Former Pole Dancer is Getting Married

- Details

- Written by: Joanne Wallenstein

- Hits: 1666

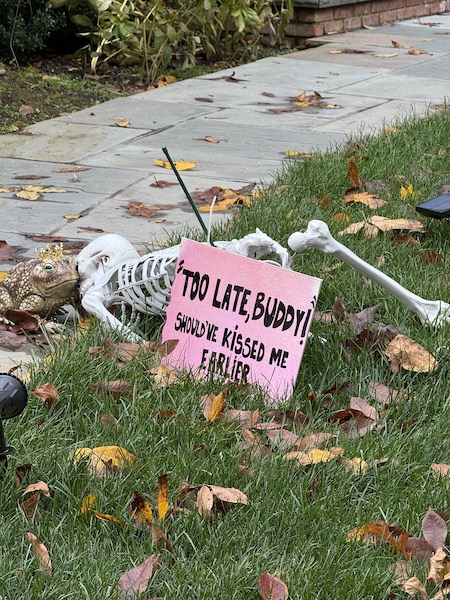

This year, the skeleton is posing for a wedding photograph.A scantily clad skeleton, posed as a pole dancer, who was the subject of complaints to the Scarsdale Police last Halloween has cleaned up her act.

This year, the skeleton is posing for a wedding photograph.A scantily clad skeleton, posed as a pole dancer, who was the subject of complaints to the Scarsdale Police last Halloween has cleaned up her act.

Last year she was posed as a pole dancer.

Last year she was posed as a pole dancer.

This year, the same skeleton is getting married! We passed by her home across the street from the Greenacres Elementary School and found last year’s pole dancer posing for a wedding photograph.

Check her out with a sign next to her photographer that says, “Pole Dancer Just Got Married.”

The front lawn of the house is a museum of skeletons and humorous signs.

Check these out!

See more Halloween decorations here:

19th Century Scarsdale School Board Notebooks Rediscovered and Digitized

- Details

- Written by: Joanne Wallenstein

- Hits: 699

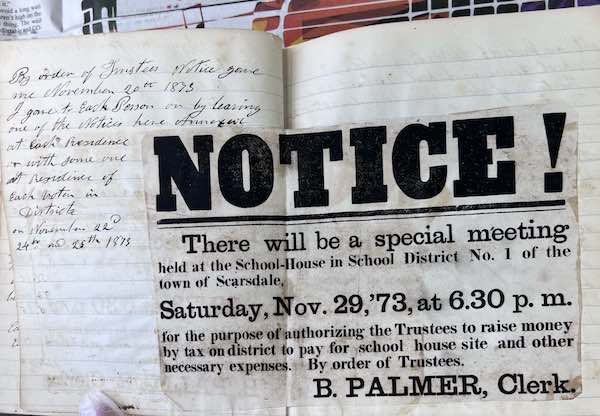

A glimpse from inside one of the books, where they saved an 1873 meeting bulletin.

A glimpse from inside one of the books, where they saved an 1873 meeting bulletin.

The Scarsdale Historical Society, in partnership with the Scarsdale Public Schools and Scarsdale Public Library, has re-discovered and digitized a collection of school board minute books dating as far back as the 1860s. The books are providing valuable material for the Historical Society’s upcoming documentary on the history of the Scarsdale schools, set to premiere in December.

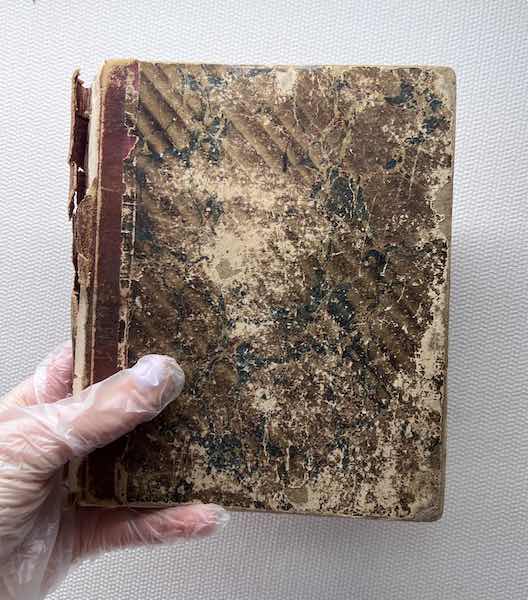

The existence of the notebooks was referenced in old articles and books from 50 years ago, but neither the Historical Society nor the Scarsdale Public Library knew of their current whereabouts. On a hunt to find them, they reached out to Honoré Adams, District Clerk and Executive Assistant to the Superintendent, who ultimately found them in district storage. Photo of the oldest School Board notebook, with entries dating back to 1868.

Photo of the oldest School Board notebook, with entries dating back to 1868.

There are 7 notebooks from the years 1868-1928, largely handwritten. They offer a rare glimpse into the district’s earliest days — a time of oil lamps, tight budgets, and even the occasional stray farm animal wandering onto the grounds. Together, the books trace the humble origins of a district that would grow into one of the nation’s most respected.

Now fully digitized, transcribed, and searchable online, the minute books are accessible to the public through the library’s Digital Collection on the New York Heritage website. “We are privileged to host these historic files and make them accessible to the public,” stated Elizabeth Bermel, Director of Scarsdale Public Library. The digitization project was funded by a grant provided by the Historical Society, with all three organizations collaborating closely to preserve the fragile originals.

"This project is exactly in keeping with our mission to preserve and share Scarsdale’s history," said Randy Guggenheimer, President of the Scarsdale Historical Society. "We are grateful to collaborate with the Scarsdale Public Schools and Scarsdale Library, continuing the village’s long tradition of community-minded spirit and collective effort."

“Our students can learn so much from this initiative,” said Drew Patrick, Superintendent of Scarsdale Public Schools. “It’s a real-life lesson on the power of primary sources, and how history is best understood through the records of those who lived it.”

For more details and access to the digitized books, visit bit.ly/schoolbooksfound.

About the Scarsdale Historical Society

The Scarsdale Historical Society exists to discover, preserve and disseminate historical information, as well as inspire others to learn about and contribute to the history of Scarsdale and the Central Mid-Westchester Region. The Scarsdale Historical Society accepts grant applications for projects that meet its mission, particularly those that will inspire others to learn about the history of Scarsdale and the surrounding communities. Learn more here.

(Submitted by Leslie Chang, Scarsdale Historical Society)

Honoré Adams, District Clerk, Executive Assistant to the Superintendent, and hero behind the rediscovery of the minute books.

Honoré Adams, District Clerk, Executive Assistant to the Superintendent, and hero behind the rediscovery of the minute books.

Real Estate: Teardown-Rebuild Cycle Continues to Drive Home Prices Up in Scarsdale

- Details

- Written by: Joanne Wallenstein

- Hits: 3460

17 Dolma Road was demolished.After a six-month moratorium on development, Scarsdale made some changes to the building code in 2024. The code changes were intended to decrease home bulk, protect wetlands and setbacks and give more scrutiny to plans.

17 Dolma Road was demolished.After a six-month moratorium on development, Scarsdale made some changes to the building code in 2024. The code changes were intended to decrease home bulk, protect wetlands and setbacks and give more scrutiny to plans.

Though some developers say it has slowed the approval process, it does not appear to have stopped the cycle of demolishing small homes and constructing far larger ones that are often priced out of reach of prospective buyers. With home inventory at historic lows, developers continue to tear down starter homes and replace them with homes priced at $3mm to $4mm and above.

We asked local realtor Jonathan Lerner of Five Corners Properties for his views on this trend and here is his reply:

“You’re absolutely right, Scarsdale’s inventory is still at historic lows. Some of the homes that end up being torn down or rebuilt do get listed on the MLS, but many never make it that far. Builders and developers have a few big advantages when it comes to securing these properties. They’re typically cash or pre-approved buyers, they don’t worry about inspections or open permits, and they can close quickly with very little risk of backing out. For many sellers, that kind of certainty and convenience outweighs trying to keep the house on the market for weeks and dealing with a parade of showings.

In other cases, sellers reach out directly to local builders they know or who have done work nearby. Sometimes they’re just trying to avoid paying broker fees. Ironically, studies have shown that homes marketed through a good broker often sell for more, because exposure drives competition — and in today’s market, we’re seeing listings draw 20 to 35 showings and multiple offers. Scarsdale continues to be one of the strongest seller markets in Westchester.

As for affordability and inventory, the constant teardown-rebuild cycle keeps upward pressure on prices and limits the number of homes available for regular buyers. Scarsdale’s median age is around 41 and trending older, which also slows turnover a bit. All of that contributes to the tight supply we’re seeing now.

For anyone even considering selling, this is a great time to get a realistic sense of what their home might be worth. At Five Corners Properties, we’ve been helping many longtime residents make smooth transitions — some staying local, others moving to places like the Carolinas or Florida, where there are still great values.”

Gregg Menell of Pendulum Property Group offered these comments on the market:

"I looked at new construction homes that are active, pending and sold in the last 360 days. 23 out of 34 of these homes had been publicly listed before they went to a builder. The other 11 (32%) appear to have been sold through an “off market” transaction. Existing homes that are good development opportunities and that are publicly listed are seeing strong competition from both builders and end users. In some cases, the builders are unwilling to pay as much as the end users. However, where a home needs to be fully gutted, it will likely go to a builder.

A quick look at the sales prices of the off-market deals shows prices that appear to be much less competitive than if they been publicly listed. There is no way of knowing, however, if these sellers were convinced that this was the best that they could have received or if they were willing to forgo upside potential in order to have a private process requiring fewer showings and that did not require any prep beforehand."

If you’re wondering what’s being torn down or built up, here are just a few of the items on the agendas at the Committee for Historic Preservation and the Planning Board this month. 19 Woodland Place will be subdivided into two lots.

19 Woodland Place will be subdivided into two lots.

Subdivision 19 Woodland Place:

A brick colonial at 19 Woodland Place on a one way street in the Village of Scarsdale, was taken down along with quite a few trees in 2024. Now an application has been filed to subdivide the half acre plus lot and build two new homes, one a Tudor and the other a Colonial. See the plans here:

2 New Homes on Coralyn Road:

Also on the agenda for the Planning Board on meeting on Wednesday October 22 at 7 pm are applications to build two new homes at 1 Coralyn Road and 3 Coralyn Road.

New Home on Fayette Road:  70 Fayette Road

70 Fayette Road

On a corner .2 acres lot at 70 Fayette Road, where a split level was approved for demolition by the CHP, developers have applied to build a new home that exceeds the site disturbance threshold.

New Home on Madison Road: Also approved for demolition is 190 Madison Road, where an application has been filed to build a new home on the corner lot that disturbs the adjoining property buffer and exceeds the site disturbance threshold.

30 Farragut RoadNew Home at 30 Farragut Road

30 Farragut RoadNew Home at 30 Farragut Road

An application to demolish 30 Farragut Road will be considered by the Committee for Historic Preservation this month.

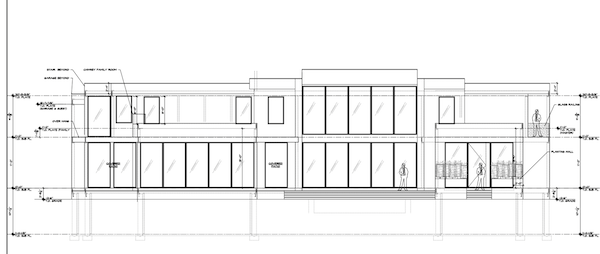

At 17 Dolma Road, the Committee for Historic Preservation denied an application to demolish the Tudor home in January 2025. However when the developer filed an appeal, the Scarsdale Board of Trustees decided not to act on the appeal and a demolition permit was issued. Developers have applied to replace the Tudor style home with a large contemporary house that exceeds the site disturbance threshold. Below see a rendering of the proposed home, which will be built on a street that architectural historian Andrew Dolkart recommended to be designated as a historic district.

See plans for the proposals here:

Rendering of a proposed new home at 17 Dolma Road

Rendering of a proposed new home at 17 Dolma Road

It Takes a Village: Volunteer Opportunities Abound

- Details

- Written by: Joanne Wallenstein

- Hits: 2406

Scarsdale is a Village run by volunteers and relies on people like you. Now that school is back in session, Scarsdale is in full swing and there are many opportunities for adults to participate in community activities, along with the kids. Volunteering is a great way to meet your neighbors, make new friends, understand how the Village works and make an impact on your community. In turn, many Scarsdale organizations depend on volunteers to carry out their missions, so it’s a win-win.

Scarsdale is a Village run by volunteers and relies on people like you. Now that school is back in session, Scarsdale is in full swing and there are many opportunities for adults to participate in community activities, along with the kids. Volunteering is a great way to meet your neighbors, make new friends, understand how the Village works and make an impact on your community. In turn, many Scarsdale organizations depend on volunteers to carry out their missions, so it’s a win-win.

We reached out to several local organizations to see how you can join them. See below for descriptions - and if you would like to add your group to the list, email us the details at [email protected].

Scarsdale School Board Nominating Committee (SBNC)

The Scarsdale School Board Nominating Committee (SBNC) invites residents to become part of a long-standing community tradition that helps shape the future of our schools. Being a part of SBNC is one of the most effective ways Scarsdale residents can impact the quality of our schools with a limited time commitment. Strong community involvement in the school board nominating process helps to ensure we get the highest quality of candidates for the Board of Education.

Members play an active role in selecting Board of Education candidates, build connections across the community, and participate in a thoughtful process that has guided Scarsdale schools for decades. All residents who are qualified voters, defined as a person at least 18 years of age, and a resident of Scarsdale for at least 30 days prior to the petition deadline of October 24, 2025, and are interested in maintaining the excellence of Scarsdale schools are strongly urged to consider running for an SBNC position. For more information, visit scarsdalesbnc.org or email [email protected].

Citizens Nominating Committee

The Scarsdale Procedure Committee is seeking 10 nominees from the community to serve on the Citizens Nominating Committee (CNC), the cornerstone of Scarsdale’s unique non-partisan system of local government. For more than a century, Scarsdale has relied on the CNC to select qualified candidates to run for election for the offices of Mayor and Village Trustee. This time-honored system ensures that local leadership remains focused on experience, integrity, and the needs of the community—rather than partisan politics.

Who Can Serve?

-Any resident of Scarsdale who is a registered voter having resided in Scarsdale for at least 2 years.

-Individuals who are not currently serving as an elected Village official.

-Community-minded residents who are willing to dedicate time by attending 6 meetings in December and January, participate in deliberations, and uphold the principles of nonpartisanship and confidentiality.

Why Serve?

-Serving on the CNC offers residents the chance to:

-Contribute meaningfully to Scarsdale’s civic life.

-Help shape the future leadership of our Village.

-Carry forward a democratic tradition that has kept Scarsdale governance responsive and effective for over 100 years.

How to Get Involved

Interested residents are encouraged to step forward as candidates for the upcoming CNC Election to be held on November 13th at the Scarsdale Library. Members serve a three-year term, with 2 representatives elected from each of Scarsdale’s neighborhoods (Fox Meadow, Greenacres, Quaker Ridge, Edgewood and Heathcote).

To learn more, download the nomination form here.

Contact: Ralph Geer, Chair and Dan Besikof, Vice-Chair, Scarsdale Procedure Committee, [email protected]. https://www.scarsdaleprocedurecommittee.org/

Scarsdale Adult School

Scarsdale Adult School (SAS) is a pre-eminent, independent, not-for-profit adult education organization, offering a wide range of intellectually stimulating, best-in-class courses, lectures, and cultural activities along with skill-enhancing and recreational classes. In 2025, SAS was awarded the Scarsdale Foundation Spotlight Award for making a significant impact and bringing about positive change in community engagement. Registration for classes is open 24/7 at ScarsdaleAdultSchool.org, with staggered class start dates and varied meeting days and times throughout the year.

The Board of Trustees convenes quarterly and the Advisory Committee meets once each semester, where volunteers get sneak previews of special events and courses being planned. Opportunities for more focused volunteer work include strategic planning and fundraising. The nominating committee begins meeting in January but accepts names and recommendations at any time. To volunteer, email Executive Director Jill Serling at [email protected].

Scarsdale Adult School Board: Photo Credit Andi Schreiber

Scarsdale Adult School Board: Photo Credit Andi Schreiber

Scarsdale Conservation Advisory Council

The Scarsdale Conservation Advisory Council (CAC) advises the Scarsdale Village Board of Trustees on environmental and conservation issues of local interest. The CAC collaborates with staff to develop and recommend solutions to concerns associated with land, water, energy, waste, and other areas impacting sustainability; members may also have an opportunity to participate in implementation activities.

Notable examples of CAC projects include developing and launching the first curbside food scrap recycling program (and the first to have home pickup!) in Westchester County, converting Scarsdale’s streetlights to LEDs, increasing Scarsdale EV fleet and charging, expanding Scarsdale’s gas leaf blower ban, banning pesticide use on Village properties, adding battery, paint, soft plastics, tennis ball, book, cork, eyeglasses, and cooking oil recycling to the Scarsdale Recycling Center, installing trash and recycling bins in all 26 Village Parks (including tennis ball recycling bins), working to install trash and recycling bins in the Scarsdale Village Center, and updating the Residential Recycling Guide.

The CAC is seeking residents to sign up for the Scarsdale Food Scrap Recycling Program - email [email protected] to sign up. Let’s all do this and help the environment! The CAC is also seeking resident volunteers to help staff events to sign up residents for food scrap recycling. Please email [email protected] to volunteer!

Scarsdale’s Volunteer Firefighters…. Answer the Call. Be the Difference

When the alarm sounds in Scarsdale, volunteer firefighters often respond alongside our career firefighters—rushing to structure fires, assisting during severe storms, and staffing the firehouse when crews are deployed for mutual aid, we’re always ready to serve.

We are not just volunteers. We are New York State Certified Volunteer Firefighters who proudly support Scarsdale’s career firefighters. While they handle the majority of emergencies in our village, we stand ready to back them up and keep Scarsdale safe—together.

Our service goes beyond emergencies. Scarsdale’s volunteer firefighters also support beloved community traditions—from fireworks displays, holiday events and parades to two cornerstone educational programs led by the Fire Department:

School Visit & Fire Prevention Fair – Each October, we engage every Scarsdale first grader and the community at large in fire safety education. This year’s Fire Fair will be held Saturday, October 18, 2025 10 AM–2 PM at Station 3 (56 Crossway, Scarsdale).

Fire Explorers Program (www.scarsdalevf.org/explorers) – Open to students in grades 9–12, this hands-on program builds teamwork, confidence, and leadership while giving teens real exposure to the fire service.

Our membership is about 50 strong, made up of people from every walk of life—healthcare professionals, accountants, lawyers, executives, teachers, tradespeople, commuters, recent graduates, and more. Some of us have decades of service; others are just beginning their journey. What unites us is simple: when our community calls, we answer.

This is your chance to make a real impact. To step up for your neighbors, your family, and your village.

Join us. Become a Scarsdale Volunteer Firefighter. Learn more here or contact our Training Officer at 914-722-1215 ext. 4, or email Lou Mancini at [email protected].

Scarsdale Volunteer Ambulance Corp

As one of the most respected ambulance services in the county, SVAC offers members countless opportunities to make a difference while giving back to the community. Team members ride along with ambulance crews, receive free, ongoing training, and successfully treat patients, all while making our community a better place. No prior medical experience is required -- just a willingness to learn and the drive to make a difference in somebody's life. From top-of-the-line equipment, to initial training for NYS EMT Certification, to ongoing medical education, to camaraderie and support, we set you up for success. Click here to see how to get started: or email David Raizen.

https://www.scarsdalevac.com/join

Friends of the Scarsdale Parks

Friends of the Scarsdale Parks, Inc. (FOSP) is a 501(c) (3) not-for-profit organization operating in the Village of Scarsdale that focuses on the preservation, restoration, and conservation of Scarsdale’s parks and open spaces. FOSP promotes the use of native plants and trees throughout Scarsdale to  support our local ecosystem. FOSP also works with the Village staff to identify residents who would like the Village to plant a new tree in the Village “right of way” in front of their homes. If you are interested in volunteering to garden with us in our local parks, or if you would like to find out more about having a Village tree planted in front of your home, please email Cynthia Roberts.

support our local ecosystem. FOSP also works with the Village staff to identify residents who would like the Village to plant a new tree in the Village “right of way” in front of their homes. If you are interested in volunteering to garden with us in our local parks, or if you would like to find out more about having a Village tree planted in front of your home, please email Cynthia Roberts.

Neighborhood Associations

Scarsdale’s fifteen Neighborhood Associations facilitate the exchange of information between and among the Village, Town of Scarsdale and School District, on the one hand, and the residents on the other hand. They promote a general and cooperative spirit to enhance the welfare of all. Every resident of Scarsdale is eligible to join his/her neighborhood association which is designated based on street address. Some have neighborhood events for July 4th, Halloween, get togethers and more.

To join your neighborhood association, contact Sarah Bell at [email protected] to request the email address of your neighborhood association president.

Scarsdale Rotary

Scarsdale Rotary is part of Rotary International, a global network of neighbors, friends, and leaders who come together to create positive, lasting change. Guided by the motto Service Above Self, our club is committed to making an impact in three key areas: Family Life, Emotional Well-Being, and the Environment—both locally and around the world.

Learn more at www.scarsdalerotary.org.

Here are just a few of our ongoing service projects:

Supporting Feeding Westchester and local food pantries

Coat Drive for the homeless and new immigrants (Midnight Run & NICE)

Backpack Drive with Patriot Bank, providing school supplies to children in need

Hosting the Children’s Village Christmas Party and gift donation

Partnering with the Alzheimer’s Association

Rochambeau Head Start – reading to children and distributing weekend food packs

Supporting the Dreams for the Slum Women’s Empowerment Center in Nigeria – providing business and computer training and opening a school for children.

Delivering Thanksgiving Dinner Baskets to individuals spending the holiday alone

Together, we continue to live our Rotary mission: to serve others, promote integrity, and advance understanding, goodwill, and peace through fellowship and service. www.scarsdalerotary.org

Grassroots Grocery

Every Saturday morning, families across Scarsdale are joining the Grassroots Grocery Produce Party! What's a Produce Party? It’s a fun, family-friendly event where parents and kids work together to pack and distribute fresh produce to food-insecure households in Harlem and the Bronx. It’s a great way to spend time together, teach children about the importance of giving back, and connect with neighbors in a meaningful way.

Families interested in joining can click here to sign up for an upcoming Produce Party that works for their schedule!

Feeding Westchester

Though we often don’t see the need, 1/3 of Westchester families are food insecure and 24% don’t make enough to feed their families. With vast warehouses in Elmsford, Feeding Westchester feeds over 200,000 people each month. The effort is partially staffed by 11,000 community and corporate volunteers who are vital part of the operation. Donate your time to pack food, raise funds, or help from home. You can provide food — and hope — to those who need it. Click here to see how you can help. https://feedingwestchester.org/get-involved/

Dorot Westchester

Dorot Westchester seeks to combat social isolation in the elderly has opportunities for volunteers of all ages to connect with homebound seniors by phone or by visiting their homes to provide social engagement and deliver meals. https://dorotusa.org/about/our-impact

Bronx River Conservancy

The Bronx River Conservancy is an advocate for the protection and preservation of the Bronx River Parkway Reservation: sign up to participate in a clean-up of the park or bi-weekly vine-cutting to save trees from invasive lethal vines. https://www.bronx-river.com/

Yonkers Partners in Education

Volunteer to help high school students as a tutor on their path to academic success or as a Coach to help them through the college application process—reading essays and helping them apply. https://www.ypie.org/volunteer

Midnight Run at Hitchcock Church

On the last Saturday of each month, prepare food or join a can of volunteers making late-night deliveries of food, toiletries and clothing to homeless individuals in Manhattan. https://www.hitchcockpresby.org/midnight-run

These are just a few of the many local organizations that will welcome your help. To add your group to the list, email us at [email protected].

Scarsdale Adult School (SAS) at the Center of Your Lifelong Learning Universe

- Details

- Written by: Joanne Wallenstein

- Hits: 2461

"Back to School" is not just for your children. SAS has a fabulous fall semester starting right after Labor Day with in-person and Zoom-based humanities, skill enhancement, recreation, and personal growth courses for all adults, regardless of residency.

"Back to School" is not just for your children. SAS has a fabulous fall semester starting right after Labor Day with in-person and Zoom-based humanities, skill enhancement, recreation, and personal growth courses for all adults, regardless of residency.

Learn the best uses for Artificial Intelligence and ChatGPT, explore world-class art, architecture, and gastronomy on SAS's one-of-a-kind walking tours in NYC, and delve into hot topics in the news such as why school boards matter and bioethics in the pharmaceutical industry. Discuss top-notch literature and films, indulge your creativity in one of the dozens of arts & crafts classes, and stay in shape all year round through fitness sessions.

This semester includes plenty of walking tours in NYC. Guided art excursions explore the Met, the Frick Collection, the Guggenheim, the Whitney, and art galleries throughout New York City. Culinary trips venture to Arthur Avenue, Astoria, Bushwick, Chinatown, Industry City, Little Arabia, the Lower East Side, and Williamsburg. Historic architectural tours take in the beauty of Brooklyn, the Botanical Garden, Grand Central Terminal, Midtown during the Holidays, and the Alexander Hamilton U.S. Custom House.

Among the many topics debuting this term are a new series on artistic rivalries, beginning with Leonardo da Vinci and Michelangelo, a deep dive into the Declaration of Independence in anticipation of its 250th anniversary, and a lecture on the Cuban Missile Crisis. Special events include a visit from Rumaan Alam, author of Entitlement (2024), with others to be added to the catalog soon.

Literature and film discussion classes cover the classics to contemporary selections across the centuries, including ancient Mesopotamian literature, Shakespeare's tyrants, Toni Morrison, bestselling debut novel The Correspondent by Virginia Evans, and several themed combination book and film discussion classes.

Arts & crafts offerings include a variety of drawing, pastels, painting, knitting, basket weaving, and other media for enrichment and enjoyment. Digital photography is also in the rotation. Performing arts lessons in piano, drums, guitar, ukulele, and voice begin in September with acting and improv starting in October. Fun continues with fitness classes for those seeking to get in shape or stay in shape, as well as games instruction in bridge, canasta, and mah jongg. Hone your skills in world language classes (Spanish, French, and German) and refine your storytelling abilities in writing workshops.

Registration is open 24/7. Visit www.ScarsdaleAdultSchool.org to register, to subscribe to the weekly newsletter, or to search the catalog. With an unparalleled breadth of course offerings, SAS has something for everyone!