BOT Discusses the Loss of the Newspaper, the Tree Canopy and the Building Moratorium at 1-23 Meeting

- Details

- Written by: Joanne Wallenstein

- Hits: 3870

The building moratorium, the tree canopy and the search for a new Village Manager were all top of mind at the Village Board meeting on January 23, 2024.

The building moratorium, the tree canopy and the search for a new Village Manager were all top of mind at the Village Board meeting on January 23, 2024.

However, before the official agenda was reviewed, Mayor Justin Arest discussed the suspension of the Scarsdale Inquirer and the role of the press in ensuring good governance. He said, “Unfortunately, our print newspaper will not be covering it this week as they have suspended publication. And this leads me to highlight invaluable role that our local print and digital news sources play in our community. These publications are not just sources of information; they are the lifeblood of our civic engagement. They provide residents with crucial insights into local events and issues that might otherwise go unnoticed, ensuring that we are all well-informed about what's happening right here in our own backyard. Print newspapers are vital in maintaining government transparency, diligently covering our village board meetings, local elections, and school board decisions, fostering a culture of accountability and openness. Moreover, they help in knitting our community closer together, celebrating our local achievements in sports and more as well as serving as a platform for public discourse. They contribute significantly to our local economy as well, supporting our businesses through advertising and helping to stimulate economic growth. And let's not forget, these outlets are a living history, chronicling our community's stories and preserving them for future generations. In a world that's rapidly moving online, the enduring presence of our local print newspapers is a testament to their irreplaceable value in our community."

Village Manager

About the open position of Scarsdale Village Manager, he said the Village has engaged SGR to conduct a national search for a new manager and the search will go live this week.

In the interim, Alexandra Marshall has been serving as the Acting Village Manager. The Board later passed a resolution to award her a stipend of $1,000 per week beginning January 23, 2024 for her service.

Tree Canopy

Cynthia Roberts of 15 Autenreith Road said she has focused on Scarsdale’s trees for nearly two and one-half decades and asked the Board to make the tree canopy part of the charge to the consultants who are analyzing the land use code during the moratorium. She asked the Board to post the questions that were asked to the consultants, saying, “Can you please update the community on the directive, or questions, that was provided to the consultants? The questions you ask the consultants will determine the usefulness of the resulting recommendations.

She said, ““Presumably, you are selecting consultants who are experts in building and zoning codes, and also tree codes, since the rationale for the moratorium included our trees as an essential factor contributing to the character of our neighborhoods. As our tree code lays out in great detail, Scarsdale’s Trees impact our health, our environment, and our sense of place. “

She made the following recommendations:

-Please convey to our consultants that an important community goal is preserving and maintaining our 50% tree canopy coverage, as identified by our CAC. The consultants should be tasked with critically reviewing our Tree Code, it’s implementation and enforcement to date, in light of (at minimum) meeting the goal of 50% canopy coverage. For example, perhaps we should consider requiring more robust tree replacement requirements, to help maintain the green infrastructure needed to absorb stormwater, absorb carbon dioxide and mitigate warming temperatures?

-The Tree Code should be considered as important as the other land use codes, and not an afterthought.

-Only by taking trees into account up front can our other building and zoning codes successfully work with the Tree Code to maintain the character and charm of our neighborhoods.

-In order to facilitate this, I urge you to explore the value of a Pre-Proposal Conference between a land developer and Village staff. At a pre-proposal conference, elements such as Scarsdale’s mature healthy trees would be flagged for consideration BEFORE an architect submits an initial design to the BAR. Other communities do this as a matter of course.

-Finally, Are the BAR members provided adequate training regarding our Tree Code and Tree protection during construction? Do they have a budget for hiring a consulting arborist?

As you conduct your review during the moratorium, please beware of killing the goose that laid the golden eggs. While families come to look at Scarsdale because of the schools, they fall in love with Scarsdale due to its architecturally diverse and charming homes, sense of community, and because it is a Village in a Park.

Later at the meeting Roberts asked the Board to post the questions they had asked the consultants to address. She said, “I am anxious for the public can see the charge to the consultants. It would be helpful for those to be shared in some way. It would give us confidence in the product knowing that they have been asked insightful questions.”

She also requested that when new homes are built, there is enough frontage available to plant canopy trees in the front yard along the street.

Elaine Weir said the Village’s tree canopy is threatened by invasive vines. She asked the Village to allocate funds to support the Village’s vine cutting efforts which could best be done during the winter when leaves do not block access to the invasive vines.

Building Moratorium

James Detmer asked the Board what is being done about the Building Moratorium. Mayor Arest said the consultants “hit the ground running before the moratorium was passed,” and are addressing “stormwater, aesthetics and bulk,” and “looking at best practices to guide us to find that balance.” He said the board and staff has had many meetings with the consultants and “they are doing their analysis based on the comments…. They are working on their recommendations – and will meet with us and the chairs of the land use committees.” The Mayor encouraged anyone with suggestions about changes to land use laws to email him at [email protected].

27 Woods Lane

An appeal to a decision by the Committee for Historic Preservation to preserve a home at 27 Woods Lane had been scheduled for Monday January 29, 2024. However, Mayor Arest said that the hearing is being postponed and a new date will be set for the appeal.

Resolutions

The Board passed a resolution to purchase a trunk mounted leaf loader for $168,049.

They set a public hearing for February 13, 2024 to authorize a real property tax levy in excess of the NYS Tax Cap in case it is needed. A memo from the Village Treasurer explains, “Adopting the local law to override the tax cap does not preclude the Village Board from adopting a budget in compliance with the property tax cap, it simply allows for the option and protects the Village from any penalties.”

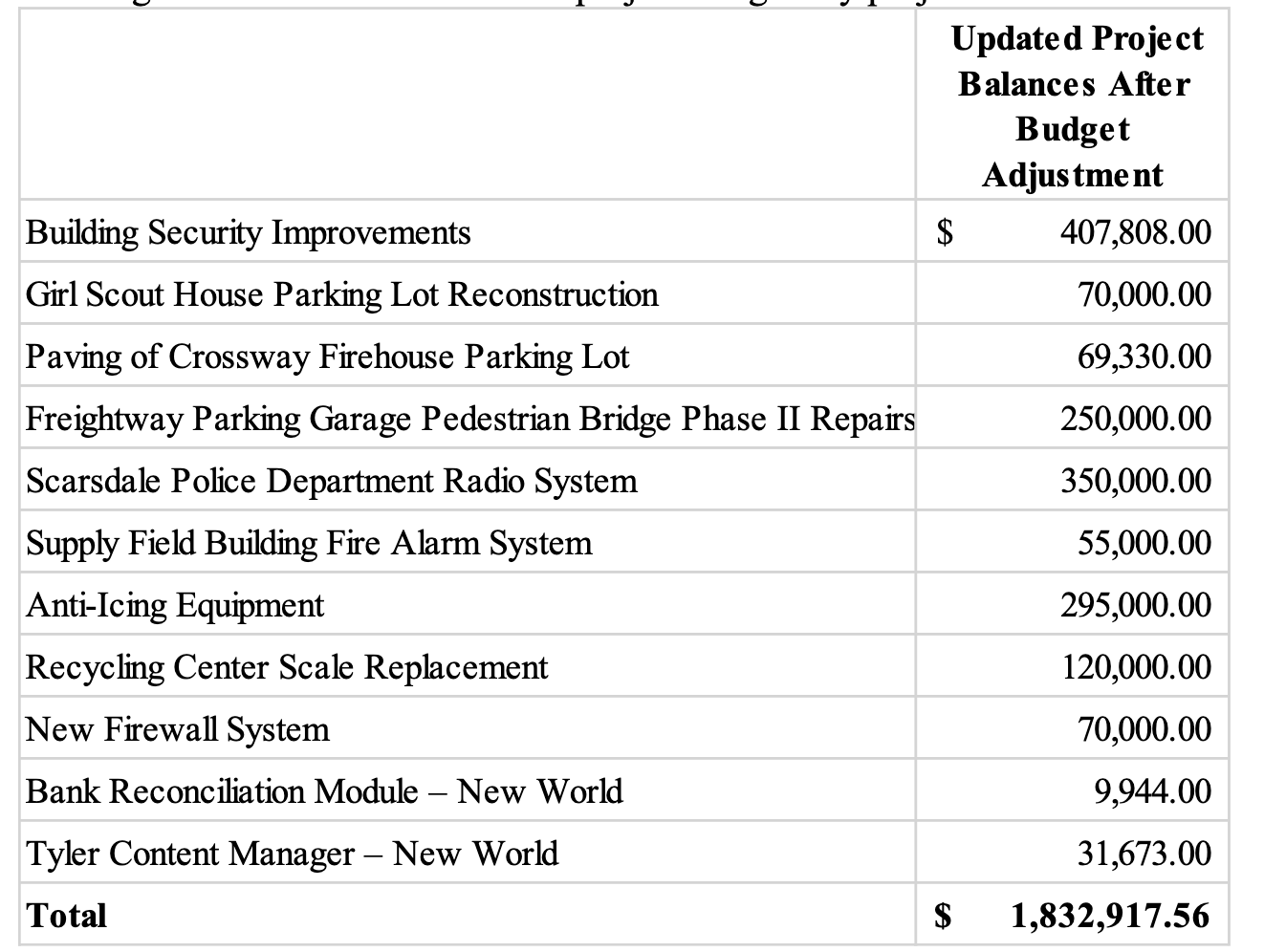

They passed a resolution to allocate the use of $1,832,917 in funds from the American Rescue Plan for the following:

See more here:

A House With a Unique Provenance

- Details

- Written by: Joanne Wallenstein

- Hits: 3534

An application to raze a mid-century modern home at 46 Lincoln Road spurred an interesting discovery about its provenance.

An application to raze a mid-century modern home at 46 Lincoln Road spurred an interesting discovery about its provenance.

Members of the Committee for Historic Preservation, who are charged with granting or denying the application, asked architectural historian Andrew Dolkart for his assessment of the house and Dolkart considered some research done by Scarsdale Village Historian Jordan Copeland and Leslie Chang.

The report shows that the house, which was built in 1954-56 by Norman and Edna Schreiber, was one of very few Modern style houses in what was then called Quaker Ridge Park. Edna had grown up at 73 Carthage Road, just a few blocks from the new house. Her father Harold Grossman was the attorney and treasurer for the Grossman Steel Stair Corporation in the Bronx, which was founded by his father. Harold Grossman paid to build the new house for his daughter and son-in-law.

Dolkart’s memo outlines some of the Modern features of the house including rectilinear massing, the use of natural materials and redwood siding and a dominant chimney at the back of the house, which he says is “reminiscent of Frank Lloyd Wright’s Usonian houses.”

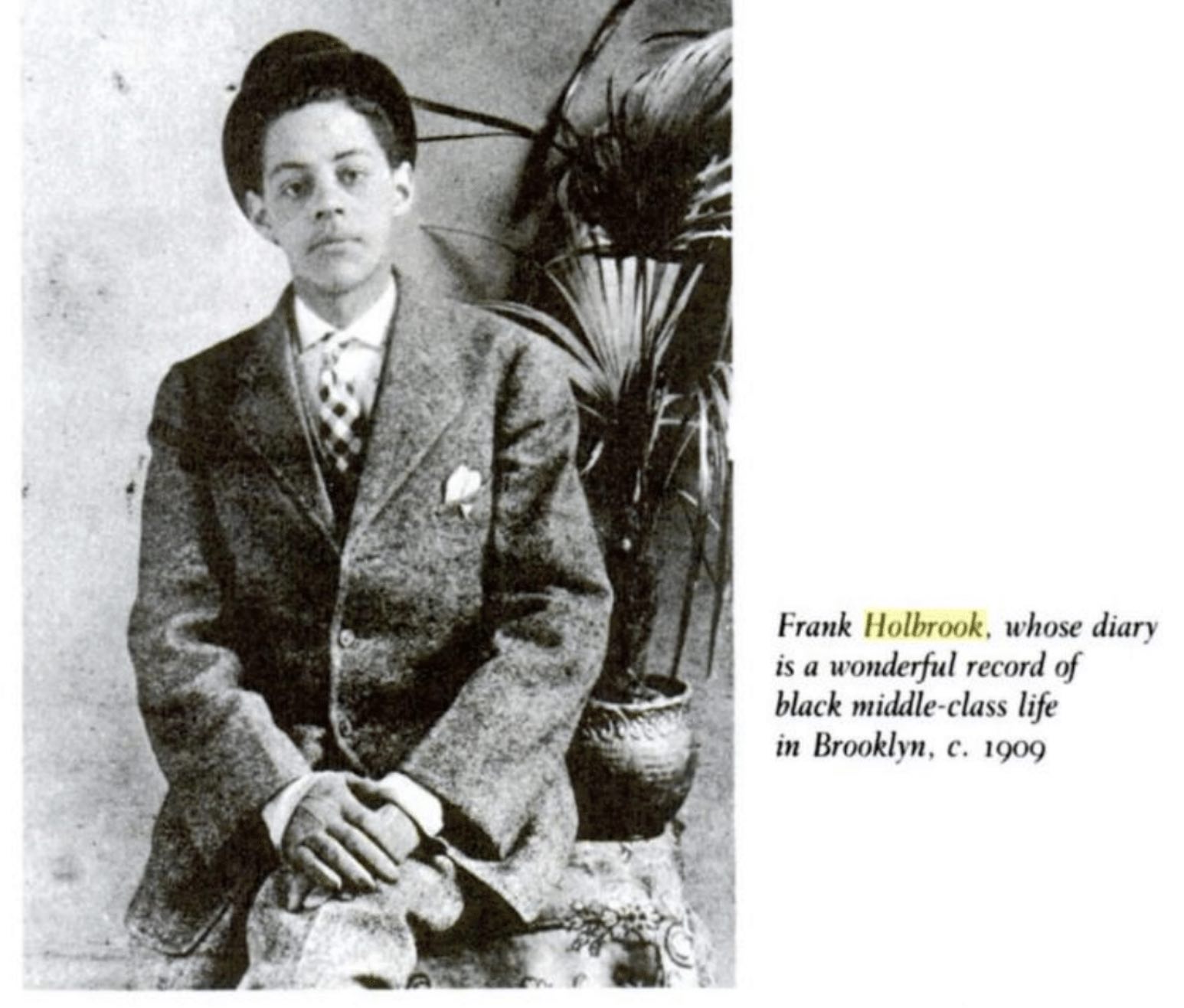

But who was the architect? Though the CHP previously knew that Francis Holbrook designed it, they were unable to find anything about his career. It turns out that he was a mechanical engineer rather than an architect and a member of the Black professional elite of his day. He had connections to the family of Lena Horne, he authored several published articles about mechanical engineering and was involved in professional organizations. He was well aware of the challenges that faced Black professionals and even published an article in a Harlem-based magazine called Opportunity about the difficulties of getting jobs or internships for Black engineers.

Though Dolkart cannot say with certainty how Holbrook came to design the house, he raises the possibility at Holbrook was involved in the construction of steel stairs. However, Dolkart does conclude that “Holbrook’s house at 46 Lincoln Road appears to the be the only historic house in Scarsdale designed by an African American.

Furthermore Dolkart says, “46 Lincoln Road is a very good Modern house. The house, which is almost entirely intact to its original design retains integrity of location, design, setting, materials and workmanship. The house represents a style used only infrequently in Scarsdale. It was erected in the early 1950’s, a period when undeveloped section of Scarsdale, such as Quaker Ridge Park, were undergoing significant development, thus it is reflective of a broad trend in the development of the area. Although Francis C. Holbrook cannot be considered a “master,” the fact that a Black engineer designed a very fine Modern house in Scarsdale makes this a special, and probably unique house in the village.

Though the application to take down the house was on the agenda for the January 16 meeting of the Committee for Historic Preservation, it was not considered that night. Since only five of the seven members of the committee were present and the applicant required four votes for approval, the applicants opted to adjourn the application until the next meeting.

Fox Meadow Third Grader Distributes 300 Pizzas for a Smile

- Details

- Written by: Joanne Wallenstein

- Hits: 3203

A third grader from Fox Meadow School gave out 300 pizzas on December 19 to those in need. The pizzas were distributed from a truck and given away at Saint Joseph's Medical Center in Yonkers, at Hope, New Rochelle, and at the Church of St. Bernard in White Plains.

A third grader from Fox Meadow School gave out 300 pizzas on December 19 to those in need. The pizzas were distributed from a truck and given away at Saint Joseph's Medical Center in Yonkers, at Hope, New Rochelle, and at the Church of St. Bernard in White Plains.

The donation, sponsored by the Saint Pio Foundation (aka The People of Hope), a Tuckahoe based not-for-profit organization, is part of the national initiative “Pizza for a Smile,” which aims at providing more than food: it is a way to forge community spirit and generate smiles, enabling the disadvantaged families to receive nourishing food in a family-like spirit of care and support. More than 2,000 pizzas have been donated nationwide since the initiative was launched from Los Angeles, on November 1, 2023.

Besides pizzas, donations included 300 boxes of Italian taralli snacks and mini panettones, in line with the Italian tradition.

Picture above: a bright, contagious smile from a woman receiving her pizza during the distribution at the Saint Joseph's Medical Center, in Yonkers, NY

Picture above: a bright, contagious smile from a woman receiving her pizza during the distribution at the Saint Joseph's Medical Center, in Yonkers, NY

Eight year-old Sebastian Lamonarca is the local Ambassador-at-Large of the initiative. “By sharing 300 pizzas, and other gifts like the taralli snacks and mini panettone, the Saint Pio Foundation intends to change the way we bring nourishment to those in need," said Founder and CEO Luciano Lamonarca. "We strive to feed not only the body but also the soul of those who are hungry. A pizza provides both nourishment and comfort, and we could not be prouder to borrow from our Italian culture and cuisine to help those that face significant hardships and spiritual challenges."

“Pizza for a Smile” is an initiative that intends to provide pizzas to those who experience the daily alienation so common to living a life of poverty in a materialistic world, and that can result in lives that are changed in meaningful ways that go far beyond the benefits of providing a single meal.

More information can be found at https://pizzaforasmile.org/

How Scarsdale Became Scarsdale: Watch the Movie Online

- Details

- Written by: Joanne Wallenstein

- Hits: 2867

Did you know that:

Did you know that:

-In the 1840’s what we now know as the Bronx was originally named Westchester?

-Caleb Heathcote, who purchased Scarsdale in 1701, actually lived in Mamaroneck?

-2,200 residents of Scarsdale served in WWII and 80 lost their lives?

-Scarsdale did not have its first female mayor until the 1980’s?

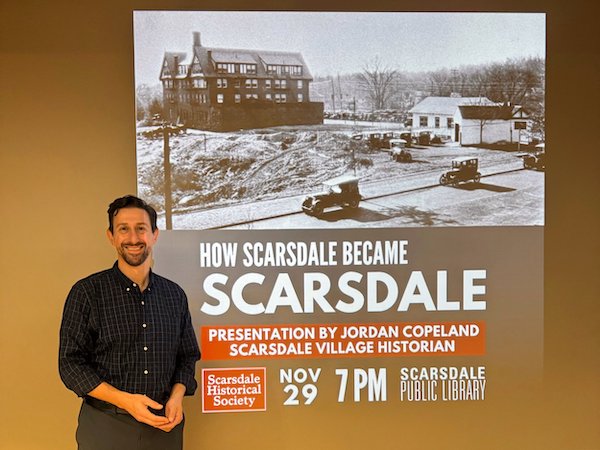

These are just a few of the surprises you’ll discover in a new movie written and narrated by Scarsdale Village Historian Jordan Copeland, that is now available to view online on the Scarsdale Historical Society website.

The 50-minute film, How Scarsdale Became Scarsdale, “explores the far-sighted decisions, community institutions, and unusual circumstances that transformed Scarsdale from a sparsely populated farming area to a prominent, sought-after suburb.”

It traces the development of the Village from a landlocked farming community, to an early home for commuters to the Village we now know. A proposed building that was never built in Fox Meadow.

A proposed building that was never built in Fox Meadow.

Surprisingly, much of what was built between 1910 and 1940 still stands today – and you’ll recognize many landmarks in the historic photos shown in the film.

In addition to exploring the geographic development of the Village, Copeland explains the formation of the original Town Club, which formed a “shadow government” and founded the non-partisan system that still governs the town today.

Downtown Scarsdale remains unchanged.

Downtown Scarsdale remains unchanged.

This free film is available online and will enrich your knowledge of the Village you now call home.

Scarsdale Foundation Bowl Committee to Select 2024 Honorees

- Details

- Written by: Joanne Wallenstein

- Hits: 2153

The 2024 Scarsdale Bowl Committee is looking for nominations for both the 2024 Bowl Award recipient and 2024 Spotlight Award recipient. The Scarsdale Bowl Committee seeks as many deserving candidates for consideration as possible.

The 2024 Scarsdale Bowl Committee is looking for nominations for both the 2024 Bowl Award recipient and 2024 Spotlight Award recipient. The Scarsdale Bowl Committee seeks as many deserving candidates for consideration as possible.

The Scarsdale Bowl Committee will hold its first of several meetings dedicated to selecting this year’s honorees on December 17, 2023. Nominees for both the Bowl Award and the Spotlight Award are requested on or before December 15th.

The Scarsdale Bowl, under the auspices of the Scarsdale Foundation, has been awarded annually since 1944, to an individual (or, in exceptional cases, to a married couple or domestic partners) who have given “unselfishly of their time, energy and effort to the civic welfare of the community.” The founding donors of the Bowl believed that “many who serve generously and voluntarily, without office, honor, or publicity, are those deserving of having their names permanently inscribed on the Scarsdale Bowl.” The Scarsdale Bowl Award is an enormous honor bestowed on a Scarsdale resident in recognition of his or her volunteer public service in the community over the course of some decades. The Bowl itself, with the honorees engraved names, is permanently displayed at the Scarsdale Public Library.

Candidates must be Scarsdale residents who do not currently hold elected office; to access the Bowl Award nominee recommendation form, please visit this URL.

In addition, the Scarsdale Foundation will continue the tradition it began last year and present a second award, called the Spotlight, to honor an individual or an organization that has made a significant impact and brought about positive change in one targeted sphere of community engagement.

The Spotlight Award recognizes a Scarsdale resident or institution that has focused on moving the needle in one particular area.

Candidates must be Scarsdale residents or institutions, and individuals may not currently hold elected office. To access the Spotlight Award nominee recommendation form, please visit this URL.

This year, the Scarsdale Foundation Bowl Dinner will be held on April 11th at Mamaroneck Beach and Yacht Club. The dinner will pay tribute to the honorees while celebrating the spirit and culture of volunteerism in Scarsdale. Funds raised at the dinner will enable the Foundation to continue its mission of quietly but effectively helping local individuals and community organizations through student scholarships and project grants. Most significantly, the Scarsdale Foundation has awarded more than $1 million in scholarships during the past ten years to Scarsdale’s high school graduates in their sophomore, junior and senior years of college.

The 2024 Scarsdale Foundation Bowl Committee members are: Randi Culang, Carl Finger, Tim Foley, Ronny Hersch, Sharon Higgins, Lori Kaplan, Angela Manson, Susan Ross, Cynthia Samwick, Ryan Spicer, Stephanie Stern, and Xue Su. Erika Rublin is serving as Chair, with Leah Dembitzer serving as Secretary and Isabel Finegold serving as Treasurer. Elyse Klayman, a Scarsdale Foundation Trustee, will serve on the committee as a liaison, along with Suzanne Seiden, President of the Scarsdale Foundation Board.

We look forward to gathering on April 11th to recognize all that makes Scarsdale a special place to live, and to benefit generations to come.

Questions? Please reach out to Erika Rublin, Bowl Chair at [email protected]. Additional information about the Scarsdale Foundation can be found at www.scarsdalefoundation.org.