take it or Leave it Shed (temporarily closed)

• Food Scraps

• Commingled Recycling (glass, plastic, metal, cartons)

• Paper and Cardboard

Please visit the Sanitation page on the Scarsdale website or review the Recycling Guide.

Crossed Opinions on Cross-Streaming

- Details

- Written by: Sydney Piccoli

- Hits: 2475

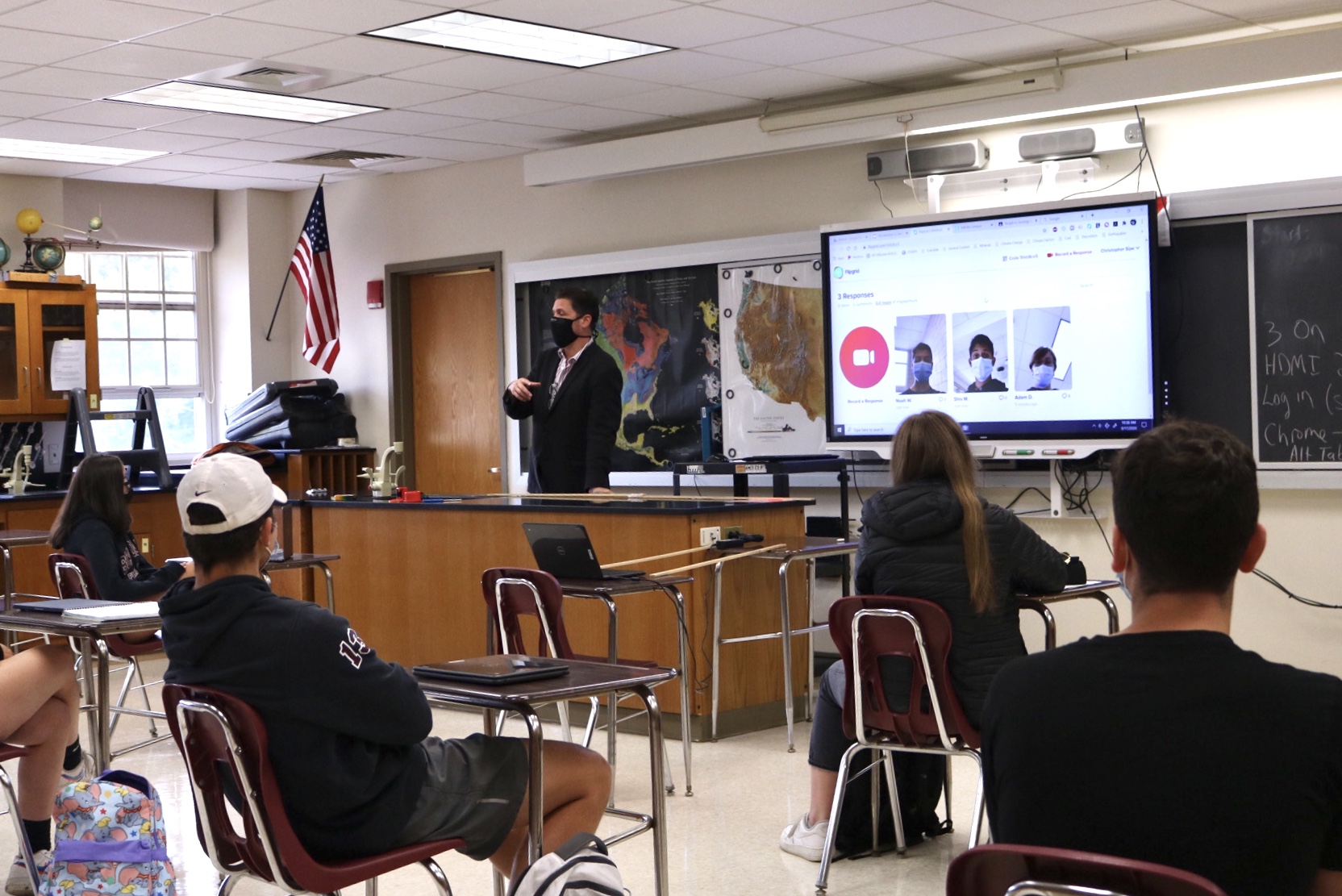

On October 15th, the Scarsdale High School administration announced that teachers will be experimenting with cross-streaming in upcoming weeks. Currently, the student body is divided into two groups, Cohort A and Cohort B. Cohort A attends in-person morning classes on Mondays and Thursdays while Cohort B attends in-person morning classes on Tuesdays and Fridays. Both cohorts have Zoom classes in the afternoon of all weekdays except Wednesdays. Wednesdays serve as an asynchronous day to allow for students to meet with teachers virtually and complete pre-assigned work.

On October 15th, the Scarsdale High School administration announced that teachers will be experimenting with cross-streaming in upcoming weeks. Currently, the student body is divided into two groups, Cohort A and Cohort B. Cohort A attends in-person morning classes on Mondays and Thursdays while Cohort B attends in-person morning classes on Tuesdays and Fridays. Both cohorts have Zoom classes in the afternoon of all weekdays except Wednesdays. Wednesdays serve as an asynchronous day to allow for students to meet with teachers virtually and complete pre-assigned work.

Cross-streaming entails teachers allowing students to Zoom into the in-person morning classes of their opposite cohort. Cohort A would attend their normally scheduled in-person morning classes on Mondays and Thursdays while streaming in the other cohorts in-person morning classes on Tuesdays and Fridays. Likewise, Cohort B would attend their normally scheduled in-person morning classes on Tuesdays and Fridays while streaming in the other cohorts in-person morning classes on Mondays and Thursdays. “The options that have been presented for streaming include connecting with the home cohort at the beginning of class, connecting with the home cohort at the beginning and end of class, and keeping the home cohort engaged throughout the lesson as observers or participants,” explained Principal Bonamo in a follow-up email on October 18th.

During the days leading up to the announcement, whispers of cross-streaming spread across Scarsdale High School, mainly under the assumption that it would meet parents' desire for more instructional time. Currently, a teacher has to teach the same lesson twice, once to each cohort. With cross-streaming, a teacher would be able to teach a lesson to the entire class during one class period. As cross-streaming would maximize class time, it could potentially lead to the coverage of more material and curriculum, which would ease some students’ thoughts of being unprepared for standardized tests such as AP exams, regents and SAT2s.

Although cross-streaming has benefits, it also follows with a myriad of drawbacks. For example, cross-streaming in the mornings may negatively affect students' mental health. Over the past few years, Scarsdale High School has prioritized students’ well-being with the implementation of mindfulness into the curriculum, the presence of several mental health awareness associations as well as the offering of meditation programs. Forcing students to increase their already heightened screen time may result in Zoom fatigue, a recently coined term meaning exhaustiveness due to the overuse of technology, which could potentially undo all the efforts Scarsdale has made.

Scarsdale High School students have also established the collective opinion that the current hybrid model allows for sufficient sleep and maximized time to complete assignments. Cross-streaming may add several fifty-minute Zoom sessions in the morning where they could

have been sleeping to better their physical and mental health or completing assigned work. As a result, students could become increasingly stressed.

“Parents are expecting students to adhere to a work schedule in a way that is less cognizant of the unique mental health demands of teens. More sleep, and less screen time, are challenges to teens’ mental health that COVID has uniquely allowed us to address. We should keep these benefits during this trying time. We also need to focus on quality versus quantity. We dilute the value of in the class time of which there is already so little when we unfairly expect teachers to split their time and energy between students in the classroom and those out of it,” remarked Benjamin Ewing ‘22 at the recent Board of Education meeting.

A primary concern thus is whether or not cross-streaming will take away from the effectiveness of the already limited in-person classroom time. If one class is learning a lesson online and the other class is learning it in-person, then the latter group will have an advantage and better synthesize the material. Teachers may also struggle equally engaging the in-person class and Zoom class. Time may be wasted as the teacher tries to adapt to teaching through two different mediums simultaneously, which could detract from the limited in-person class time. One commonly experienced issue is that students on Zoom have a hard time hearing from their in-person counterparts, leading to them not fully comprehending the teachers’ remarks.

A feasible mode of cross-streaming is that it will be department specific and used for classes where there is a clear chance for enhanced learning and not for classes where it would not make logical sense. For example, it could be a successful tool in the math department whereas it renders itself useless in hands-on art electives.

There is no indication as to whether or not experimenting with cross-streaming will affect the asynchronous model of Wednesdays. Wednesdays serve as a day where students can engage in virtual office hours, listen to pre-recorded lectures, complete assignments, and meet with clubs virtually. If cross-streaming has the potential to affect the current nature of Wednesdays, Scarsdale residents, both students, and parents, will consider cross-streaming in different terms.

In a year labeled as chaotic and unprecedented, the question is whether or not changing the school schedule, which a majority of students have adapted and developed a liking to, is the correct move. “I understand the parent’s concern for the learning of their children, but ultimately we should focus on helping teachers maximize our current hybrid model rather than instituting something which has caused both teachers and students to express concern and dismay,” said Ebonie Kibalya ‘22.

However, it is important to understand that the Scarsdale High School administration is asking all teachers to try cross-streaming, emphasizing that the decision is not final nor should be

perceived as so. “I am confident that a genuine spirit of inquiry and the integration of feedback from all members of the school community will lead us to an approach that has the broadest possible benefit to our students, which as always is the guiding principle of our work,” concluded Principal Ken Bonamo in his latest email.

This article was written by Sydney Piccoli, a junior at SHS. She has a passion for writing and hopes you enjoy reading her articles!

This article was written by Sydney Piccoli, a junior at SHS. She has a passion for writing and hopes you enjoy reading her articles!

A History of Black People in Scarsdale on Sunday October 18 at 3 pm

- Details

- Written by: Joanne Wallenstein

- Hits: 2618

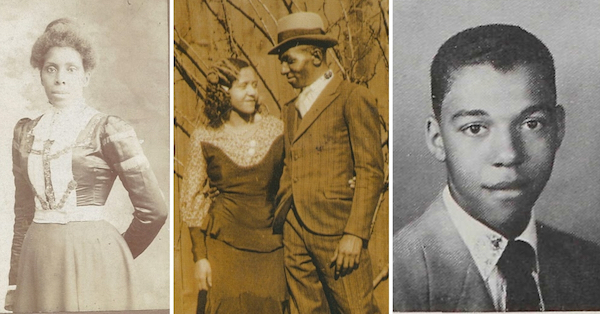

A History of Black People in Scarsdale, will be presented over Zoom by Jordan Copeland on Sunday, October 18 at 3pm. Free registration is at https://bit.ly/BlackHistoryScarsdale

A History of Black People in Scarsdale, will be presented over Zoom by Jordan Copeland on Sunday, October 18 at 3pm. Free registration is at https://bit.ly/BlackHistoryScarsdale

Black people have lived in Scarsdale since Westchester was first settled by Europeans in the 1600s. Through a variety of sources including maps, newspaper articles, photographs, recorded interviews, and census records, you will learn about Scarsdale’s important Black community and how it has changed over the past 300 years, from the time of slavery through suburbanization and the civil rights era. The program is sponsored by the Scarsdale Forum, the Scarsdale Historical Society and the Scarsdale Public Library.

Pedestrian Dies After Accident on Crane Road

- Details

- Written by: Joanne Wallenstein

- Hits: 2577

Scarsdale Police are reporting that a female pedestrian died after an accident on Crane Road at the intersection of Church Lane on Wednesday morning October 7 at around 8:09 am. The accident is currently under investigation and the identity of the victim are being witheld, pending notification of the next of kin.

Scarsdale Police are reporting that a female pedestrian died after an accident on Crane Road at the intersection of Church Lane on Wednesday morning October 7 at around 8:09 am. The accident is currently under investigation and the identity of the victim are being witheld, pending notification of the next of kin.

We do know that there was a "serious automobile accident involving a pedestrian." The victim was treated by Scarsdale Volunteer Ambulance Corps and transported to Westchester Medical Center where she "succumbed to her injuries." Police say that the operator of the vehicle remained at the scene and is cooperating with the investigation.

Check back for further information which will be released as the investigation progresses.